Reference: <An Introduction to Management Science Quantitative Approaches to Decision Making, Revised 13th Edition>

Instance

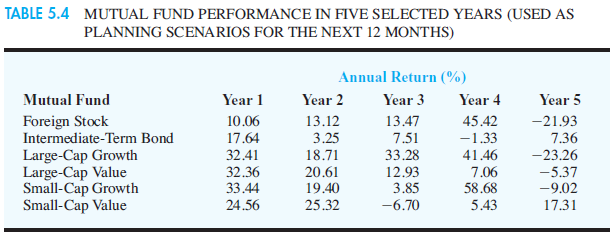

Hauck Investment Services designs annuities, IRAs, 401(k) plans, and other investment vehicles for investors with a variety of risk tolerances. Hauck would like to develop a portfolio model that can be used to determine an optimal portfolio involving a mix of six mutual funds. A variety of measures can be used to indicate risk, but for portfolios of financial assets all are related to variability in return. Table 5.4 shows the annual return (%) for five 1-year periods for the six mutual funds. Year 1 represents a year in which the annual returns are good for all the mutual funds. Year 2 is also a good year for most of the mutual funds. But year 3 is a bad year for the small-cap value fund; year 4 is a bad year for the intermediate-term bond fund; and year 5 is a bad year for four of the six mutual funds.

It is not possible to predict exactly the returns for any of the funds over the next 12 months, but the portfolio managers at Hauck Financial Services think that the returns for the five years shown in Table 5.4 are scenarios that can be used to represent the possibilities for the next year. For the purpose of building portfolios for their clients, Hauck’s portfolio managers will choose a mix of these six mutual funds and assume that one of the five possible scenarios will describe the return over the next 12 months.

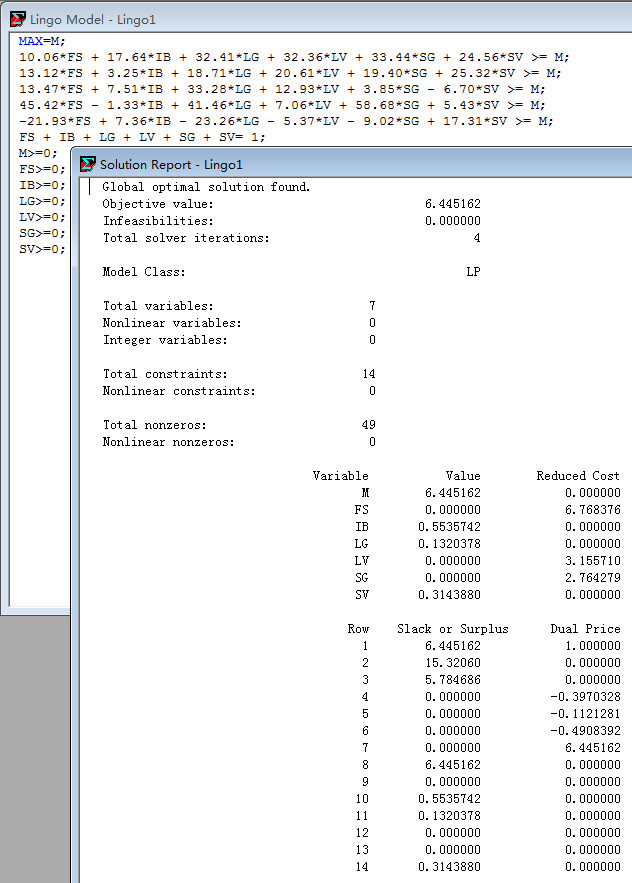

Soultion-Conservative Portfolio

The manager’s task is to determine the proportion of the portfolio to invest in each of the six mutual funds so that the portfolio provides the best return possible with a minimum risk.

Decision variables:

FS = proportion of portfolio invested in the foreign stock mutual fund

IB = proportion of portfolio invested in the intermediate-term bond fund

LG = proportion of portfolio invested in the large-cap growth fund

LV = proportion of portfolio invested in the large-cap value fund

SG = proportion of portfolio invested in the small-cap growth fund

SV = proportion of portfolio invested in the small-cap value fund

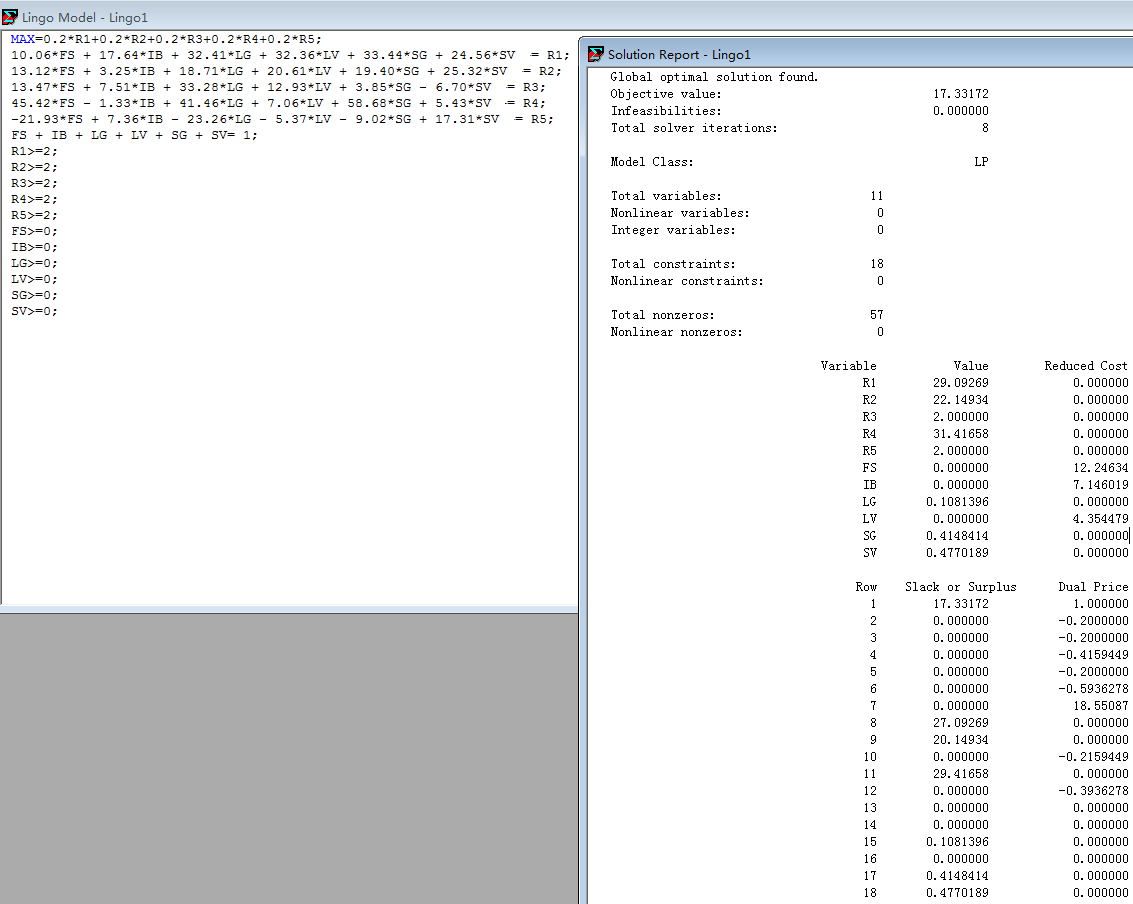

Soultion-Moderate Risk Portfolio

Hauck’s portfolio manager would like to also construct a portfolio for clients who are willing to accept a moderate amount of risk in order to attempt to achieve better returns. Suppose that clients in this risk category are willing to accept some risk but do not want the annual return for the portfolio to drop below 2%. By setting M 2 in the minimum-return constraints in the maximin model, we can constrain the model to provide a solution with an annual return of at least 2%.

A different objective is needed for this portfolio optimization problem. A common approach is to maximize the expected value of the return for the portfolio. For instance, if we assume that the planning scenarios are equally likely, we would assign a probability of 0.20 to each scenario.

The formulation we have developed for a moderate risk portfolio can be modified to account for other risk tolerances. If an investor can tolerate the risk of no return, the righthand sides of the minimum-return constraints would be set to 0. If an investor can tolerate a loss of 3%, the right-hand side of the minimum-return constraints would be set equal to –3.

3170

3170

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?