这一章我们分析pool中流动性的修改过程,

在阅读本章之前一定要先通读uniswap v3/v4 中pool的状态管理

在阅读本章之前一定要先通读uniswap v3/v4 中pool的状态管理

在阅读本章之前一定要先通读uniswap v3/v4 中pool的状态管理

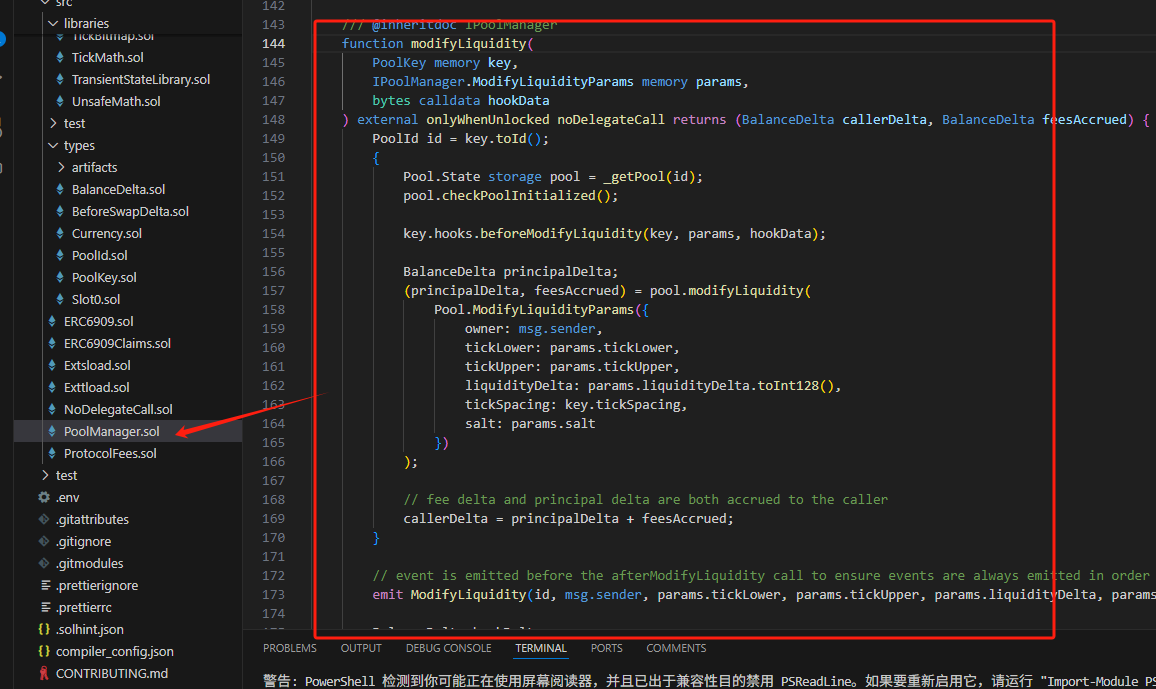

代码位置如下:

这个方法提供增加或减少流动性的功能,并计算用户应得的手续费(feesAccrued)和流动性变化(callerDelta),同时支持钩子(Hooks)机制,允许在流动性修改前后执行自定义逻辑。

先看代码:

function modifyLiquidity(

PoolKey memory key,

IPoolManager.ModifyLiquidityParams memory params,

bytes calldata hookData

) external onlyWhenUnlocked noDelegateCall returns (BalanceDelta callerDelta, BalanceDelta feesAccrued) {

PoolId id = key.toId();

{

Pool.State storage pool = _getPool(id);

pool.checkPoolInitialized();

key.hooks.beforeModifyLiquidity(key, params, hookData);

BalanceDelta principalDelta;

(principalDelta, feesAccrued) = pool.modifyLiquidity(

Pool.ModifyLiquidityParams({

owner: msg.sender,

tickLower: params.tickLower,

tickUpper: params.tickUpper,

liquidityDelta: params.liquidityDelta.toInt128(),

tickSpacing: key.tickSpacing,

salt: params.salt

})

);

// fee delta and principal delta are both accrued to the caller

callerDelta = principalDelta + feesAccrued;

}

// event is emitted before the afterModifyLiquidity call to ensure events are always emitted in order

emit ModifyLiquidity(id, msg.sender, params.tickLower, params.tickUpper, params.liquidityDelta, params.salt);

BalanceDelta hookDelta;

(callerDelta, hookDelta) = key.hooks.afterModifyLiquidity(key, params, callerDelta, feesAccrued, hookData);

// if the hook doesn't have the flag to be able to return deltas, hookDelta will always be 0

if (hookDelta != BalanceDeltaLibrary.ZERO_DELTA) _accountPoolBalanceDelta(key, hookDelta, address(key.hooks));

_accountPoolBalanceDelta(key, callerDelta, msg.sender);

}入参

-

PoolKey memory key:

表示池的唯一标识,这里面池的基本信息(代币对、手续费、tick 间距等)。通过 key.toId() 转换为池的唯一 ID。

-

具体参数如下:IPoolManager.ModifyLiquidityParams memory params:salt:用于唯一标识流动性位置的附加参数。liquidityDelta:流动性变化量(正值表示增加流动性,负值表示减少流动性)。tickUpper:流动性范围的上界。tickLower:流动性范围的下界。

-

钩子(Hooks)所需的附加数据,允许在流动性修改前后执行自定义逻辑。bytes calldata hookData:

这些参数都比较简单,唯一的需要解释的是salt参数,这里包含一个v4版本相对v3版本的升级,在v3版本中,增减流动性只需要提供tick的范围,合约根据发送者的地址和tick范围就可以定位到用户所拥有的流动性,并对其做增减。但是我们试想这样一个场景。用户可能希望在相同的价格范围内应用不同的策略,一部分资金用于长期流动性提供,另一部分用于短期套利。这样的话在同一个tick范围内统一做流动性管理就不太合适了。所以uniswap v4版本在此基础上对于同一用户,同一tick范围的流动性又做了一层分区,允许用户在不同的分区采取不同的交易策略,而这些分区就是用salt来区分位置的。需要注意的是salt 是一个 用户定义的参数,Uniswap 并不会自动生成 salt。用户需要自己管理它。

前面几行代码比较简单

- Pool.State storage pool = _getPool(id); //获取相应的pool

- pool.checkPoolInitialized();//校验当前pool是否初始化

- key.hooks.beforeModifyLiquidity(key, params, hookData);//执行更新流动性的相应钩子

更新pool

这个方法的核心步骤就是

(principalDelta, feesAccrued) = pool.modifyLiquidity( Pool.ModifyLiquidityParams({

owner: msg.sender,

tickLower: params.tickLower,

tickUpper: params.tickUpper,

liquidityDelta: params.liquidityDelta.toInt128(),

tickSpacing: key.tickSpacing,

salt: params.salt

}));我们仔细分析一下:

function modifyLiquidity(State storage self, ModifyLiquidityParams memory params)

internal

returns (BalanceDelta delta, BalanceDelta feeDelta)

{

int128 liquidityDelta = params.liquidityDelta;

int24 tickLower = params.tickLower;

int24 tickUpper = params.tickUpper;

checkTicks(tickLower, tickUpper);

{

ModifyLiquidityState memory state;

// if we need to update the ticks, do it

if (liquidityDelta != 0) {

(state.flippedLower, state.liquidityGrossAfterLower) =

updateTick(self, tickLower, liquidityDelta, false);

(state.flippedUpper, state.liquidityGrossAfterUpper) = updateTick(self, tickUpper, liquidityDelta, true);

// `>` and `>=` are logically equivalent here but `>=` is cheaper

if (liquidityDelta >= 0) {

uint128 maxLiquidityPerTick = tickSpacingToMaxLiquidityPerTick(params.tickSpacing);

if (state.liquidityGrossAfterLower > maxLiquidityPerTick) {

TickLiquidityOverflow.selector.revertWith(tickLower);

}

if (state.liquidityGrossAfterUpper > maxLiquidityPerTick) {

TickLiquidityOverflow.selector.revertWith(tickUpper);

}

}

if (state.flippedLower) {

self.tickBitmap.flipTick(tickLower, params.tickSpacing);

}

if (state.flippedUpper) {

self.tickBitmap.flipTick(tickUpper, params.tickSpacing);

}

}

{

(uint256 feeGrowthInside0X128, uint256 feeGrowthInside1X128) =

getFeeGrowthInside(self, tickLower, tickUpper);

Position.State storage position = self.positions.get(params.owner, tickLower, tickUpper, params.salt);

(uint256 feesOwed0, uint256 feesOwed1) =

position.update(liquidityDelta, feeGrowthInside0X128, feeGrowthInside1X128);

// Fees earned from LPing are calculated, and returned

feeDelta = toBalanceDelta(feesOwed0.toInt128(), feesOwed1.toInt128());

}

// clear any tick data that is no longer needed

if (liquidityDelta < 0) {

if (state.flippedLower) {

clearTick(self, tickLower);

}

if (state.flippedUpper) {

clearTick(self, tickUpper);

}

}

}

if (liquidityDelta != 0) {

Slot0 _slot0 = self.slot0;

(int24 tick, uint160 sqrtPriceX96) = (_slot0.tick(), _slot0.sqrtPriceX96());

if (tick < tickLower) {

// current tick is below the passed range; liquidity can only become in range by crossing from left to

// right, when we'll need _more_ currency0 (it's becoming more valuable) so user must provide it

delta = toBalanceDelta(

SqrtPriceMath.getAmount0Delta(

TickMath.getSqrtPriceAtTick(tickLower), TickMath.getSqrtPriceAtTick(tickUpper), liquidityDelta

).toInt128(),

0

);

} else if (tick < tickUpper) {

delta = toBalanceDelta(

SqrtPriceMath.getAmount0Delta(sqrtPriceX96, TickMath.getSqrtPriceAtTick(tickUpper), liquidityDelta)

.toInt128(),

SqrtPriceMath.getAmou

最低0.47元/天 解锁文章

最低0.47元/天 解锁文章

851

851

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?