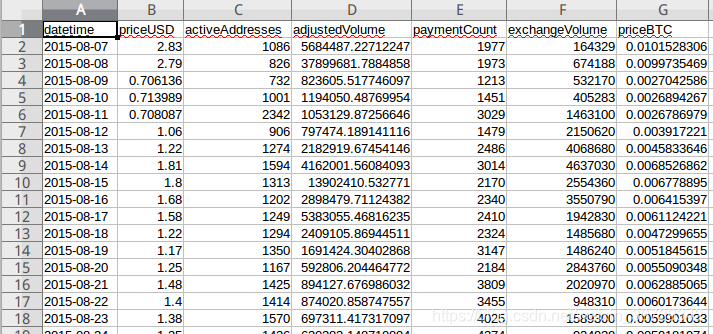

首先我们先看数据集以及我们要解决的问题

数据集如下:

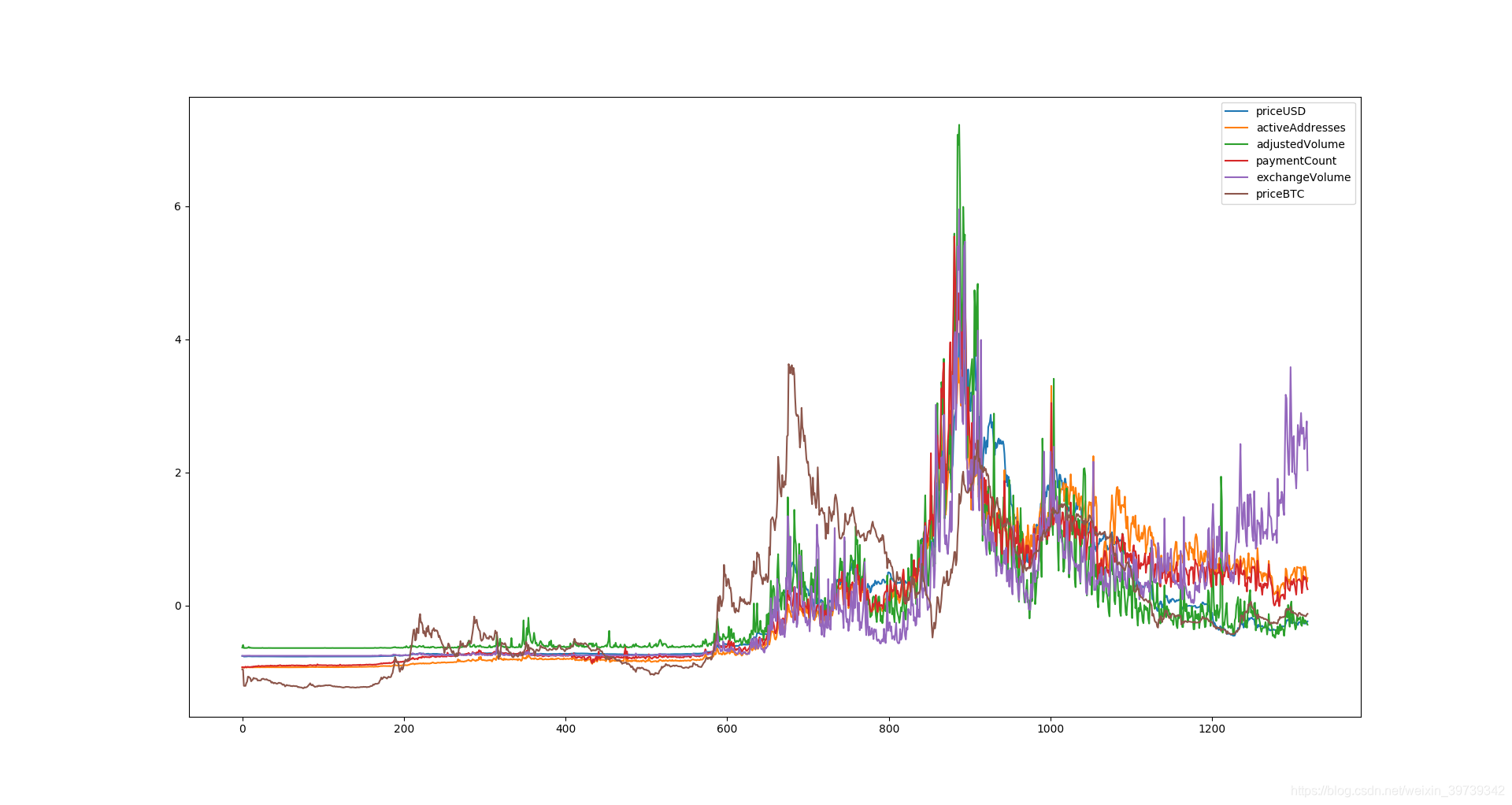

要解决的是分析priceUSB与其他因素的关系,做出关系式,也就是Y为priceUSD,X分别为其他5个因素,做出多元线性回归方程。

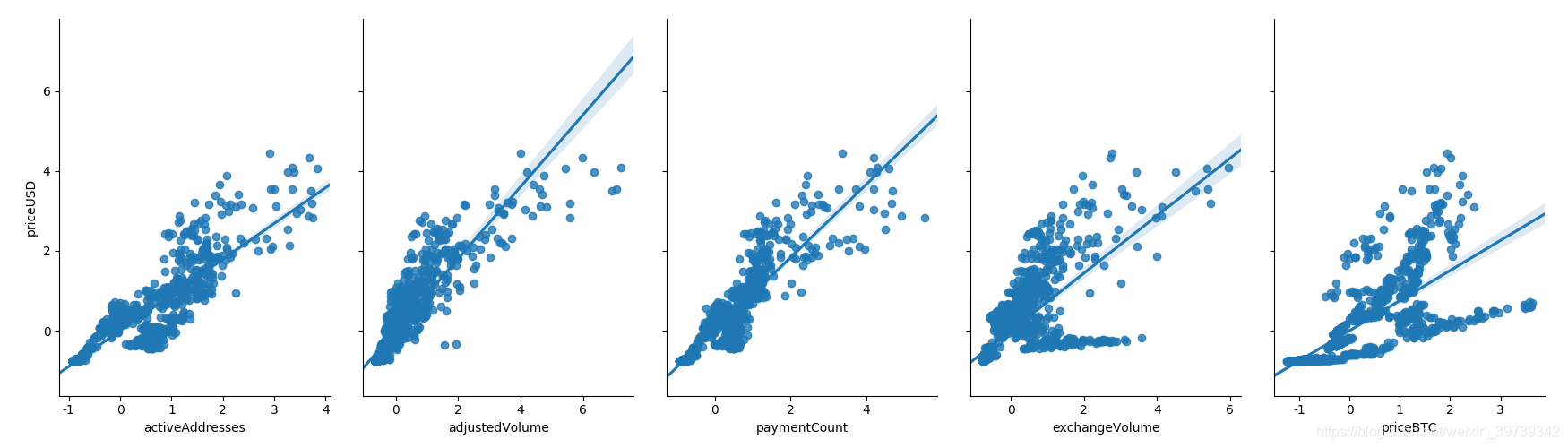

①分析下每个因素和Y的关系(这一步就是只是看个开心而已其实)

def display_lr():

pd_data=pd.read_csv('eth.csv')#原始数表

#画出单因素拟合情况

print('pd_data.head(10)=\n{}'.format(pd_data.head(10)))

# mpl.rcParams['font.sans-serif'] = ['SimHei'] #配置显示中文,否则乱码

mpl.rcParams['axes.unicode_minus']=False #用来正常显示负号,如果是plt画图,则将mlp换成plt

sns.pairplot(pd_data, x_vars=['activeAddresses','adjustedVolume','paymentCount','exchangeVolume','priceBTC'], y_vars='priceUSD',kind="reg", size=5, aspect=0.7)

plt.show()

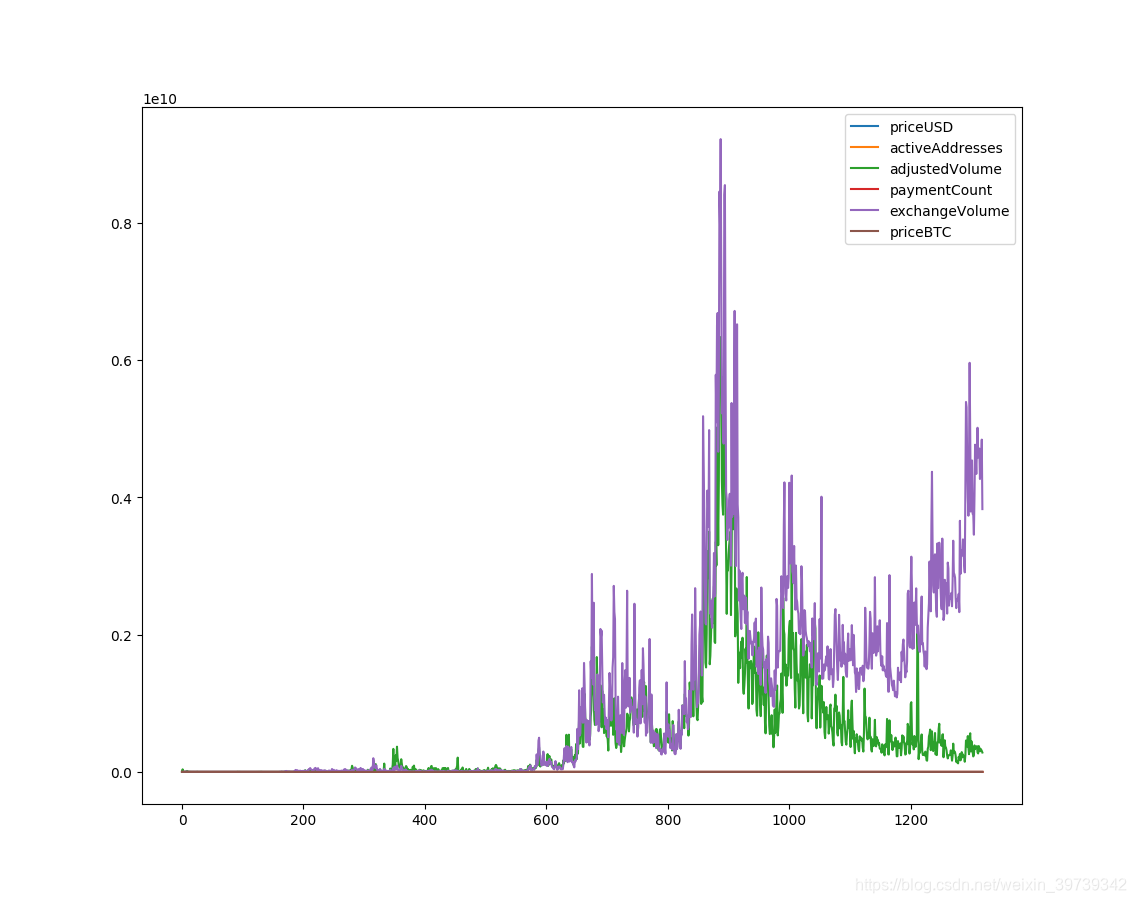

②数据归一化(数据存在差异性过大,需要归一化统一处理)

def Normalization():

#对数据进行归一化处理 并存储到eth2.csv

pd_data=pd.read_csv('eth.csv')

sam=[]

a=['priceUSD','activeAddresses','adjustedVolume','paymentCount','exchangeVolume','priceBTC']

for i in a:

y = pd_data.loc[:, i]

ys = list(preprocessing.scale(y)) # 归一化

sam.append(ys)

print len(sam)

with open('eth2.csv', 'w') as file:

writer = csv.writer(file)

for i in range(len(sam[0])):

writer.writerow([sam[0][i],sam[1][i],sam[2][i],sam[3][i],sam[4][i],sam[5][i]])

print('完毕')

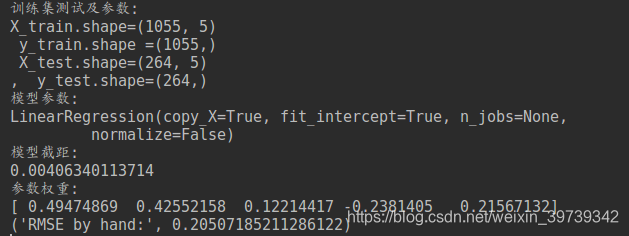

③利用sklearn的LinearRegression进行训练,训练集:测试集=8:2

from sklearn.model_selection import train_test_split #这里是引用了交叉验证

from sklearn.linear_model import LinearRegression #线性回归

def build_lr():

X = pd_data.loc[:, ('activeAddresses','adjustedVolume','paymentCount','exchangeVolume','priceBTC')]

y = pd_data.loc[:, 'priceUSD']

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=532)#选择20%为测试集

print('训练集测试及参数:')

print('X_train.shape={}\n y_train.shape ={}\n X_test.shape={}\n, y_test.shape={}'.format(X_train.shape,

y_train.shape,

X_test.shape,

y_test.shape))

linreg = LinearRegression()

#训练

model = linreg.fit(X_train, y_train)

print('模型参数:')

print(model)

# 训练后模型截距

print('模型截距:')

print linreg.intercept_

# 训练后模型权重(特征个数无变化)

print('参数权重:')

print (linreg.coef_)

y_pred = linreg.predict(X_test)

sum_mean = 0

for i in range(len(y_pred)):

sum_mean += (y_pred[i] - y_test.values[i]) ** 2

sum_erro = np.sqrt(sum_mean /len(y_pred)) # 测试级的数量

# calculate RMSE

print ("RMSE by hand:", sum_erro)

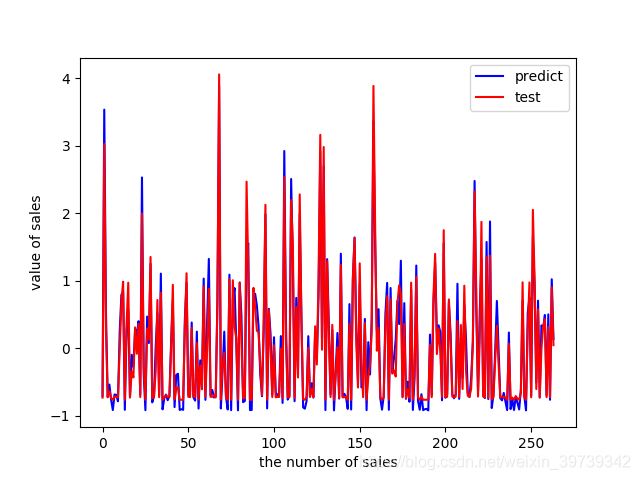

# 做ROC曲线

plt.figure()

plt.plot(range(len(y_pred)), y_pred, 'b', label="predict")

plt.plot(range(len(y_pred)), y_test, 'r', label="test")

plt.legend(loc="upper right") # 显示图中的标签

plt.xlabel("the number of sales")

plt.ylabel('value of sales')

plt.show()输出如下

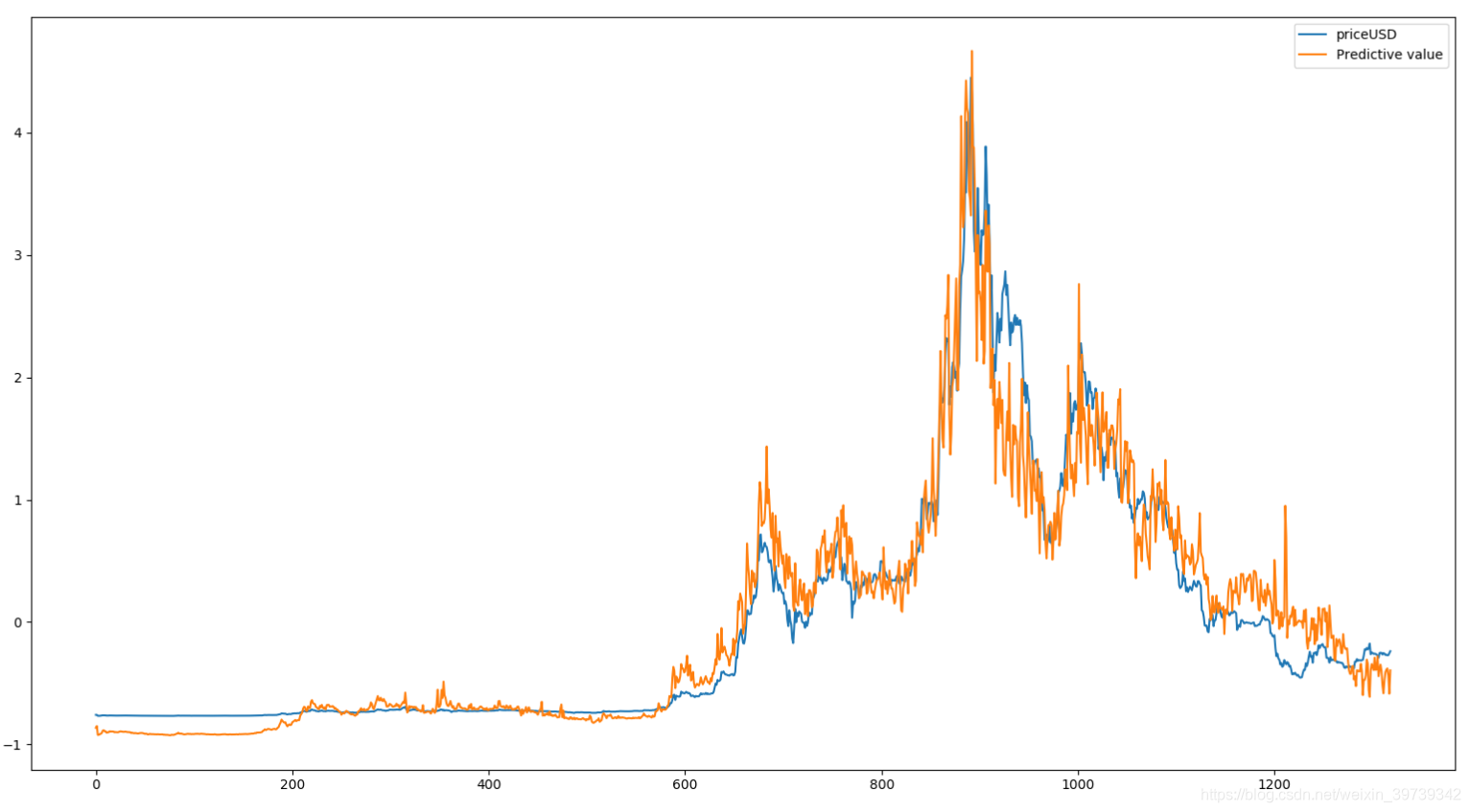

对于这份数据而言,由于priceUSD的价格不单单由上诉因素决定,以及波动性较大,所以RMSE为0.20507在此处算是一个较好的结果。

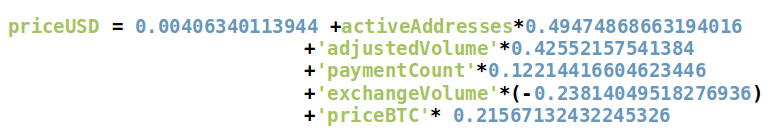

所以我们可以得出我们的结果(大致的过程就这样了)

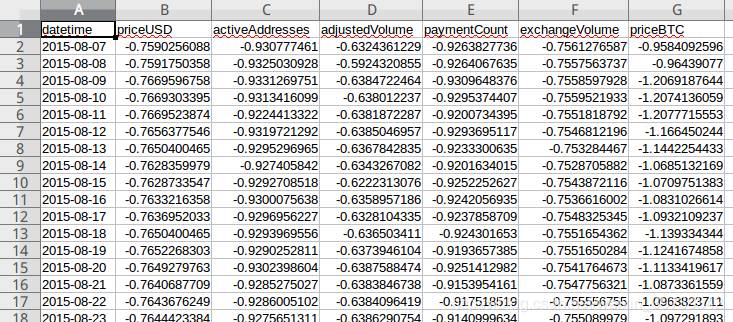

④最后写一个测试程序看一下总体结果是怎样的

def Compared():

#利用方程进行拟合 对比 并存储数据到eth3.csv

pd_data = pd.read_csv('eth2.csv')

sam=[]

a=['priceUSD','activeAddresses','adjustedVolume','paymentCount','exchangeVolume','priceBTC']

dic={}

for i in a:

y = pd_data.loc[:, i]

dic[i] = list(y) # 归一化

print(dic)

for i in range(len(dic['priceUSD'])):

x = 0.00406340113944 + float(dic['activeAddresses'][i])*0.49474868663194016+float(dic['adjustedVolume'][i])*0.42552157541384+float(dic['paymentCount'][i])*0.12214416604623446 +float(dic['exchangeVolume'][i])*(-0.23814049518276936) +float(dic['priceBTC'][i])* 0.21567132432245326

sam.append(x)

with open('eth3.csv', 'w') as file:

writer = csv.writer(file)

writer.writerow(['priceUSD','Predictive value'])

for i in range(len(sam)):

writer.writerow([dic['priceUSD'][i],sam[i]])

print('完毕')

pd_data=pd.read_csv('eth3.csv')

pd_data.plot()

plt.show()得到结果如下:

⑤数据及相关的py文件:https://download.youkuaiyun.com/download/weixin_39739342/11254555

博客围绕分析priceUSD与其他因素的关系展开,要构建多元线性回归方程。先分析各因素与priceUSD的关系,对数据进行归一化处理,利用sklearn的LinearRegression按8:2划分训练集和测试集进行训练,RMSE为0.20507是较好结果,最后写测试程序查看总体结果。

博客围绕分析priceUSD与其他因素的关系展开,要构建多元线性回归方程。先分析各因素与priceUSD的关系,对数据进行归一化处理,利用sklearn的LinearRegression按8:2划分训练集和测试集进行训练,RMSE为0.20507是较好结果,最后写测试程序查看总体结果。

7941

7941

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?