1. Requirement Analysis

1.1 Requirement Analysis for Our Exchange Platform

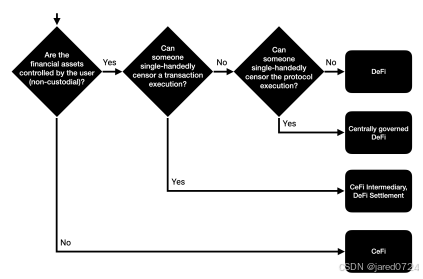

Centralized and decentralized exchange platforms constitute two distinct types of digital

marketplaces that trade assets, including cryptocurrencies, stocks, and other securities. These

platforms diverge in operational structures, control mechanisms, and security features. The

primary distinctions between centralized and decentralized exchange platforms are outlined

below:

Control and Management:

Centralized exchanges (CEX) operate under the management

and control of a single organization or entity, which serves as an intermediary between buyers

and sellers. These exchanges safeguard users' funds, oversee orders, and ensure efficient

transaction execution. Conversely, decentralized exchanges (DEX) function on a distributed

ledger, typically a blockchain, and do not depend on a central authority for transaction

facilitation. Trades are executed directly between users through smart contracts or other peer

to-peer methods without intermediaries.

Custody of Funds:

In centralized exchanges, users deposit assets into the exchange's wallets,

effectively ceding control of their funds to the exchange and necessitating trust in the

platform. In decentralized exchanges, users maintain control over their assets and private

keys, trading directly from their wallets, eliminating the need to trust a centralized authority

with their funds.

Security:

Centralized exchanges are more susceptible to hacks, given their status as single

points of failure. A compromised centralized exchange can jeopardize users' funds and

sensitive information. In contrast, decentralized exchanges are more secure due to their

distributed nature. They do not store users' funds centrally, reducing the risk of theft and

hacks.

Regulatory Compliance:

Centralized exchanges are under regulatory oversight and must

adhere to regulations, such as Know Your Customer (KYC) and Anti-Money Laundering

(AML) requirements. Decentralized exchanges, lacking a central authority and operating on a

peer-to-peer basis, often function beyond regulatory oversight. This can increase anonymity

but carries risks associated with money laundering and other illicit activities.

In conclusion, centralized and decentralized exchanges exhibit notable differences in control,

fund custody, security, regulatory compliance, performance, liquidity, and user experience.

Each exchange type possesses its advantages and drawbacks, and users should carefully

weigh these factors when selecting the most appropriate platform for their trading

requirements.

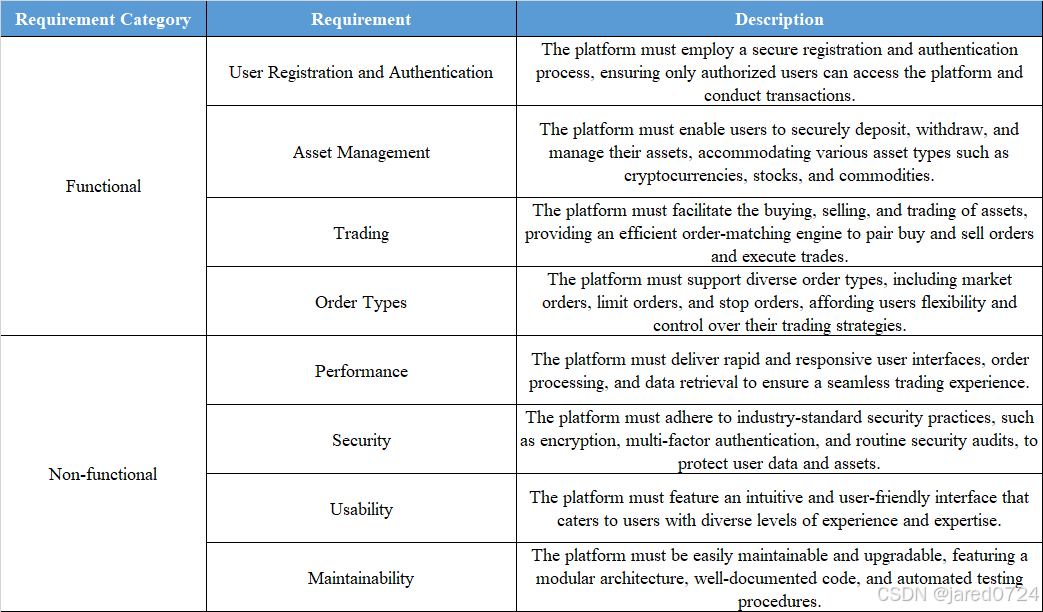

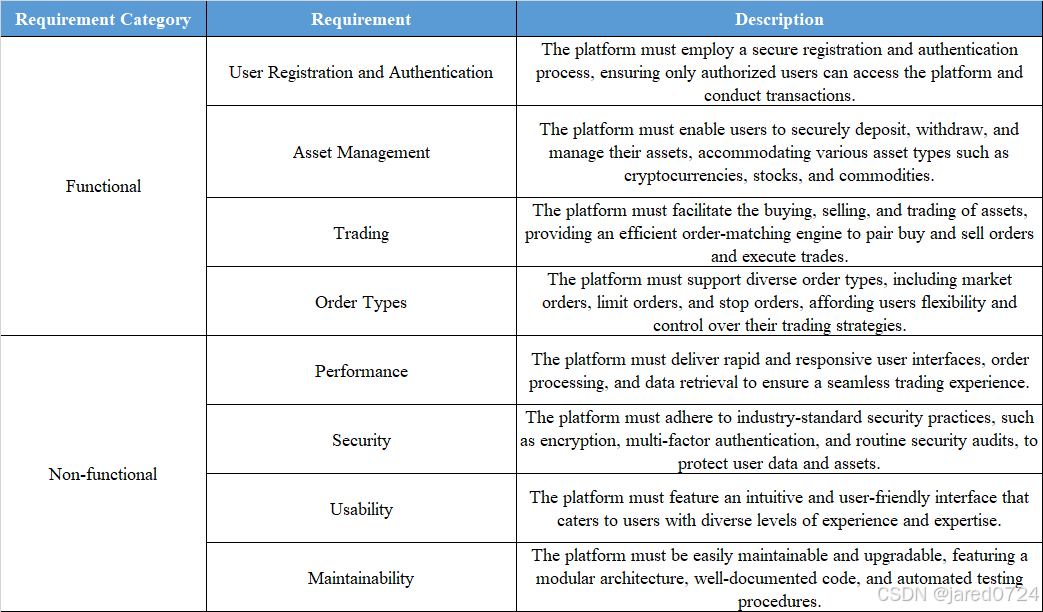

A centralized exchange platform constitutes a digital marketplace where users can purchase, sell,and trade various assets, including cryptocurrencies, stocks, commodities, and other securities. Centralized exchanges operate under a single organization's management as an intermediary between buyers and sellers. To develop a resilient and efficient centralized exchange platform, it is crucial to identify and examine the diverse functional and nonfunctional requirements.

1.2 Functional Requirements:

User Registration and Authentication:

The platform must employ a secure registration and

authentication process, ensuring only authorized users can access the platform and conduct

transactions.

Asset Management:

The platform must enable users to securely deposit, withdraw, and

manage their assets, accommodating various asset types such as cryptocurrencies, stocks, and

commodities.

Trading:

The platform must facilitate the buying, selling, and trading of assets, providing an

efficient order-matching engine to pair buy and sell orders and execute trades.

Order Types:

The platform must support diverse order types, including market orders, limit

orders, and stop orders, affording users flexibility and control over their trading strategies.

Non-functional Requirements:

Performance:

The platform must deliver rapid and responsive user interfaces, order

processing, and data retrieval to ensure a seamless trading experience.

Security:

The platform must adhere to industry-standard security practices, such as

encryption, multi-factor authentication, and routine security audits, to protect user data and

assets.

Usability:

The platform must feature an intuitive and user-friendly interface that caters to

users with diverse levels of experience and expertise.

Maintainability:

The platform must be easily maintainable and upgradable, featuring a

modular architecture, well-documented code, and automated testing procedures.

2. System Design and Implementation

2.1 Functional System Requirements

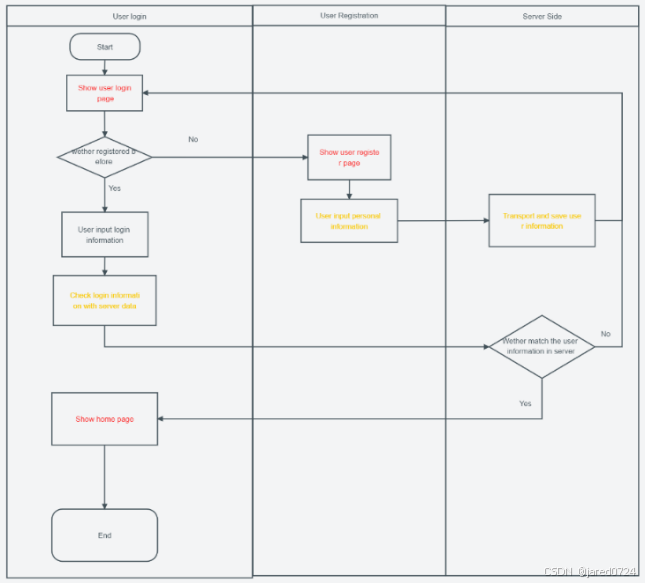

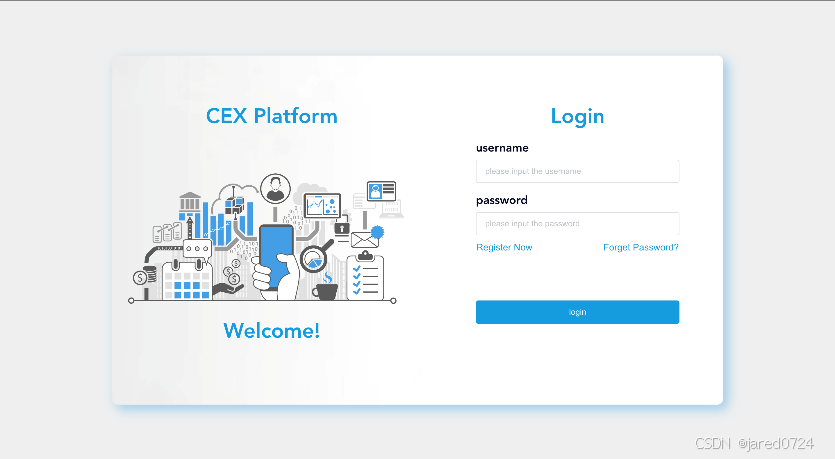

2.1.1 User Registration and Authentication

In this section, we present a comprehensive description of the design process for a login

system, detailing both frontend and backend components:

Frontend - Login Page:

a. HTML/CSS: Design the login page structure and aesthetics, incorporating input fields for

email/username and password and the "Log In" button.

b. JavaScript: Incorporate event listeners to manage user interactions, including form

submission and input validation.

c. Input validation: Establish frontend validation protocols, such as verifying field

completeness.

d. AJAX/JavaScript framework: Transmit the login data to the backend server via a POST

request targeting the designated API endpoint.

Backend - API Endpoint:

a. Web framework: Configure a route to process the login API request.

b. Input validation: Execute server-side validation of incoming data, including verification of

field completeness and email format correctness.

c. Data retrieval: Search the database for a user record corresponding to the provided

email/username.

d. Authentication: Assess the consistency between the received password and the stored

hashed password using an identical hashing algorithm.

i. If the password is consistent, proceed to the subsequent step.

ii. If the password is inconsistent, return an error response to the front.

e. Session/JWT: Generate a session or JWT containing relevant user information.

f. Response: Dispatch a successful response to the front end, incorporating the session/JWT

data.

Frontend - Authentication State:

a. Response handling: Examine the backend response to ascertain success or error presence.

b. Store session/JWT: If successful, securely store the acquired session/JWT data.

c. Redirect: Direct the user to the appropriate protected page or dashboard upon successful

login.

Frontend - Authenticated Requests:

a. Include session/JWT: For all subsequent requests to protected API endpoints, incorporate

the stored session/JWT data within the request headers.

b. Handle expired sessions: Should the backend return a response indicating session/JWT

expiration, prompt the user to re-login.

Backend - Authenticated Endpoints:

a. Middleware: Implement middleware to validate the session/JWT data in requests targeting

protected API endpoints.

b. Access control: Regulate access to specific resources based on the user's authentication

status and permissions.

The following is a flowchart of the completed process:

Users can access the platform by entering their unique username and password. First-time

users may also create a new account by selecting the 'register now' option. If users forget their

password, a password reset function is available. The entire login process has been designed

to be secure and efficient while providing password recovery options.

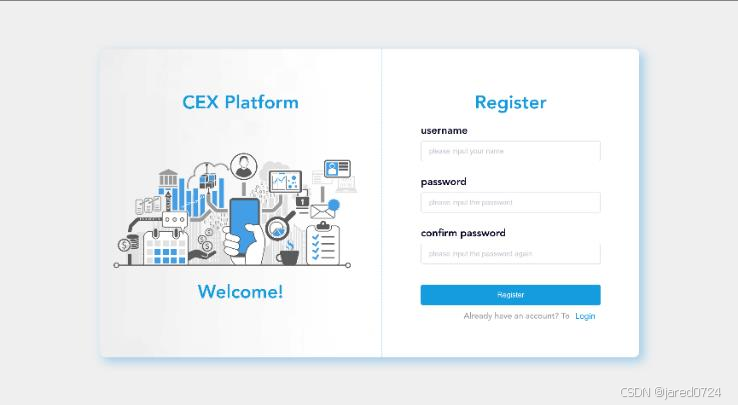

New users accessing the platform for the first time can register and create an account. They

can define a custom username and password, with the latter supporting a combination of

letters, numbers, and special symbols for enhanced security. To minimize issues arising from

input errors, users must enter their password twice during registration. This approach ensures

the utmost security for user accounts.

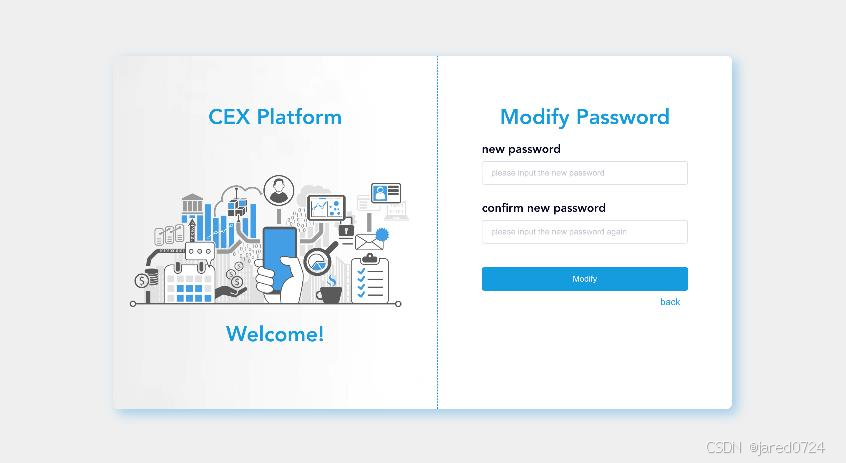

A password recovery portal is available if a user forgets their login password. Through this

portal, users can initiate a password reset process to create a new password for their account.

This feature contributes to the ongoing accessibility and security of the user's account.

2.1.2 Trade-Buy Cryptocurrency

This section presents a comprehensive system design for purchasing cryptocurrency,

encompassing frontend, backend, and external components.

Frontend - Buy Cryptocurrency Interface:

a. HTML/CSS: Construct a user-friendly interface incorporating input fields for

cryptocurrency selection, purchase amount specification, and current market price display.

b. JavaScript: Integrate event listeners to manage user interactions, such as choosing a

cryptocurrency and defining the purchase amount.

c. AJAX/JavaScript framework: Request the selected cryptocurrency's current market price

from the backend, updating the displayed price accordingly.

d. Form submission: Transmit the buy order data (cryptocurrency, amount, and price) to the

backend server via a POST request targeting the designated API endpoint.

Backend - API Endpoint:

a. Web framework: Configure a route to process the buy order API request.

b. Input validation: Execute server-side validation of incoming data, verifying field

completeness and numerical value validity.

c. Authentication: Confirm the user's authentication state using session or JWT data included

in the request.

d. User account balance: Determine if the user possesses adequate fund

最低0.47元/天 解锁文章

最低0.47元/天 解锁文章

1170

1170