一、获取数据

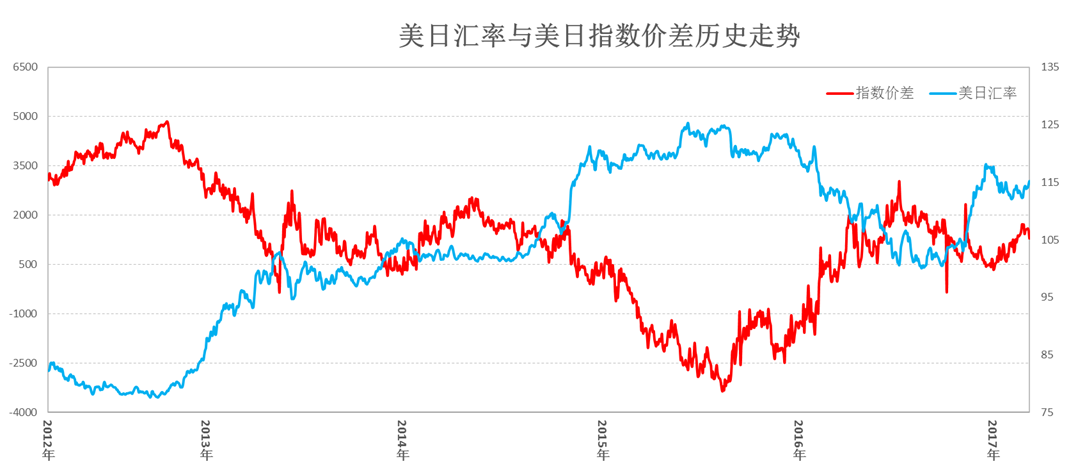

在yahoo抓取自2012年以来,美日汇率、日经指数和美国道指指数价差。

> library(quantmod)

> Indexdata<-list()

> Index<-c("^N225","DJIA")

> IndexName<-c("N225","US30","USD/JPY")

> for(i in 1:2){

+ n<-Index[i]

+ res<-get(getSymbols(n,src="yahoo",from="2012-01-01",to=Sys.Date()))

+ cp<-res[,4]

+ Indexdata[[i]]<-cp

+ next}

> forex<-get(getFX("USD/JPY",from="2012-01-01",to=Sys.Date(),auto.assign=TRUE))

> Indexdata[[3]]<-forex

> Returndata<-do.call(merge,Indexdata)

> names(Returndata)<-IndexName

> mydata<-na.omit(Returndata)

> mydata$diff<-mydata$US30-mydata$N225

> getdata<-mydata[,3:4]

> head(getdata) #查看前6条记录

USD.JPY diff

2012-03-12 82.2687 3069.850

2012-03-13 82.5322 3278.600

2012-03-14 83.3701 3143.580

2012-03-15 83.6701 3129.479

2012-03-16 83.5102 3102.790

2012-03-19 83.3502 3097.140

> tail(getdata) #查看后6条记录

USD.JPY diff

2017-03-03 114.315 1536.541

2017-03-06 113.846 1575.199

2017-03-07 113.963 1580.609

2017-03-08 114.100 1601.701

2017-03-09 114.622 1539.609

2017-03-10 115.178 1298.371

> dim(getdata)

[1] 1199 2

二、数据的初步探索

> cordata<-cor(getdata[,1:2])

> cordata

USD.JPY diff

USD.JPY 1.0000000 -0.9195801

diff -0.9195801 1.0000000

由上面可以看到,美日汇率与美日股市指数差价具有强负相关性。

三、构造线性回归模型

1、以汇率为因变量,指数价差为自变量:

> model<-lm(USD.JPY~diff,getdata)

> summary(model)

Call:

lm(formula = USD.JPY ~ diff, data = getdata)

Residuals:

Min 1Q Median 3Q Max

-10.8174 -4.4264 -0.7552 4.0511 13.7444

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.115e+02 1.799e-01 619.80 <2e-16 ***

diff -6.825e-03 8.428e-05 -80.97 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 5.339 on 1197 degrees of freedom

Multiple R-squared: 0.8456, Adjusted R-squared: 0.8455

F-statistic: 6557 on 1 and 1197 DF, p-value: < 2.2e-16

P值小,说明回归效果显著。

当美日股市指数差价为2000时,预测美日汇率:

> new<-data.frame(diff=2000)

> myforex<-predict(model,new,interval="prediction",level=0.95)

> myforex

fit lwr upr

1 97.82946 87.34874 108.3102

本文通过抓取美日汇率、日经指数和美国道指指数的数据,探索了美日汇率与美日股市指数差价之间的关系。利用R语言进行数据分析,发现两者存在强负相关性,并建立线性回归模型进行预测。

本文通过抓取美日汇率、日经指数和美国道指指数的数据,探索了美日汇率与美日股市指数差价之间的关系。利用R语言进行数据分析,发现两者存在强负相关性,并建立线性回归模型进行预测。

500

500

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?