今日知识点:Analysis of Tax

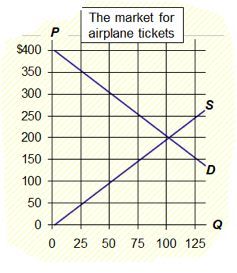

例题

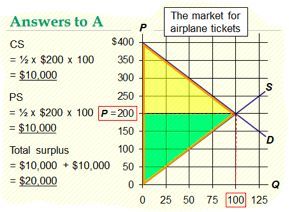

A. Compute consumer surplus, producer surplus, and total surplus without a tax.

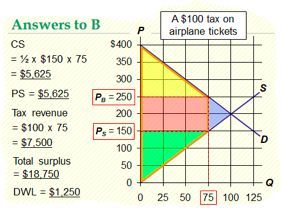

B. If $100 tax per ticket, compute consumer surplus, producer surplus, tax revenue, total surplus, and deadweight loss.

解析

下面我们为大家准备了一道同类型的题目,请大家一起来试试解答。

Question: Elasticity and the deadweight loss of a tax

Would the deadweight loss of a tax be larger if the tax were on:

A. Breakfast cereal or sunscreen?

B. Hotel rooms in the short run or hotel rooms in the long run?

C. Groceries or meals at fancy restaurants?

.

.

.

.

.

.

.

.

.

.

.

.

.

正确答案:

A. Breakfast cereal or sunscreen

Breakfast cereal has more close substitutes than sunscreen, so demand for breakfast cereal is more price-elastic than demand for sunscreen. So, a tax on breakfast cereal would cause a larger deadweight loss than a tax on sunscreen.

B. Hotel rooms in the short run or long run

The price elasticities of demand and supply for hotel rooms are larger in the long run than in the short run. So, a tax on hotel rooms would cause a larger deadweight loss in the long run than in the short run.

C. Groceries or meals at fancy restaurants

Groceries are more of a necessity and therefore less price-elastic than meals at fancy restaurants. So, a tax on restaurant meals would cause a larger deadweight loss than a tax on groceries.

本文探讨了不同产品和服务的税收如何影响消费者剩余、生产者剩余及总剩余。通过分析早餐麦片与防晒霜、短期与长期酒店房间以及杂货与高档餐厅用餐的税收,解释了需求弹性的变化如何导致税收带来的福利损失差异。

本文探讨了不同产品和服务的税收如何影响消费者剩余、生产者剩余及总剩余。通过分析早餐麦片与防晒霜、短期与长期酒店房间以及杂货与高档餐厅用餐的税收,解释了需求弹性的变化如何导致税收带来的福利损失差异。

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?