写在前面,基础的数理知识如下:

Have a look

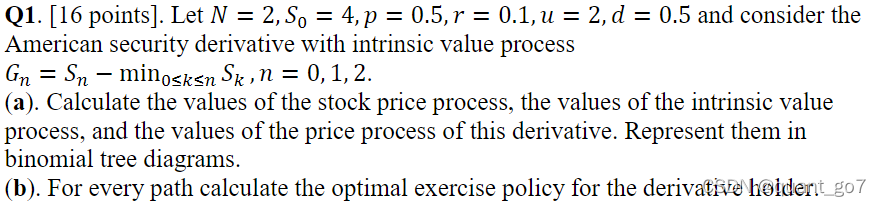

Q1:二叉树相关计算 binomial calculate

stock price process; instrinsic value process;optimal exercise time

sample:

这就是optimal exercise time:

Vn对于美式期权来说就是max (内在价值和 不行权的话在那一刻欧式期权的价值)

如果内在价值大于那个欧式期权的价值就是vn=gn

这个时候就立马行权,就是最优的exercise time,因为这个时刻行权比不行权获利更多.

理性人的话就第一次出现这种情景的时候就行权,所以是min

Q2:Martingale proof

sample:

这篇博客概述了金融量化分析中的关键知识点,包括二叉树模型的应用,如股票价格过程和期权定价;马尔科夫过程的证明;协方差与二次变化的计算;条件期望的几何意义及其迭代性;随机微分方程的探讨;Black-Scholes-Merton模型与套利机会;以及随机过程中的鞅等概念的证明。

这篇博客概述了金融量化分析中的关键知识点,包括二叉树模型的应用,如股票价格过程和期权定价;马尔科夫过程的证明;协方差与二次变化的计算;条件期望的几何意义及其迭代性;随机微分方程的探讨;Black-Scholes-Merton模型与套利机会;以及随机过程中的鞅等概念的证明。

最低0.47元/天 解锁文章

最低0.47元/天 解锁文章

36万+

36万+

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?