目录

1、策略编写

1.1、三均线策略

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

def 三均线策略_v1(cl):

"""

此策略为三均线演示策略

:param cl策略类

:param cl.klines: k线数据,为df表,0层数据用klines[0]表示

:param cl.openingdata: 交易数据,为字典,里面有持仓状态,理论持仓数量,开仓价格,开仓时间等

:param cl.zhanghu: 账户列表

:param cl.jiaoyishezhi: 为交易设置数据,算法交易,交易合约,其他功能参数都在里面

:param cl.jiaoyiqidong: 是否启动了交易,为TRUS表示启动

:return: 输出要在软件上显示的指标

"""

# 数据提取区

Open = cl.klines[0].open.values # 开盘价np列表

High = cl.klines[0].high.values # 最高价np列表

Low = cl.klines[0].low.values # 最低价np列表

Close = cl.klines[0].close.values # 收盘价np列表,Close[-1]这样为最新价

canshu = [cl.jiaoyiqidong, cl.zhanghu, cl.jiaoyishezhi, cl.openingdata, cl.klines[0].datetime.values] # 传递给交易函数用于交易

riqi = cl.get_riqi(1)

shijian = cl.get_shijian(1)

chicang = cl.openingdata['kaicangzhuangtai'] # 持仓状态和持仓数量

chicangshuliang = cl.openingdata['kaicangshuliang'] # 理论持仓数量

kaicangjia = cl.openingdata['kaicangjia'] # 开仓价格

# 参数设置区

ss = cl.jiaoyishezhi[5][0] # 开仓数量

n1 = cl.jiaoyishezhi[5][1] # ma1周期

n2 = cl.jiaoyishezhi[5][2] # ma2周期

n3 = cl.jiaoyishezhi[5][3] # ma3周期

# 指标计算区

ma1 = ema_z(Close[-300:], n1)

ma2 = ema_z(Close[-300:], n2)

ma3 = ema_z(Close[-300:], n3)

# # 用ma

# ma1 = ma_z(Close[-300:], n1)

# ma2 = ma_z(Close[-300:], n2)

# ma3 = ema_z(Close[-300:], n2)

# 交易逻辑执行区

if chicang <= 0 and ma1[-2] > ma2[-2] and ma2[-2] > ma3[-2]:

Buy(ss, Open[-1], canshu)

else:

if chicang >= 0 and ma1[-2] < ma2[-2] and ma2[-2] < ma3[-2]:

SellShort(ss, Open[-1], canshu)

return ma1[-2], ma2[-2], ma3[-2], 0 # 此处输出的指标会在k线图中和监控界面中显示

1.2、单均线策略

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

def 单均线策略_v1(cl):

"""

此策略为单均线策略

"""

# 数据提取区

Open = cl.klines[0].open.values # 开盘价np列表

# High = cl.klines[0].high.values # 最高价np列表

# Low = cl.klines[0].low.values # 最低价np列表

Close = cl.klines[0].close.values # 收盘价np列表,Close[-1]这样为最新价

Datetime = cl.klines[0].datetime.values # 日期时间np列表,为时间戳

canshu = [cl.jiaoyiqidong, cl.zhanghu, cl.jiaoyishezhi, cl.openingdata, Datetime] # 传递给交易函数用于交易

# riqi = cl.get_riqi(1)

# shijian = cl.get_shijian(1)

理论持仓 = cl.openingdata['kaicangshuliang'] * cl.openingdata['kaicangzhuangtai']

开仓价格 = cl.openingdata['kaicangjia'] # 开仓价格

# 参数设置区

开仓手数 = cl.jiaoyishezhi[5][0] # 开仓数量

均线周期 = cl.jiaoyishezhi[5][1] # ma1周期

# 指标计算区

ma1 = ema_z(Close[-300:], 均线周期)

# 交易逻辑执行区

if 理论持仓 <= 0 and Open[-2] > ma1[-2] and Close[-2] > ma1[-2]: # 开盘价和收盘价都要大于均线

Buy(开仓手数, Open[-1], canshu) # 平空开多

else:

if 理论持仓 >= 0 and Open[-2] < ma1[-2] and Close[-2] < ma1[-2]: # 开盘价和收盘价都要小于均线

SellShort(开仓手数, Open[-1], canshu) # 平多开空

return round(ma1[-2], 2), 'w', 开仓价格, 理论持仓 # 此处输出的指标会在k线图中和监控界面中显示

1.3、唐琪安通道策略

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

def 唐琪安通道_v1(cl):

"""

此策略为唐琪安通道突破演示策略

"""

# 数据提取区

Open = cl.klines[0].open.values # 开盘价np列表

High = cl.klines[0].high.values # 最高价np列表

Low = cl.klines[0].low.values # 最低价np列表

Close = cl.klines[0].close.values # 收盘价np列表,Close[-1]这样为最新价

Datetime = cl.klines[0].datetime.values # 日期时间np列表,为时间戳

canshu = [cl.jiaoyiqidong, cl.zhanghu, cl.jiaoyishezhi, cl.openingdata, Datetime] # 传递给交易函数用于交易

chicang = cl.openingdata['kaicangzhuangtai'] *cl.openingdata['kaicangshuliang'] # 持仓状态和持仓数量

kaicangjia = cl.openingdata['kaicangjia'] # 开仓价格

# 参数设置区

ss = cl.jiaoyishezhi[5][0] # 开仓数量

n1 = cl.jiaoyishezhi[5][1]+1 # 高点周期

n2 = cl.jiaoyishezhi[5][2]+1 # 低点周期

# print(ss,n1,n2)

# 指标计算区

gd = max(High[-n1:-1])

dd = min(Low[-n2:-1])

# 交易逻辑执行区

if chicang <= 0 and High[-1] >= gd:

Buy(ss, max(Open[-1], gd), canshu)

else:

if chicang >= 0 and Low[-1] <= dd:

SellShort(ss, min(Open[-1], dd), canshu)

return gd, dd, kaicangjia, 0

1.4、多空线加atr通道出场策略

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

def 多空线策略加atr通道出场_v1(cl):

"""

多空线策略

"""

# 数据提取区

Open = cl.klines[0].open.values # 开盘价np列表

High = cl.klines[0].high.values # 最高价np列表

Low = cl.klines[0].low.values # 最低价np列表

Close = cl.klines[0].close.values # 收盘价np列表,Close[-1]这样为最新价

Datetime = cl.klines[0].datetime.values # 日期时间np列表,为时间戳

canshu = [cl.jiaoyiqidong, cl.zhanghu, cl.jiaoyishezhi, cl.openingdata, Datetime] # 传递给交易函数用于交易

chicang = cl.openingdata['kaicangzhuangtai'] # 持仓状态和持仓数量0,1或-1

# 参数设置区

ss = cl.jiaoyishezhi[5][0] # 开仓数量

慢线周期 = cl.jiaoyishezhi[5][1]

牛熊线周期 = cl.jiaoyishezhi[5][2]

慢线周期 = 10

# 指标计算区

# DKX计算

MIB = (2 * Close + Low + Open + High) / 5

MIB = MIB[:-1]

XD = np.zeros(23)

j = 20

kk = 1

for k in range(0, 20):

lsbl = j * MIB[:-kk]

XD = XD + lsbl[-23:]

j = j - 1

kk = kk + 1

dkx = XD / 210

慢线 = ma_z(dkx, 慢线周期)

牛熊线 = ma_z(Close, 牛熊线周期)

# 交易逻辑执行区

# 开仓

if chicang <= 0 and dkx[-2] > 慢线[-2] and dkx[-3] < 慢线[-3] and Close[-2]>牛熊线[-2]:

Buy(ss, Open[-1], canshu)

# print(ma1.iat[-2],ma2.iat[-2])

else:

if chicang >= 0 and dkx[-2] < 慢线[-2] and dkx[-3] > 慢线[-3] and Close[-2]<牛熊线[-2]:

SellShort(ss, Open[-1], canshu)

# dkx平仓

if chicang > 0 and dkx[-2] < 慢线[-2]:

Sell(0, Open[-1], canshu)

else:

if chicang < 0 and dkx[-2] > 慢线[-2]:

BuyToCover(0, Open[-1], canshu)

# atr通道平仓

atr = atr_z(High, Low, Open, 10)

atr上轨 = High[-2] + atr[-2]

atr下轨 = Low[-2] - atr[-2]

if chicang > 0 and Close[-2] < atr下轨: # 平多

Sell(0, Open[-1], canshu)

else:

if chicang < 0 and Close[-2] > atr下轨: # 平空

BuyToCover(0, Open[-1], canshu)

return dkx[-2], 慢线[-2], atr上轨, atr下轨

1.5、红三兵策略

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

def 红三兵策略_v1(cl):

"""

连续n根阳线开多,n根阴线开空

"""

# 数据提取区

Open = cl.klines[0].open.values # 开盘价np列表

High = cl.klines[0].high.values # 最高价np列表

Low = cl.klines[0].low.values # 最低价np列表

Close = cl.klines[0].close.values # 收盘价np列表,Close[-1]这样为最新价

Datetime = cl.klines[0].datetime.values # 日期时间np列表,为时间戳

canshu = [cl.jiaoyiqidong, cl.zhanghu, cl.jiaoyishezhi, cl.openingdata, Datetime] # 传递给交易函数用于交易

riqi = cl.get_riqi(1) # 上一个周期日期

shijian = cl.get_shijian(1) # 上一个周期时间

chicang = cl.openingdata['kaicangzhuangtai'] # 持仓状态和持仓数量

# 参数设置区

ss = cl.jiaoyishezhi[5][0] # 开仓数量

n1 = cl.jiaoyishezhi[5][1] # 周期

# 指标计算

n = n1+1

dd = np.sum(Close[-n:-1] > Open[-n:-1]) # 判断阳线数量

xx = np.sum(Close[-n:-1] < Open[-n:-1]) # 判断阴线数量

# 交易逻辑执行区

if chicang <= 0 and dd >= n1:

Buy(ss, Open[-1], canshu) # 平空开多

else:

if chicang >= 0 and xx >= n1:

SellShort(ss, Open[-1], canshu) # 平多开空

return dd, xx, 0, 0 # 此处输出的指标会在k线图中和监控界面中显示

1.6、macd策略

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

def macd策略_diff(cl):

"""

macd,diff策略,diff大于0平空开多,diff小于0平多开空。

"""

# 数据提取区

Open = cl.klines[0].open.values # 开盘价np列表

Close = cl.klines[0].close.values # 收盘价np列表,Close[-1]这样为最新价

Datetime = cl.klines[0].datetime.values # 日期时间np列表,为时间戳

canshu = [cl.jiaoyiqidong, cl.zhanghu, cl.jiaoyishezhi, cl.openingdata, Datetime] # 传递给交易函数用于交易

chicang = cl.openingdata['kaicangzhuangtai'] * cl.openingdata['kaicangshuliang'] # 持仓状态和持仓数量

# 参数设置区

手数 = cl.jiaoyishezhi[5][0] # 开仓数量

macdzq = cl.jiaoyishezhi[5][1] # macd短周期

macdzq2 = cl.jiaoyishezhi[5][2] # macd长周期

# 指标计算区

# if cl.shangcishijian != Datetime[-1]: # 更新k线时执行,一般用与计算指标

diff = ema_z(Close[-300:], macdzq) - ema_z(Close[-300:], macdzq2)

kctj_diff = round(diff[-2], 4)

# 交易逻辑执行区

if chicang <= 0 and kctj_diff > 0:

Buy(手数, Open[-1], canshu)

else:

if chicang >= 0 and kctj_diff < 0:

SellShort(手数, Open[-1], canshu)

return 'w', kctj_diff, 'w', chicang

1.7、定时清仓策略

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

def 定时清仓策略_v1(cl):

"""

定时清仓程序

"""

# 数据提取区

Open = cl.klines[0].open.values # 开盘价np列表

Datetime = cl.klines[0].datetime.values # 日期时间np列表,为时间戳

canshu = [cl.jiaoyiqidong, cl.zhanghu, cl.jiaoyishezhi, cl.openingdata, Datetime] # 传递给交易函数用于交易

chicangshuliang = cl.openingdata['kaicangshuliang'] # 理论持仓数量

shijian = int(time_to_datetime(Datetime[-1]).time().strftime("%H%M%S")) # 当前时间

# 参数设置区

ss = cl.jiaoyishezhi[5][0] # 每次开仓数量,0为停止此策略

清仓时间 = cl.jiaoyishezhi[5][1] # 时间格式为145500,用的k线时间

pcpz = cl.jiaoyishezhi[5][2:] # 排除不平仓的合约

# zhanghu = cl.zhanghu[cl.jiaoyishezhi[0][0]] # 开仓账户

# 初始化,初始化策略,和更新时运行一次

if 'cczt' not in cl.sjb: # 初始化时执行一次,用于初始化缓存字典

cl.sjb['cczt'] = 0 # 持仓状态记录

# 指标计算区

if cl.shangcishijian != Datetime[-1]: # 更新k线时执行,一般用与计算指标

if shijian == 210000:

cl.sjb['cczt'] = 0

if shijian == 清仓时间 and cl.sjb['cczt'] == 0 and cl.jiaoyiqidong:

cl.sjb['cczt'] = 1

cc = cl.zhanghu[cl.jiaoyishezhi[0][0]].df_cc

for i in range(len(cc)):

if cc['InstrumentID'].iat[i] not in pcpz:

if cc['Side'].iat[i] == 0:

cl.jiaoyishezhi[3][0] = cc['InstrumentID'].iat[i] # 交易合约存入交易设置中

canshu = [cl.jiaoyiqidong, cl.zhanghu, deepcopy(cl.jiaoyishezhi), cl.openingdata, Datetime] # 传递给交易函数用于交易

Sell_gzxd(int(cc['Position'].iat[i]), 8888, canshu) # 平多

print(shijian, canshu[2][3][0], int(cc['Position'].iat[i]), '平多')

else:

if cc['Side'].iat[i] == 1:

cl.jiaoyishezhi[3][0] = cc['InstrumentID'].iat[i] # 交易合约存入交易设置中

canshu = [cl.jiaoyiqidong, cl.zhanghu, deepcopy(cl.jiaoyishezhi), cl.openingdata, Datetime] # 传递给交易函数用于交易

BuyToCover_gzxd(int(cc['Position'].iat[i]), 8888, canshu) # 平多

print(shijian, canshu[2][3][0], int(cc['Position'].iat[i]), '平空')

return cl.sjb['cczt'], shijian, 0, 0

1.8、双通道突破回调加仓策略

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

def 双通道突破回调加仓_v1(cl_sj):

"""

双通道突破回调加仓策略,双通道为均线百分比包络线和收盘价n周期高低点。

开仓:突破或跌破双通道。

加仓:开仓后盈利达到百分之2,价格回调到5日均线,然后又突破高点就加仓1次,一直往复。

平仓:开仓后的最高价回调百分之n平仓,或者反手。

"""

# 数据初始化,

Datetime = cl_sj.klines[0].datetime.values # 时间转换为np列表

canshu = [cl_sj.jiaoyiqidong, cl_sj.zhanghu, cl_sj.jiaoyishezhi, cl_sj.openingdata, Datetime] # 传递给交易函数用于交易

Open = cl_sj.klines[0].open.values

high = cl_sj.klines[0].high.values

low = cl_sj.klines[0].low.values

close = cl_sj.klines[0].close.values

chicang = cl_sj.openingdata['kaicangzhuangtai']

kaicangjia = cl_sj.openingdata['kaicangjia']

riqishijian = str(time_to_datetime(Datetime[-1]))

# 参数设置区

SS = cl_sj.jiaoyishezhi[5][0] # 开仓手数

MAZQ = cl_sj.jiaoyishezhi[5][1] # 均线周期

MATDFD = cl_sj.jiaoyishezhi[5][2] # MA通道幅度 %

GDDZQ = cl_sj.jiaoyishezhi[5][3]+1 # 高低点周期

JCMAZQ = cl_sj.jiaoyishezhi[5][4] # 加仓均线周期

PCFD = cl_sj.jiaoyishezhi[5][5] # 平仓和保本幅度 %

YLFD = cl_sj.jiaoyishezhi[5][6] # 达到盈利幅度回调加仓

# 全局变量的初始化,为空的时候执行

if 'KCGD' not in cl_sj.sjb: # 初始化时执行一次,用于初始化缓存字典

cl_sj.sjb['KCGD'] = [close[-1]] # 开仓上轨

cl_sj.sjb['KCDD'] = [close[-1]] # 开仓下轨

cl_sj.sjb['JCMA'] = [close[-1]] # 加仓ma

cl_sj.sjb['ZGYL'] = 0 # 最高盈利

cl_sj.sjb['PCJG'] = 0 # 平仓价格

cl_sj.sjb['HTDMAJS'] = 0 # 回调到均线计数

cl_sj.sjb['DDYLHJS'] = 0 # 盈利达到计数

cl_sj.sjb['DQYL'] = 0 # 当前盈利

cl_sj.sjb['kchgd'] = [0] # 开仓后最高点

cl_sj.sjb['kchdd'] = [999999] # 开仓后最低点

cl_sj.sjb['kchzq'] = 0 # 开仓后的周期

cl_sj.sjb['kchbj'] = 1 # 开仓后的标记

# cl_sj.sjb['fshkcbz'] = 0 # 反手或开仓标志,用于计算开仓后周期

# 指标计算区

if cl_sj.shangcishijian != datetime[-1]: # 更新k线时执行,一般用与计算指标

MA = ma_z(close[:-1], MAZQ)

cl_sj.sjb['JCMA'] = ma_z(close[:-1], JCMAZQ)

MAG = MA[-1]+MA[-1]*(MATDFD*0.01)

MAD = MA[-1]-MA[-1]*(MATDFD*0.01)

UP = max(close[-GDDZQ:-1])

DN = min(close[-GDDZQ:-1])

cl_sj.sjb['KCGD'].append(max(MAG, UP))

cl_sj.sjb['KCDD'].append(min(MAD, DN))

cl_sj.sjb['kchbj'] = 1

# 求开仓后的周期

if chicang == 0:

cl_sj.sjb['kchzq'] = 0

cl_sj.sjb['fshkcbz'] = 0

else:

cl_sj.sjb['kchzq'] = cl_sj.sjb['kchzq'] + 1

# 交易逻辑执行区

# 开仓

if chicang <= 0 and cl_sj.sjb['kchbj'] > 0 and high[-1] > cl_sj.sjb['KCGD'][-1]: # 开多

kaicangjia = max(cl_sj.sjb['KCGD'][-1], Open[-1])

Buy(SS, kaicangjia, canshu)

cl_sj.sjb['kchbj'] = 0

cl_sj.sjb['kchzq'] = 0

cl_sj.sjb['HTDMAJS'] = 0

cl_sj.sjb['DDYLHJS'] = 0

chicang = 1

print(cl_sj.jiaoyishezhi[3][0], riqishijian, '开多:', SS, kaicangjia, '---------------------------------------')

else:

if chicang >= 0 and cl_sj.sjb['kchbj'] > 0 and low[-1] < cl_sj.sjb['KCDD'][-1]: # 开空

kaicangjia = min(cl_sj.sjb['KCDD'][-1], Open[-1])

SellShort(SS, kaicangjia, canshu)

cl_sj.sjb['kchbj'] = 0

cl_sj.sjb['kchzq'] = 0

cl_sj.sjb['HTDMAJS'] = 0

cl_sj.sjb['DDYLHJS'] = 0

chicang = -1

print(cl_sj.jiaoyishezhi[3][0], riqishijian, '开空:', SS, kaicangjia, '-----------------------------------')

# 加仓

# 加仓条件计算

if chicang == 1:

DQYL = (high[-2] - kaicangjia) / kaicangjia * 100 # 当前盈利

if DQYL > YLFD:

cl_sj.sjb['DDYLHJS'] = 1 # 达到盈利后计数

if close[-2] < cl_sj.sjb['JCMA'][-1] and cl_sj.sjb['DDYLHJS'] > 0:

cl_sj.sjb['HTDMAJS'] = 1 # 价格回调到ma处

else:

if chicang == -1:

DQYL = (kaicangjia - low[-2]) / kaicangjia * 100 # 当前盈利

if DQYL > YLFD:

cl_sj.sjb['DDYLHJS'] = 1 # 达到盈利后计数

if close[-2] > cl_sj.sjb['JCMA'][-1] and cl_sj.sjb['DDYLHJS'] > 0:

cl_sj.sjb['HTDMAJS'] = 1 # 价格回调到ma处

else:

DQYL = 0

cl_sj.sjb['DDYLHJS'] = 0

cl_sj.sjb['HTDMAJS'] = 0

# print(riqishijian, DQYL)

if chicang == 1 and high[-1]>cl_sj.sjb['KCGD'][-1] and cl_sj.sjb['HTDMAJS']>0 and cl_sj.sjb['DDYLHJS']>0:

kaicangjia = max(cl_sj.sjb['KCGD'][-1], Open[-1])

Buy_jjc(SS, kaicangjia, canshu)

cl_sj.sjb['kchzq'] = 0

cl_sj.sjb['HTDMAJS'] = 0

cl_sj.sjb['DDYLHJS'] = 0

print(cl_sj.jiaoyishezhi[3][0], riqishijian, '加多:', shujuku.hget(cl_sj.openingdata['name'], 'kaicangshuliang'), kaicangjia)

else:

if chicang == -1 and low[-1] < cl_sj.sjb['KCDD'][-1] and cl_sj.sjb['HTDMAJS'] > 0 and cl_sj.sjb['DDYLHJS'] > 0:

kaicangjia = min(cl_sj.sjb['KCDD'][-1], Open[-1])

SellShort_jjc(SS, kaicangjia, canshu)

cl_sj.sjb['kchzq'] = 0

cl_sj.sjb['HTDMAJS'] = 0

cl_sj.sjb['DDYLHJS'] = 0

print(cl_sj.jiaoyishezhi[3][0], riqishijian, '加空:', shujuku.hget(cl_sj.openingdata['name'], 'kaicangshuliang'), kaicangjia)

# 平仓

# 记录开仓后高低点

if cl_sj.sjb['kchzq'] == 0:

cl_sj.sjb['kchgd'] = kaicangjia

cl_sj.sjb['kchdd'] = kaicangjia

else:

if cl_sj.sjb['kchzq'] > 0:

cl_sj.sjb['kchgd'] = max(cl_sj.sjb['kchgd'], high[-1])

cl_sj.sjb['kchdd'] = min(cl_sj.sjb['kchdd'], low[-1])

# print(riqishijian, cl_sj.sjb['kchgd'], cl_sj.sjb['kchdd'])

if chicang == 1:

cl_sj.sjb['ZGYL'] = (cl_sj.sjb['kchgd']-kaicangjia)/kaicangjia*100

cl_sj.sjb['PCJG'] = kaicangjia*(1-PCFD*0.01) # 平仓价格计算

if cl_sj.sjb['ZGYL'] > PCFD:

cl_sj.sjb['PCJG'] = kaicangjia # 最高盈利到达指定幅度,平仓价格调到指定价

else:

if chicang == -1:

cl_sj.sjb['ZGYL'] = (kaicangjia-cl_sj.sjb['kchdd']) / kaicangjia * 100

cl_sj.sjb['PCJG'] = kaicangjia * (1 + PCFD * 0.01) # 平仓价格计算

if cl_sj.sjb['ZGYL'] > PCFD:

cl_sj.sjb['PCJG'] = kaicangjia # 最高盈利到达指定幅度,平仓价格调到指定价

else:

cl_sj.sjb['ZGYL'] = close[-1]

cl_sj.sjb['PCJG'] = close[-1]

if chicang == 1 and cl_sj.sjb['kchzq'] > 0 and low[-1] <= cl_sj.sjb['PCJG']:

kaicangjia = min(cl_sj.sjb['PCJG'], Open[-1])

print(cl_sj.jiaoyishezhi[3][0], riqishijian, '平多:', shujuku.hget(cl_sj.openingdata['name'], 'kaicangshuliang'), kaicangjia)

Sell(0, kaicangjia, canshu)

cl_sj.sjb['kchzq'] = 0

else:

if chicang == -1 and cl_sj.sjb['kchzq'] > 0 and high[-1] >= cl_sj.sjb['PCJG']:

kaicangjia = max(cl_sj.sjb['PCJG'], Open[-1])

print(cl_sj.jiaoyishezhi[3][0], riqishijian, '平空:', shujuku.hget(cl_sj.openingdata['name'], 'kaicangshuliang'), kaicangjia)

BuyToCover(0, kaicangjia, canshu)

cl_sj.sjb['kchzq'] = 0

return cl_sj.sjb['KCGD'][-1], cl_sj.sjb['KCDD'][-1], cl_sj.sjb['PCJG'], cl_sj.sjb['kchzq']

1.9、唐琪安通道加跨周期均线过滤策略

说明:如需开发跨周期或跨品种策略,可以参考此策略进行开发

#!/usr/bin/env python

# -*- coding: utf-8 -*-

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

import tool.MyTT as myttzb

RXZQ = {} # 按合约储存日线周期k线和指标数据

XIAOSHIZQ = {} # 按合约储存小时周期k线和指标数据

def 日线周期指标计算_v1(cl):

"""

日线周期指标计算,用于给下面策略周期调用

"""

# 数据提取区

Close = cl.klines[0].close.values # 收盘价np列表,Close[-1]这样为最新价

# 参数设置区

ss = cl.jiaoyishezhi[5][0] # 开仓数量, 也是控制策略的开关

n1 = cl.jiaoyishezhi[5][1] # ma1周期

n2 = cl.jiaoyishezhi[5][2] # ma2周期

交易合约 = cl.jiaoyishezhi[3][0]

# 指标计算区

ma1 = myttzb.MA(Close, n1)

ma2 = myttzb.MA(Close, n2)

# 数据合并与储存

df = cl.klines[0]

df['ma1'] = ma1

df['ma2'] = ma2

# 向下移动一位,防止偷价

df['ma1'] = (df['ma1'].shift(1)).fillna(method='bfill')

df['ma2'] = (df['ma2'].shift(1)).fillna(method='bfill')

df = df.set_index(df['datetime'])

RXZQ[交易合约] = df

# print(df)

return 'w', 'w', 'w', 'w' # 此处输出的指标会在k线图中和监控界面中显示

def 小时周期指标计算_v1(cl):

"""

小时周期指标计算,用于给下面策略周期调用

"""

# 数据提取区

# Open = cl.klines[0].open.values # 开盘价np列表

# High = cl.klines[0].high.values # 最高价np列表

# Low = cl.klines[0].low.values # 最低价np列表

Close = cl.klines[0].close.values # 收盘价np列表,Close[-1]这样为最新价

# 参数设置区

ss = cl.jiaoyishezhi[5][0] # 开仓数量, 也是控制策略的开关

n1 = cl.jiaoyishezhi[5][1] # ma1周期

n2 = cl.jiaoyishezhi[5][2] # ma2周期

交易合约 = cl.jiaoyishezhi[3][0]

# 指标计算区

ma1 = myttzb.MA(Close, n1)

ma2 = myttzb.MA(Close, n2)

# 数据合并与储存

df = cl.klines[0]

df['ma1'] = ma1

df['ma2'] = ma2

# 向下移动一位,防止偷价

df['ma1'] = (df['ma1'].shift(1)).fillna(method='bfill')

df['ma2'] = (df['ma2'].shift(1)).fillna(method='bfill')

df = df.set_index(df['datetime'])

XIAOSHIZQ[交易合约] = df

return 'w', 'w', 'w', 'w' # 此处输出的指标会在k线图中和监控界面中显示

def 唐琪安通道跨周期过滤_v1(cl):

"""

此策略为唐琪安通道突破演示策略,用日线周期和小时线周期过滤

"""

# 数据提取区

Open = cl.klines[0].open.values # 开盘价np列表

High = cl.klines[0].high.values # 最高价np列表

Low = cl.klines[0].low.values # 最低价np列表

Close = cl.klines[0].close.values # 收盘价np列表,Close[-1]这样为最新价

Datetime = cl.klines[0].datetime.values # 日期时间np列表,为时间戳

Date = cl.klines[0].date.values # 日期

canshu = [cl.jiaoyiqidong, cl.zhanghu, cl.jiaoyishezhi, cl.openingdata, Datetime] # 传递给交易函数用于交易

chicang = cl.openingdata['kaicangzhuangtai'] *cl.openingdata['kaicangshuliang'] # 持仓状态和持仓数量

# 参数设置区

ss = cl.jiaoyishezhi[5][0] # 开仓数量

n1 = cl.jiaoyishezhi[5][1]+1 # 高点周期

n2 = cl.jiaoyishezhi[5][2]+1 # 低点周期

交易合约 = cl.jiaoyishezhi[3][0]

# 全局变量的初始化,为空的时候执行

if '日周期均线' not in cl.sjb: # 初始化时执行一次,用于初始化缓存字典

cl.sjb['日周期均线'] = 0

cl.sjb['时周期均线'] = 0

# 指标计算区

gd = max(High[-n1:-1])

dd = min(Low[-n2:-1])

try:

cl.sjb['日周期均线'] = RXZQ[交易合约].loc[Date[-1]]['ma1']

except:

pass

try:

cl.sjb['时周期均线'] = XIAOSHIZQ[交易合约].loc[Datetime[-1]]['ma1']

except:

pass

# 交易逻辑执行区

if chicang <= 0 and High[-1] >= gd and Close[-2] > cl.sjb['日周期均线'] and Close[-2] > cl.sjb['时周期均线']:

Buy(ss, max(Open[-1], gd), canshu)

else:

if chicang >= 0 and Low[-1] <= dd and Close[-2] < cl.sjb['日周期均线'] and Close[-2] < cl.sjb['时周期均线']:

SellShort(ss, min(Open[-1], dd), canshu)

return gd, dd, cl.sjb['日周期均线'], cl.sjb['时周期均线']

1.10、策略改进实例v1

#!/usr/bin/env python

# -*- coding: utf-8 -*-

from tool.gongju import *

from tool.zhibiao import ma_z, ema_z, atr_z

import tool.MyTT as myttzb

def 策略改进实例_v1(cl):

"""

策略改进实例,均线与回调加仓策略

"""

# 数据提取区

Open = cl.klines[0].open.values # 开盘价np列表

Open_z = cl.klines[0].open.values / cl.klines[0].fqxs.values

High = cl.klines[0].high.values # 最高价np列表

Low = cl.klines[0].low.values # 最低价np列表

Close = cl.klines[0].close.values # 收盘价np列表

Datetime = cl.klines[0].datetime.values # 日期时间序列

canshu = [cl.jiaoyiqidong, cl.zhanghu, cl.jiaoyishezhi, cl.openingdata, Datetime] # 传递给交易函数用于交易

riqi = cl.get_riqi(0) # 当前k线日期

shijian = cl.get_shijian(0) # 当前k线时间

持仓数量 = cl.openingdata['kaicangshuliang']

chicang = cl.openingdata['kaicangzhuangtai'] * 持仓数量 # 持仓状态和持仓数量

kaicangjia = cl.openingdata['kaicangjia'] # 开仓价格

# 参数设置区

ss = cl.jiaoyishezhi[5][0] # 开仓数量

n1 = cl.jiaoyishezhi[5][1] # ma1周期

n2 = cl.jiaoyishezhi[5][2] # ma2周期

资金 = cl.jiaoyishezhi[5][3]

账户 = cl.zhanghu[cl.jiaoyishezhi[0][0]] # 设置的交易账户对象

交易合约 = cl.jiaoyishezhi[3][0]

# 全局变量的初始化,为空的时候执行

if '最小变动' not in cl.sjb: # 每次策略初始化或更新数据时执行一次,用于在策略运行期间想持久化的数据

cl.sjb['最小变动'] = 账户.get_zuixiaobiandong(交易合约)

cl.sjb['加仓次数'] = 0

cl.sjb['开仓后最大盈亏'] = 0

cl.sjb['开仓后利润回调'] = 0

# 指标计算区

ma1 = ema_z(Close[-300:], n1)

ma2 = ema_z(Close[-300:], n2)

if cl.shangcishijian != Datetime[-1]: # 更新k线时执行,一般用与收盘需要计算的指标

乘值 = 账户.get_chengzhi(交易合约)

开仓手数 = max(1, round(资金 / (Open_z[-1] * 乘值 * 0.1))) # 保证金比例设置的百分之10

# 交易逻辑执行区

if chicang <= 0 and Close[-2] > ma2[-2] and ma1[-2] > ma2[-2]: # and Close[-3] < ma2[-3]

Buy(开仓手数, Open[-1], canshu)

cl.sjb['加仓次数'] = 0

# print('平空开多', riqi,shijian, ss, Open[-1])

else:

if chicang >= 0 and Close[-2] < ma2[-2] and ma1[-2] < ma2[-2]: # and Close[-3] > ma2[-3]

SellShort(开仓手数, Open[-1], canshu)

cl.sjb['加仓次数'] = 0

# print('平多开空', riqi, shijian, ss, Open[-1])

首次开仓位置 = cl.shoucikaicangjuli + 1

开仓后最高价 = High[-首次开仓位置:].max()

开仓后最低价 = Low[-首次开仓位置:].min()

if chicang > 0:

cl.sjb['开仓后最大盈亏'] = (开仓后最高价 - kaicangjia) / kaicangjia * 100

cl.sjb['开仓后利润回调'] = (开仓后最高价 - Close[-2]) / Close[-2] * 100

elif chicang < 0:

cl.sjb['开仓后最大盈亏'] = (kaicangjia - 开仓后最低价) / kaicangjia * 100

cl.sjb['开仓后利润回调'] = (Close[-2] - 开仓后最低价) / Close[-2] * 100

else:

cl.sjb['开仓后最大盈亏'] = 0

cl.sjb['开仓后利润回调'] = 0

if cl.shangcikaicangjuli > 2 and cl.sjb['加仓次数'] < 1:

if chicang > 0 and cl.sjb['开仓后最大盈亏'] > 2 and cl.sjb['开仓后利润回调'] > 1:

Buy_jjc(开仓手数, Open[-1], canshu)

cl.sjb['加仓次数'] += 1

# print('平空开多', riqi,shijian, ss, Open[-1])

else:

if chicang < 0 and cl.sjb['开仓后最大盈亏'] > 2 and cl.sjb['开仓后利润回调'] > 1:

SellShort_jjc(开仓手数, Open[-1], canshu)

cl.sjb['加仓次数'] += 1

# print('平多开空', riqi, shijian, ss, Open[-1])

if cl.shoucikaicangjuli > 6:

if chicang > 0 and Close[-2] < ma2[-2] and Close[-3] < ma2[-3] and Close[-4] < ma2[-4]:

Sell(持仓数量, Open[-1], canshu)

else:

if chicang < 0 and Close[-2] > ma2[-2] and Close[-3] > ma2[-3] and Close[-4] > ma2[-4]:

BuyToCover(持仓数量, Open[-1], canshu)

return ma1[-2], ma2[-2], cl.sjb['开仓后最大盈亏'], chicang # 此处输出的指标会在k线图中和监控界面中显示

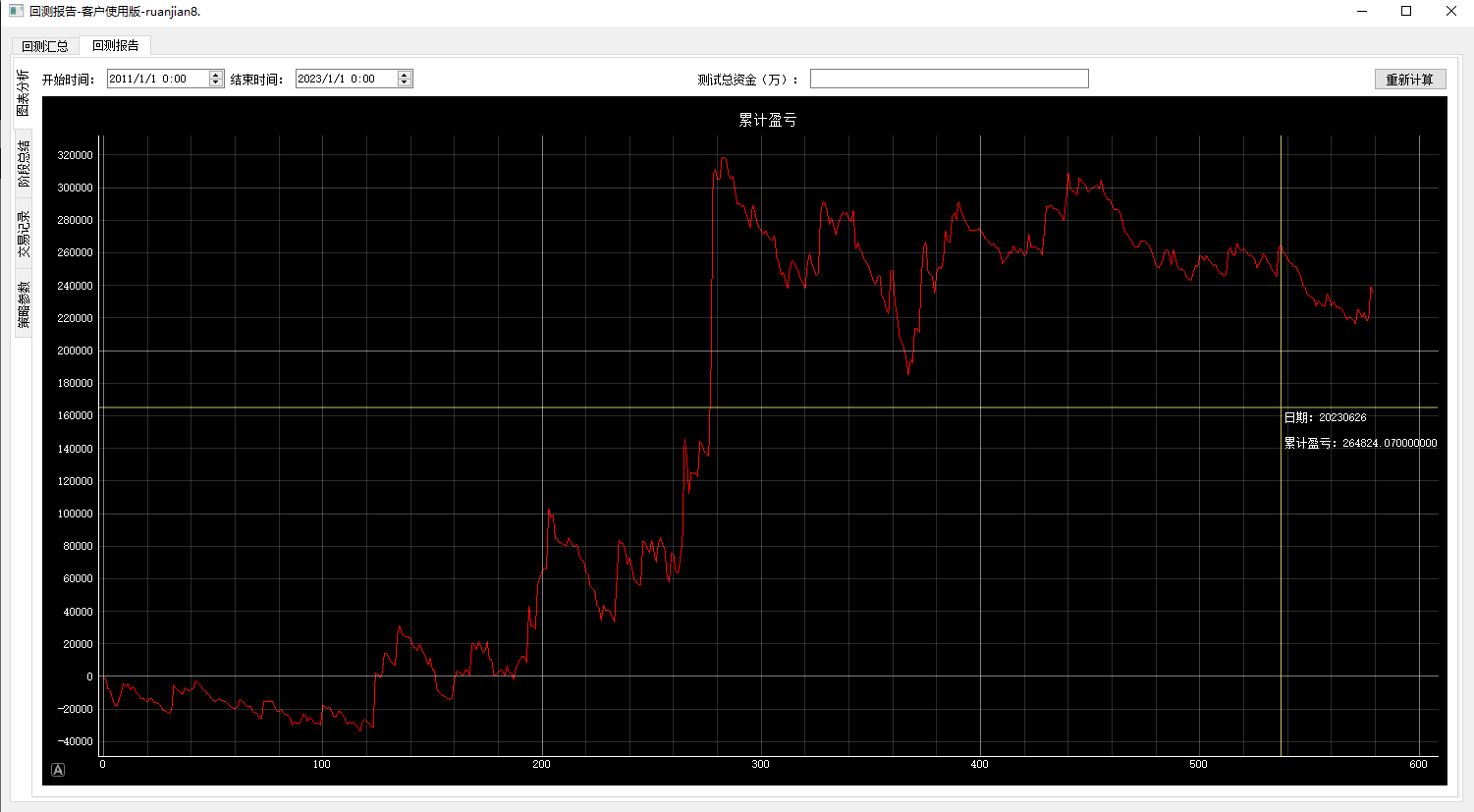

2、上面部分策略回测

策略参数完全凭经验设置。

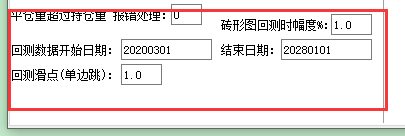

回测参数如下图:

回测模式和工作区如下图:

2.1、三均线策略

报告总汇:

累计收益:

信号图:

2.2、单均线策略

报告总汇:

累计收益:

信号图:

2.3、唐琪安通道策略

报告总汇:

累计收益:

信号图:

2.4、多空线加atr通道出场策略

报告总汇:

累计收益:

信号图:

2.5、红三兵策略(指数砖形图模式回测)

设置:砖形图幅度设置为1%,回测模式设置为8.

报告总汇:

累计收益:

信号图:

2.6、macd策略

报告总汇:

累计收益:

信号图:

2.7、双通道突破回调加仓策略

报告总汇:

累计收益:

信号图:

2.8、唐琪安通道加跨周期均线过滤策略

工作区:

报告总汇:

累计收益:

信号图:

博客介绍了多种期货交易策略的编写,包括三均线、单均线、唐琪安通道等策略,还给出了策略改进实例v1。同时对部分策略进行回测,展示了各策略的报告总汇、累计收益和信号图等信息,策略参数凭经验设置。

博客介绍了多种期货交易策略的编写,包括三均线、单均线、唐琪安通道等策略,还给出了策略改进实例v1。同时对部分策略进行回测,展示了各策略的报告总汇、累计收益和信号图等信息,策略参数凭经验设置。

2535

2535

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?