上一篇学习《深入浅出python量化交易交易实战》第二章(笔记2)实现了第二章移动平均策略和双移动平均策略的代码实现。

1.学习《深入浅出python量化交易交易实战》第二章(笔记3)

记录学习过程中的代码、疑问和心得

3 海龟策略

在股价超过过去N个交易日股价最高点时买入,在股价低于过去N个交易日的股价最低点时卖出。

上述的若干个最高点和最低点会组成一个通道—‘唐奇安通道’

使用过去N天的股价最高点和过去N天的股价最低点生成唐奇安通道。

一般N=20 (书中获取数据时间区间小N取了5天)

海龟策略代码实现:

def turtle_strategy(symbol, start_date, end_date):

# 创建一个turtle的数据表,使用原始数据的日期序列号

stock_data = gen_stock_data_table(symbol, start_date, end_date)

stock_002419 = stock_data['stock']

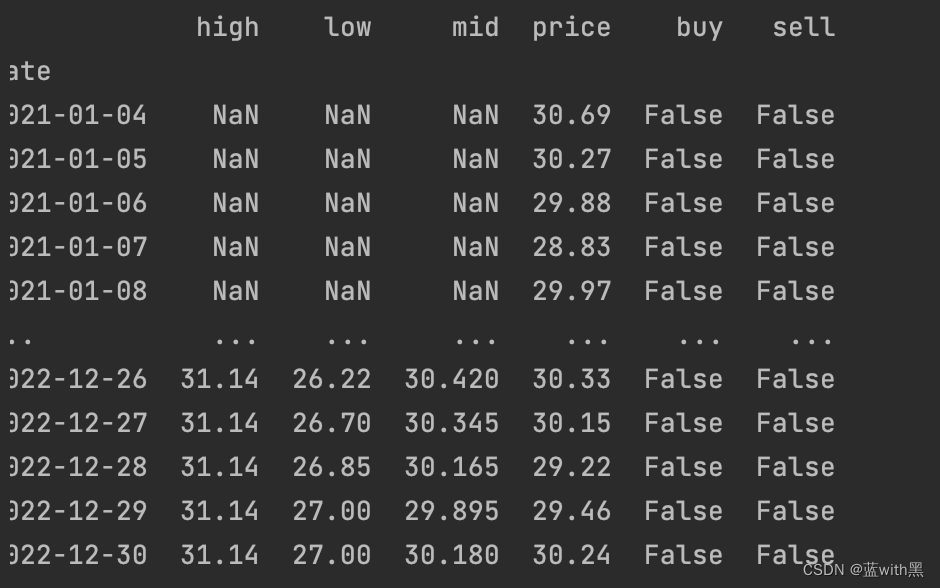

print("-------------stock_002419_turtle--------------------")

print(stock_002419)

turtle = pd.DataFrame(index=stock_002419.index)

print("-------------turtle--------------------")

# 通道上界=过去20日内的最高价

# 通道下界=过去20日内的最低价

# 中轨道=0.5*(通道上界+通道下界)

# 为什么要用shift(1)要向下移1?

turtle['high'] = stock_002419['close'].shift(1).rolling(20).max()

turtle['low'] = stock_002419['close'].shift(1).rolling(20).min()

turtle['mid'] = (turtle['high'] + stock_002419['low']) / 2

turtle['price'] = stock_002419['close']

# 当股价突破下沿时卖出,发出卖出信号,反之买入

# 代码实现是简化的买入卖出策略,并不是实际的海龟策略算法的买入卖出时机。

turtle['buy'] = stock_002419['close'] > turtle['high']

turtle['sell'] = stock_002419['close'] < turtle['low']

print(turtle)

# 订单初始状态为0

turtle['order'] = 0

# 前一天的仓位

turtle['preposition'] = 0

# 当前仓位

turtle['position'] = 0

# 初始仓位为0

position = 0

# 设置循环,便利turtle数据表

for k in range(len(turtle)):

# 当买入信号为true时,且仓位为0时,下单买入一手

if turtle.buy[k] and position == 0:

turtle.preposition.values[k] = position # 保存前一天仓位

turtle.order.values[k] = 1

position = 1

turtle.position.values[k] = position # 修改当前仓位

elif turtle.sell[k] and position > 0:

turtle.preposition.values[k] = position # 保存前一天仓位

turtle.order.values[k] = -1

position = 0

turtle.position.values[k] = position # 修改当前仓位

return turtle

执行海龟策略得到的结果

回测

import pandas as pd

from matplotlib import pyplot as plt

from chapter_2_3_sea_turtle import turtle_strategy

stock_turtle = turtle_strategy('002419', '20210101', '20221231')

print('-------------stock_turtle-------------')

print(stock_turtle)

initial_cash = 20000

positions = pd.DataFrame(index=stock_turtle.index).fillna(0.0)

# 每次交易为1手,即100股,仓位即买单和卖单的累加和

positions['stock'] = 100 * stock_turtle['order'].cumsum()

# 持仓价格

portfolio = positions.multiply(stock_turtle['price'], axis=0)

# 持仓市值 持仓数*价格

portfolio['holding_values'] = (positions.multiply(stock_turtle['price'], axis=0))

# 计算仓位变化

pos_diff = positions.diff()

# 剩余的现金 = 初始资金 - 仓位变化pos_diff*价格的累加和

portfolio['cash'] = initial_cash - (pos_diff.multiply(stock_turtle['price'], axis=0)).cumsum()

# 总资产即持仓股票市值加剩余现金

portfolio['total'] = portfolio['cash'] + portfolio['holding_values']

# stock_turtle.to_excel('dahua_002419_stock_turtle.xls')

# 可视化

plt.figure(figsize=(10, 5))

plt.plot(portfolio['total']) # 总资产

plt.plot(portfolio['holding_values'], '--') # 持仓市值

plt.grid()

plt.legend()

plt.show()

回测结果

资产和持仓情况曲线

本文介绍了使用Python实现《深入浅出python量化交易交易实战》中第三章的海龟策略,包括基于过去N天最高价和最低价构建的唐奇安通道,以及基于通道突破的买卖信号。代码展示了如何计算通道上界、下界和中轨道,并进行了简化版的买入卖出策略。之后,对策略进行了回测,展示资产和持仓情况的曲线变化。

本文介绍了使用Python实现《深入浅出python量化交易交易实战》中第三章的海龟策略,包括基于过去N天最高价和最低价构建的唐奇安通道,以及基于通道突破的买卖信号。代码展示了如何计算通道上界、下界和中轨道,并进行了简化版的买入卖出策略。之后,对策略进行了回测,展示资产和持仓情况的曲线变化。

2万+

2万+

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?