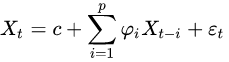

Autoregressive model is a statistical method to deal with time series. It uses the same variable, such as the previous periods of X, that is, X1 to xt-1, to predict the performance of XT in this period, and assumes that they are a linear relationship. Because this is developed from linear regression in regression analysis, but x is not used to predict y, but x is used to predict x (itself); So it’s called autoregression.

Where: C is a constant term; It is assumed that the mean is equal to 0 and the standard deviation is equal to the random error value of; It is assumed to be constant for any t. The text description is: the expected value of X is equal to the linear combination of one or several late stages, plus constant term and random error.

Vector autoregressive model is a generalization of AR model. This concept should be different from the VAR model of financi

本文介绍了如何使用r语言构建平稳的AR(Autoregressive)序列,并详细阐述了AR模型的原理,即利用前期的X值线性预测当前期的XT。同时,提到了该模型是线性回归的拓展,但这里的X预测X自身。还提及了VAR向量自回归模型作为AR模型的推广,与金融风险管理中的VAR模型区分开来。

本文介绍了如何使用r语言构建平稳的AR(Autoregressive)序列,并详细阐述了AR模型的原理,即利用前期的X值线性预测当前期的XT。同时,提到了该模型是线性回归的拓展,但这里的X预测X自身。还提及了VAR向量自回归模型作为AR模型的推广,与金融风险管理中的VAR模型区分开来。

最低0.47元/天 解锁文章

最低0.47元/天 解锁文章

1万+

1万+

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?