第一题:

(1)

> fm=lm(exp~income,data=consumption[25:200,])

> fm

Call:

lm(formula = exp ~ income, data = consumption[25:200, ])

Coefficients:

(Intercept) income

7550.2970 0.8567

故可支配收入的边际消费倾向为0.8567

(2)

>b=residuals(fm)

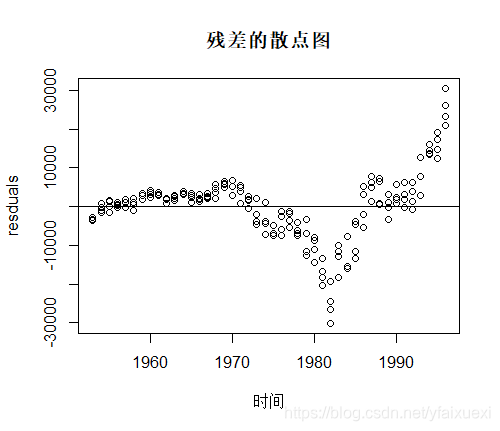

> plot(b~consumption$year[25:200],xlab="时间",ylab="resduals",main="残差的散点图")

> abline(h=0)

由残差的散点图可以看出,残差并不均匀的分布于0的两边,故消费函数的模型没有被很好的说明

(3)

> consumtion.simulate=numeric(0)

> e=rnorm(1000,mean=0,sd=sd(b))

> for(i in 25:200){

+ consumtion.simulate[i]=fm$coefficients[1]+fm$coefficients[2]*consumption$income[i]+e[i]

+ }

> consumtion.simulate

[1] NA NA NA NA NA NA NA NA NA NA NA NA NA

[14] NA NA NA NA NA NA NA NA NA NA NA 67602.38 85361.77

[27] 91099.13 70015.95 60661.14 55368.01 73888.95 68236.34 83866.94 71897.67 75680.88 78062.76 70394.12 84843.30 91000.17

[40] 87677.12 74300.04 81240.22 92586.31 83171.57 104099.65 97171.95 94383.86 80940.79 92911.47 88645.74 87371.14 104732.63

[53] 83170.00 88732.84 95637.48 108196.25 97111.01 98903.78 103386.57 85517.69 100632.89 109468.58 93445.84 104913.64 115803.67

[66] 112661.08 114327.32 100433.40 106786.50 105092.67 106094.08 111246.33 112058.63 125349.80 121831.10 121320.89 113496.89 129664.88

[79] 129077.53 141532.35 156271.87 134235.05 133661.62 125898.42 160840.96 130739.91 127310.58 149179.79 153186.93 141285.96 142481.44

[92] 154480.87 154751.36 162861.08 139387.68 158845.07 150828.99 161372.45 167336.35 177637.52 169567.68 180572.40 157809.60 191593.46

[105] 189344.36 187312.54 199243.93 188721.23 208851.13 205626.25 198539.07 205412.41 200494.46 225353.16 220274.46 225245.26 226412.29

[118] 240965.72 223026.73 233325.44 237005.07 237281.97 250961.51 228358.83 250932.17 253592.84 230730.16 255180.34 249588.10 248038.71

[131] 267452.41 264014.04 248605.48 264046.10 252463.65 257183.41 280553.85 275228.67 287612.17 282627.58 273259.42 291749.13 263067.30

[144] 265522.83 274601.96 262936.90 276549.90 272589.96 284995.22 286564.34 283023.15 299163.32 286280.12 306082.98 290402.80 302817.12

[157] 296547.00 293310.55 290185.30 300831.89 299587.42 301168.93 303105.27 297884.62 309939.98 317422.30 337479.84 329209.80 322125.42

[170] 336058.18 330487.34 321292.91 349703.02 329182.67 344560.38 345304.33 315574.14 314761.65 325225.87 339137.94 324060.50 331547.16

[183] 348333.15 323140.18 339415.36 335924.37 353086.22 324917.34 341164.77 333653.74 346251.10 339287.65 346000.25 346904.47 346162.92

[196] 365042.41 335132.85 355920.85 343495.43 360925.92

(4)

> fm1=lm(consumtion.simulate[25:200]~consumption$income[25:200])

> fm1

Call:

lm(formula = consumtion.simulate[25:200] ~ consumption$income[25:200])

Coefficients:

(Intercept) consumption$income[25:200]

4447.8737 0.8692

估计参数和原数据的估计参数明显不同,因为之前的模型中误差并不符合正态分布,而我们现在的误差是符合正态分布的。

(5)

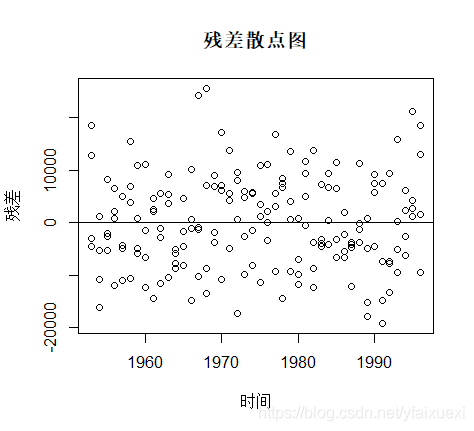

> c=residuals(fm1)

> plot(consumption$year[25:200],c,xlab="时间",ylab="残差",main="残差散点图")

> abline(h=0)

该残差散点图看起来与之前的残差散点图明显不同。

第二题

(1)

tbrate.lm <- lm (`delta r(t)`~1+`delta r(t-1)`+`delta r(t-2)`+`pi(t-1)`+`delta y(t-1)`,tbrate)

> summary(tbrate.lm)

Call:

lm(formula = `delta r(t)` ~ 1 + `delta r(t-1)` + `delta r(t-2)` +

`pi(t-1)` + `delta y(t-1)`, data = tbrate)

Residuals:

Min 1Q Median 3Q Max

-3.6601 -0.3893 -0.0103 0.4276 3.9350

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.23194 0.12561 -1.846 0.06647 .

`delta r(t-1)` 0.23746 0.07407 3.206 0.00159 **

`delta r(t-2)` -0.15402 0.07254 -2.123 0.03510 *

`pi(t-1)` 0.01606 0.02003 0.802 0.42367

`delta y(t-1)` 18.38074 5.75892 3.192 0.00167 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.8911 on 180 degrees of freedom

(3 observations deleted due to missingness)

Multiple R-squared: 0.1344, Adjusted R-squared: 0.1152

F-statistic: 6.988 on 4 and 180 DF, p-value: 2.984e-05

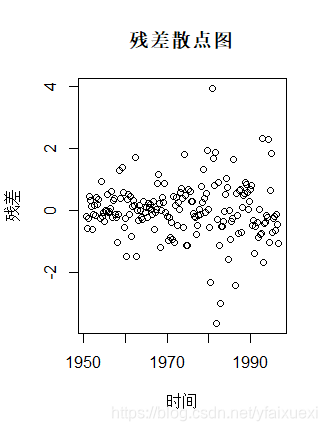

> b=residuals(tbrate.lm)

> t<-seq(1950.75,1996.75,0.25)

> plot(t,b,xlab="时间",ylab="残差",main="残差散点图")

>abline(h=0)

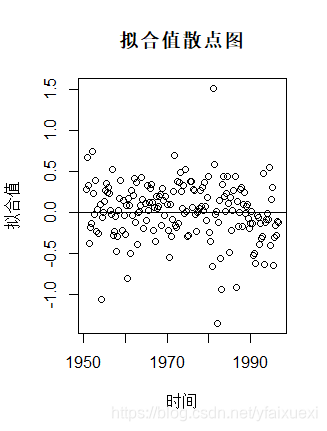

> plot(t,tbrate.lm$fitted.values,xlab="时间",ylab="拟合值",main="拟合值散点图")

> abline(h=0)

> lm2<-lm(b~tbrate.lm$fitted.values)

> summary(lm2)

Call:

lm(formula = b ~ tbrate.lm$fitted.values)

Residuals:

Min 1Q Median 3Q Max

-3.6601 -0.3893 -0.0103 0.4276 3.9350

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.218e-17 6.503e-02 0 1

tbrate.lm$fitted.values -5.891e-16 1.876e-01 0 1

Residual standard error: 0.8838 on 183 degrees of freedom

Multiple R-squared: 4.048e-32, Adjusted R-squared: -0.005464

F-statistic: 7.408e-30 on 1 and 183 DF, p-value: 1

将残差对拟合值做回归,可以看出回归的调整拟合优度接近于0,且t-value=0.说明残差不能对拟合值进行拟合。

> lm3<-lm(tbrate.lm$fitted.values~b)

> summary(lm3)

Call:

lm(formula = tbrate.lm$fitted.values ~ b)

Residuals:

Min 1Q Median 3Q Max

-1.37411 -0.18022 0.01318 0.22632 1.50550

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.339e-02 2.561e-02 0.523 0.602

b -1.021e-16 2.913e-02 0.000 1.000

Residual standard error: 0.3483 on 183 degrees of freedom

Multiple R-squared: 6.272e-32, Adjusted R-squared: -0.005464

F-statistic: 1.148e-29 on 1 and 183 DF, p-value: 1

将拟合值对残差做回归,调整拟合优度接近0,且t-value接近于0,故拟合值中不存在残差可以解释的部分。

(2)

> lm4<- lm (`delta r(t)`~1+`delta r(t-1)`+`delta r(t-2)`+`delta y(t-1)`,tbrate)

> ethat=residuals(lm4)

> lm5<- lm (`pi(t-1)`~1+`delta r(t-1)`+`delta r(t-2)`+`delta y(t-1)`,tbrate)

> vthat=residuals(lm5)

> lm6<-lm(ethat~vthat)

> summary(lm6)

Call:

lm(formula = ethat ~ vthat)

Residuals:

Min 1Q Median 3Q Max

-3.6601 -0.3893 -0.0103 0.4276 3.9350

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 3.288e-17 6.498e-02 0.000 1.00

vthat 1.606e-02 1.987e-02 0.809 0.42

Residual standard error: 0.8838 on 183 degrees of freedom

Multiple R-squared: 0.00356, Adjusted R-squared: -0.001885

F-statistic: 0.6538 on 1 and 183 DF, p-value: 0.4198

R-squared接近于0,t值也接近于0,且不显著,说明ethat不能与vthat进行回归,ethat中不存在vthat能够解释的部分。也就是说,对于pi(t-1)和delta r(t),在排除delta r(t-1),delta r(t-2),delta y(t-1)的解释部分后,pi(t-1)中不存在能解释delta r(t)的部分,这正好解释了回归方程(1)中pi(t-1)的估计参数不显著,因为其能解释的已经被其他三者覆盖了。

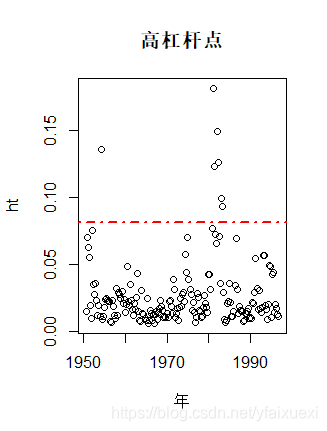

(3)

ht <- hatvalues(tbrate.lm)

p <- length(tbrate.lm$coefficients)

n <- length(tbrate.lm$fitted.values)

plot(t,ht,xlab = '年',main = '高杠杆点')

abline(h = 3*p/n,col = 2,lty = 4 , lwd = 2)

如上图所示,虚线以上为高杠杆点。

4731

4731

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?