内容全部的策略交易的结果,不做投资参考

链接量化策略---自定义股票池,红利策略创新高,收益14%,最大回撤1%,提供策略源代码 (qq.com)

今天量化策略创新高。2个月没有手动了,全部程序交易,程序24小时运行的效果

2个策略同时运行,最大回撤1%,严格止盈止损,趋势轮动

4个月程序运行的结果,不断升级,现在已经很完善了

这一路写下来真不容易,去年6月毕业,去bigquant实习的时候有想法写一套自己的量化交易系统,一年的努力,不知不觉一年过去了,基本的功能差不多了,后面就是完善细节,添加功能,源代码全部上传了知识星球,可以直接用

可以加我备注加群,一起研究策略,完善策略

策略全部源代码

from trader_tool.stock_data import stock_datafrom trader_tool.bond_cov_data import bond_cov_datafrom trader_tool.shape_analysis import shape_analysisfrom trader_tool.analysis_models import analysis_modelsimport pandas as pdfrom trader_tool.ths_rq import ths_rqfrom tqdm import tqdmimport numpy as npimport jsonfrom trader_tool import jsl_datafrom qmt_trader.qmt_trader_ths import qmt_trader_thsfrom xgtrader.xgtrader import xgtraderfrom trader_tool.ths_rq import ths_rqfrom trader_tool.ths_board_concept_data import ths_board_concept_datafrom trader_tool.unification_data import unification_dataimport osimport pandas as pdfrom trader_tool.dfcf_etf_data import dfcf_etf_data#债券模型from trader_models.custom_bond_trend_rotation_strategy.custom_bond_trend_rotation_strategy import custom_bond_trend_rotation_strategyclass customize_trading_strategies:def __init__(self,trader_tool='ths',exe='C:/同花顺软件/同花顺/xiadan.exe',tesseract_cmd='C:/Program Files/Tesseract-OCR/tesseract',qq='1029762153@qq.com',open_set='否',qmt_path='D:/国金QMT交易端模拟/userdata_mini',qmt_account='55009640',qmt_account_type='STOCK',name='customize_trading_strategies'):'''分析模型'''self.exe=exeself.tesseract_cmd=tesseract_cmdself.qq=qqself.trader_tool=trader_toolself.open_set=open_setself.qmt_path=qmt_pathself.qmt_account=qmt_accountself.qmt_account_type=qmt_account_typeif trader_tool=='ths':self.trader=xgtrader(exe=self.exe,tesseract_cmd=self.tesseract_cmd,open_set=open_set)else:self.trader=qmt_trader_ths(path=qmt_path,account=qmt_account,account_type=qmt_account_type)self.stock_data=stock_data()self.bond_cov_data=bond_cov_data()self.ths_rq=ths_rq()self.path=os.path.dirname(os.path.abspath(__file__))self.ths_board_concept_data=ths_board_concept_data()self.name=nameself.data=unification_data(trader_tool=self.trader_tool)self.data=self.data.get_unification_data()self.dfcf_etf_data=dfcf_etf_data()self.trader.connect()def save_position(self):'''保存持股数据'''with open(r'分析配置.json',encoding='utf-8') as f:com=f.read()text=json.loads(com)del_df=pd.read_excel(r'{}\黑名单\黑名单.xlsx'.format(self.path),dtype='object')del_trader_stock=text['黑名单']if del_df.shape[0]>0:del_df['证券代码']=del_df['证券代码'].apply(lambda x : str(x).split('.')[0])del_df['证券代码']=del_df['证券代码'].apply(lambda x: '0'*(6-len(str(x)))+str(x))del_stock_list=del_df['证券代码'].tolist()else:del_stock_list=[]for del_stock in del_trader_stock:del_stock_list.append(del_stock)trader_type=text['交易品种']def select_del_stock_list(x):if str(x)[:6] in del_stock_list:return '是'else:return '否'df=self.trader.position()try:if df==False:print('获取持股失败')except:if df.shape[0]>0:if trader_type=='全部':df=dfelse:df['选择']=df['证券代码'].apply(self.trader.select_data_type)df=df[df['选择']==trader_type]print(df)df=df[df['可用余额']>=10]df['黑名单']=df['证券代码'].apply(select_del_stock_list)df=df[df['黑名单']=='否']print('剔除黑名单**********')df.to_excel(r'持股数据\持股数据.xlsx')return dfelse:df=pd.DataFrame()df['账号类型']=Nonedf['资金账号']=Nonedf['证券代码']=Nonedf['股票余额']=Nonedf['可用余额']=Nonedf['成本价']=Nonedf['市值']=Nonedf['选择']=Nonedf['持股天数']=Nonedf['交易状态']=Nonedf['明细']=Nonedf['证券名称']=Nonedf['冻结数量']=Nonedf['市价']=Nonedf['盈亏']=Nonedf['盈亏比(%)']=Nonedf['当日买入']=Nonedf['当日卖出']=Nonedf.to_excel(r'持股数据\持股数据.xlsx')return dfdef save_balance(self):'''保持账户数据'''df=self.trader.balance()df.to_excel(r'账户数据\账户数据.xlsx')return dfdef mean_line_models(self,df):'''均线模型趋势模型5,10,20,30,60'''df=df#df=self.bond_cov_data.get_cov_bond_hist_data(stock=stock,start=start_date,end=end_date,limit=1000000000)df1=pd.DataFrame()df1['date']=df['date']df1['5']=df['close'].rolling(window=5).mean()df1['10']=df['close'].rolling(window=10).mean()df1['20']=df['close'].rolling(window=20).mean()df1['30']=df['close'].rolling(window=30).mean()df1['60']=df['close'].rolling(window=60).mean()score=0#加分的情况mean_5=df1['5'].tolist()[-1]mean_10=df1['10'].tolist()[-1]mean_20=df1['20'].tolist()[-1]mean_30=df1['30'].tolist()[-1]mean_60=df1['60'].tolist()[-1]#相邻2个均线进行比较if mean_5>mean_10:score+=25if mean_10>mean_20:score+=25if mean_20>mean_30:score+=25if mean_30>mean_60:score+=25return scoredef get_del_buy_sell_data(self):'''处理交易股票池买入股票'''with open(r'{}\自定义股票池策略.json'.format(self.path),encoding='utf-8') as f:com=f.read()text=json.loads(com)limit=text['持股限制']n=text['自定义交易品种跌破N日均线卖出']max_yjl=text['ETF溢价率上限']min_yjl=text['ETF溢价率下限']buy_min_srore=text['买入最低分']df=pd.read_excel(r'持股数据\持股数据.xlsx',dtype='object')df1=df[df['股票余额']>=10]df1['证券代码']=df1['证券代码'].astype(str)hold_stock_list=df1['证券代码'].tolist()trader_df=pd.read_excel(r'{}\自定义交易股票池\自定义交易股票池.xlsx'.format(self.path),dtype='object')print('原始自定义交易股票池****************')print(trader_df)trader_df['证券代码']=trader_df['证券代码'].astype(str)def select_data(stock):if str(stock) in hold_stock_list:return '持股超过限制'else:return '没有持股'trader_df['持股检查']=trader_df['证券代码'].apply(select_data)trader_df=trader_df[trader_df['持股检查'] !='持股超过限制']print('处理原始自定义交易股票池****************')print(trader_df)#再次处理is_buffer=text['是否开启策略缓冲区']deviation_mean=text['偏离均线']deviation_up_spot=text['买入时候的偏离度']deviation_down_spot=text['跌破偏离线下穿N点卖出']minimum_guarantee=text['买入保底均线']n=text['自定义交易品种跌破N日均线卖出']max_zdf=text['最大涨跌幅']min_zdf=text['最小涨跌幅']trader_list=trader_df['证券代码'].tolist()zdf_list=[]sell_list=[]if is_buffer=='是':print("开启策略缓冲区**************")for stock in trader_list:try:#偏离hist=self.data.get_hist_data_em(stock=stock)zdf=hist['涨跌幅'].tolist()[-1]zdf_list.append(zdf)price=hist['close'].tolist()[-1]hist['mean_line']=hist['close'].rolling(window=deviation_mean).mean()line=hist['mean_line'].tolist()[-1]deviation=((price-line)/line)*100print('{} {}价格 {}日均线{} 偏离度{}'.format(stock,price,deviation_mean,line,deviation))models=shape_analysis(df=hist)mean_line=models.get_down_mean_line_sell(n=n)minimum=models.get_down_mean_line_sell(n=minimum_guarantee)if minimum=='是':print('{} 跌破保底均线{} 卖出'.format(stock,minimum_guarantee))sell_list.append(stock)elif deviation>0 and deviation>=deviation_up_spot:print('{} 偏离{}均线并且 偏离{} 偏离向上缓冲区{}'.format(stock,n,deviation,deviation_up_spot))sell_list.append(stock)elif mean_line=='是':print('{} 跌破均线{} 进入缓冲区分析'.format(n,stock))if deviation<=0 and abs(deviation)>=deviation_down_spot:print('{} 跌破{}均线并且 下穿{} 跌破向下缓冲区{}'.format(stock,n,deviation,deviation_down_spot))sell_list.append(stock)else:print('{} 正常{}均线并且 偏离{} 偏离在正常的缓冲区{}'.format(stock,n,deviation,deviation_down_spot))else:print('{} 符合缓冲区要求'.format(stock))except:print('{} 缓冲区处理有问题'.format(stock))zdf_list.append(None)trader_df['涨跌幅']=zdf_listtrader_df=trader_df[trader_df['涨跌幅']>=min_zdf]trader_df=trader_df[trader_df['涨跌幅']<=max_zdf]trader_df['缓冲区']=trader_df['证券代码'].apply(lambda x: '是' if x in sell_list else '不是')trader_df=trader_df[trader_df['缓冲区']=='不是']print('处理的交易股票池********************')print(trader_df)trader_list=trader_df['证券代码'].tolist()sell_list=[]mean_score_list=[]for stock in trader_list:try:hist_df=self.data.get_hist_data_em(stock=stock)score=self.mean_line_models(df=hist_df)mean_score_list.append(score)models=shape_analysis(df=hist_df)mean_line=models.get_down_mean_line_sell(n=n)if mean_line=='是':sell_list.append('是')else:sell_list.append('不是')except:print('{}有问题--处理交易股票池买入股票'.format(stock))mean_score_list.append(None)sell_list.append('是')trader_df['均线得分']=mean_score_listtrader_df=trader_df[trader_df['均线得分']>=buy_min_srore]fund=self.dfcf_etf_data.get_all_etf_data_1()yjl_dict=dict(zip(fund['基金代码'].tolist(),fund['溢价率'].tolist()))trader_df['溢价率']=trader_df['证券代码'].apply(lambda x :yjl_dict.get(str(x),0))print('00000000000000000000000000000000000000')trader_df=trader_df[trader_df['溢价率']<=max_yjl]trader_df=trader_df[trader_df['溢价率']>=min_yjl]trader_df.to_excel(r'买入股票\买入股票.xlsx')else:zdf_list=[]print('不开启策略缓冲区**********************')trader_df=pd.read_excel(r'自定义交易股票池\自定义交易股票池.xlsx',dtype='object')trader_df['证券代码']=trader_df['证券代码'].astype(str)df=pd.read_excel(r'持股数据\持股数据.xlsx',dtype='object')df1=df[df['股票余额']>=10]df1['证券代码']=df1['证券代码'].astype(str)hold_stock_list=df1['证券代码'].tolist()def select_data(stock):if stock in hold_stock_list:return '持股超过限制'else:return '没有持股'trader_df['持股检查']=trader_df['证券代码'].apply(select_data)trader_df=trader_df[trader_df['持股检查'] !='持股超过限制']hold_stock_list=trader_df['证券代码'].tolist()sell_list=[]mean_score_list=[]for stock in hold_stock_list:try:hist_df=self.data.get_hist_data_em(stock=stock)zdf=hist_df['涨跌幅'].tolist()[-1]zdf_list.append(zdf)score=self.mean_line_models(df=hist_df)mean_score_list.append(score)models=shape_analysis(df=hist_df)mean_line=models.get_down_mean_line_sell(n=n)if mean_line=='是':sell_list.append('是')else:sell_list.append('不是')except:print('{}有问题--处理交易股票池买入股票'.format(stock))mean_score_list.append(None)sell_list.append('是')zdf_list.append(None)trader_df['涨跌幅']=zdf_listtrader_df['跌破均线']=sell_listtrader_df['均线得分']=mean_score_listtrader_df=trader_df[trader_df['涨跌幅']>=min_zdf]trader_df=trader_df[trader_df['涨跌幅']<=max_zdf]trader_df=trader_df[trader_df['跌破均线']=='不是']trader_df=trader_df[trader_df['均线得分']>=buy_min_srore]fund=self.dfcf_etf_data.get_all_etf_data_1()yjl_dict=dict(zip(fund['基金代码'].tolist(),fund['溢价率'].tolist()))trader_df['溢价率']=trader_df['证券代码'].apply(lambda x :yjl_dict.get(str(x),0))print('00000000000000000000000000000000000000')trader_df=trader_df[trader_df['溢价率']<=max_yjl]trader_df=trader_df[trader_df['溢价率']>=min_yjl]print(trader_df)is_buy=text['是否开启当日卖出买回']if is_buy=='是':trader_df.to_excel(r'买入股票\买入股票.xlsx')else:today_trades=self.trader.today_trades()if today_trades.shape[0]>0:trader_list=today_trades['证券代码'].tolist()trader_df['今日成交']=trader_df['证券代码'].apply(lambda x: '是' if x in trader_list else '不是')trader_df=trader_df[trader_df['今日成交']=='不是']trader_df.to_excel(r'买入股票\买入股票.xlsx')else:print('当日没有委托)))))))))))))))))))')return trader_dfdef get_buy_sell_stock(self):'''获取买卖数据'''with open(r'{}\自定义股票池策略.json'.format(self.path),encoding='utf-8') as f:com=f.read()text=json.loads(com)buy_num=text['买入前N']hold_limit=text['持有限制']df=pd.read_excel(r'持股数据\持股数据.xlsx',dtype='object')hold_min_score=text['自定义交易品种持有分数']df1=df[df['可用余额']>=10]hold_stock_list=df['证券代码'].tolist()def select_stock(x):'''选择股票'''if x in hold_stock_list:return '持股超过限制'else:return "持股不足"try:del df['Unnamed: 0']except:passtrader_df=pd.read_excel(r'买入股票\买入股票.xlsx',dtype='object')try:del trader_df['Unnamed: 0']except:passsell_df=pd.read_excel(r'卖出股票\卖出股票.xlsx')sell_list=[]trader_df['选择']=trader_df['证券代码'].apply(select_stock)trader_df=trader_df[trader_df['选择']!='持股超过限制']if True:if df1.shape[0]>0:#卖出列表#持股列表hold_stock_list=df['证券代码'].tolist()#对持有的可转债做均线分析for stock in hold_stock_list:try:bond_data=self.data.get_hist_data_em(stock=stock)socre=self.mean_line_models(df=bond_data)if socre<hold_min_score:print('{} {}分数不符合最低{}分'.format(stock,socre,hold_min_score))sell_list.append(stock)else:print('{}符合最低分{}'.format(stock,hold_min_score))except:print('{}卖出数据有问题'.format(stock))#跌破均线分析'''for stock in hold_stock_list:try:hist_df=self.data.get_hist_data_em(stock=stock)models=shape_analysis(df=hist_df)mean_line=models.get_down_mean_line_sell(n=n)if mean_line=='是':sell_list.append(stock)print('{}跌破均线'.format(stock))else:passexcept:pass'''#再次处理is_buffer=text['是否开启策略缓冲区']deviation_mean=text['偏离均线']deviation_up_spot=text['向上偏离N点卖出']deviation_down_spot=text['跌破偏离线下穿N点卖出']minimum_guarantee=text['偏离保底均线N卖出']n=text['自定义交易品种跌破N日均线卖出']if is_buffer=='是':print("开启策略缓冲区**************")for stock in hold_stock_list:try:#偏离hist=self.data.get_hist_data_em(stock=stock)price=hist['close'].tolist()[-1]hist['mean_line']=hist['close'].rolling(window=deviation_mean).mean()line=hist['mean_line'].tolist()[-1]deviation=((price-line)/line)*100print('{} {}价格 {}日均线{} 偏离度{}'.format(stock,price,deviation_mean,line,deviation))models=shape_analysis(df=hist)mean_line=models.get_down_mean_line_sell(n=n)minimum=models.get_down_mean_line_sell(n=minimum_guarantee)if minimum=='是':print('{} 跌破保底均线{} 卖出'.format(stock,minimum_guarantee))sell_list.append(stock)elif deviation>0 and deviation>=deviation_up_spot:print('{} 偏离{}均线并且 偏离{} 偏离向上缓冲区{}'.format(stock,n,deviation,deviation_up_spot))sell_list.append(stock)elif mean_line=='是':print('{} 跌破均线{} 进入缓冲区分析'.format(n,stock))if deviation<=0 and abs(deviation)>=deviation_down_spot:print('{} 跌破{}均线并且 下穿{} 跌破向下缓冲区{}'.format(stock,n,deviation,deviation_down_spot))sell_list.append(stock)else:print('{} 正常{}均线并且 偏离{} 偏离在正常的缓冲区{}'.format(stock,n,deviation,deviation_down_spot))else:print('{} 符合缓冲区要求'.format(stock))except:print('{} 缓冲区处理有问题'.format(stock))else:print('不开启策略缓冲区**********************')for stock in hold_stock_list:try:hist_df=self.data.get_hist_data_em(stock=stock)models=shape_analysis(df=hist_df)mean_line=models.get_down_mean_line_sell(n=n)if mean_line=='是':sell_list.append(stock)print('{}跌破均线'.format(stock))else:passexcept:print('不开启策略缓冲区{}有问题'.format(stock))#溢价率自动平仓fund=self.dfcf_etf_data.get_all_etf_data_1()yjl_dict=dict(zip(fund['基金代码'].tolist(),fund['溢价率'].tolist()))is_yjl=text['是否开启溢价率平仓']max_yjl=text['平仓溢价率']if is_yjl=='是':print('********************溢价率自动平仓')for stock in hold_stock_list:try:yjl=yjl_dict.get(stock,0)if yjl>=max_yjl:print('{} 溢价率{} 符合最大溢价率{} 自动平仓'.format(stock,yjl,max_yjl))sell_list.append(stock)else:print('{} 溢价率{} 不符合最大溢价率{} 不自动平仓'.format(stock,yjl,max_yjl))except:print('{} 溢价率平仓有问题'.format(stock))#是否开启大涨卖出is_max_up=text['是否开启大涨卖出']max_up=text['大涨']if is_max_up=='是':print('开启大涨卖出')for stock in hold_stock_list:try:hist=self.data.get_hist_data_em(stock=stock)zdf=hist['涨跌幅'].tolist()[-1]if zdf>=max_up:print('{} 今日涨跌幅{} 大于最大涨跌幅{} 卖出'.format(stock,zdf,max_up))sell_list.append(stock)else:print('{} 今日涨跌幅{} 小于最大涨跌幅{} 不操作'.format(stock,zdf,max_up))except:print('{} 开启大涨卖出有问题'.format(stock))else:print('不开启大涨卖出')sell_df=pd.DataFrame()sell_list=list(set(sell_list))print('************************')print(sell_list)is_sell=text['是否开启大跌不卖']sell_spot=text['大跌']if is_sell=='是':print("开启大跌不卖****************")for stock in sell_list:try:hist=self.data.get_hist_data_em(stock=stock)zdf=hist['涨跌幅'].tolist()[-1]if zdf>=sell_spot:print('大跌不卖{} 今日涨跌幅{} 大于大跌涨跌幅{} 符合模型'.format(stock,zdf,sell_spot))else:print('大跌不卖{} 今日涨跌幅{} 小于大跌涨跌幅{} 不卖出'.format(stock,zdf,sell_spot))sell_list.remove(stock)except:print('大跌不卖{} 开启大写不卖出有问题'.format(stock))else:print('不开启大跌不卖00000000000000000000000000000000000000000')sell_df['证券代码']=sell_listsell_df['交易状态']='未卖'if sell_df.shape[0]>0:print('卖出*****************')print(sell_df)sell_df=sell_df[['证券代码','交易状态']]sell_df.to_excel(r'卖出股票\卖出股票.xlsx')else:print('没有卖出的可转债')sell_df['证券代码']=[None]sell_df['交易状态']=[None]sell_df['策略名称']=self.namesell_df=sell_df[['证券代码','交易状态']]sell_df.to_excel(r'卖出股票\卖出股票.xlsx')hold_num=df1.shape[0]if hold_num>0:av_buy_num=hold_limit-hold_numav_buy_num=av_buy_num+sell_df.shape[0]if av_buy_num>=hold_limit:av_buy_num=hold_limitelse:av_buy_num=av_buy_numbuy_df=trader_df[:av_buy_num]if buy_df.shape[0]>0:passelse:buy_df=pd.DataFrame()buy_df['证券代码']=[None]buy_df['交易状态']=[None]else:buy_df=trader_df[:buy_num]if buy_df.shape[0]>0:passelse:buy_df=pd.DataFrame()buy_df['证券代码']=[None]buy_df['交易状态']=[None]buy_df['交易状态']='未买'print('买入*****************')print(buy_df)buy_df=buy_df[['证券代码','交易状态']]buy_df.to_excel(r'买入股票\买入股票.xlsx')return buy_dfelse:buy_df=trader_df[:hold_limit]buy_df['交易状态']='未买'print('买入*****************')print(buy_df)buy_df=buy_df[['证券代码','交易状态']]buy_df.to_excel(r'买入股票\买入股票.xlsx')return buy_dfelse:print('买入股票文件没有数据')def get_del_not_trader_stock(self):'''剔除黑名单'''print('剔除黑名单______________*************************_______________________')with open(r'分析配置.json',encoding='utf-8') as f:com=f.read()text=json.loads(com)del_df=pd.read_excel(r'{}\黑名单\黑名单.xlsx'.format(self.path),dtype='object')del_trader_stock=text['黑名单']if del_df.shape[0]>0:del_df['证券代码']=del_df['证券代码'].apply(lambda x : str(x).split('.')[0])del_df['证券代码']=del_df['证券代码'].apply(lambda x: '0'*(6-len(str(x)))+str(x))del_stock_list=del_df['证券代码'].tolist()else:del_stock_list=[]for del_stock in del_trader_stock:del_stock_list.append(del_stock)def select_del_stock_list(x):if str(x)[:6] in del_stock_list:return '是'else:return '否'buy_df=pd.read_excel(r'买入股票\买入股票.xlsx',dtype='object')if buy_df.shape[0]>0:buy_df['证券代码']=buy_df['证券代码'].apply(lambda x: '0'*(6-len(str(x)))+str(x))try:del buy_df['Unnamed: 0']except:passbuy_df['黑名单']=buy_df['证券代码'].apply(select_del_stock_list)buy_df=buy_df[buy_df['黑名单']=='否']#隔离策略buy_df['证券代码']=buy_df['证券代码'].apply(lambda x: '0'*(6-len(str(x)))+str(x))buy_df['品种']=buy_df['证券代码'].apply(lambda x: self.trader.select_data_type(x))buy_df.to_excel(r'买入股票\买入股票.xlsx')print(buy_df)else:buy_df=pd.DataFrame()buy_df.to_excel(r'买入股票\买入股票.xlsx')#卖出sell_df=pd.read_excel(r'卖出股票\卖出股票.xlsx',dtype='object')if sell_df.shape[0]>0:sell_df['证券代码']=sell_df['证券代码'].apply(lambda x: '0'*(6-len(str(x)))+str(x))try:del sell_df['Unnamed: 0']except:passsell_df['黑名单']=sell_df['证券代码'].apply(select_del_stock_list)sell_df=sell_df[sell_df['黑名单']=='否']#隔离策略sell_df['证券代码']=sell_df['证券代码'].apply(lambda x: '0'*(6-len(str(x)))+str(x))sell_df['品种']=sell_df['证券代码'].apply(lambda x: self.trader.select_data_type(x))sell_df.to_excel(r'卖出股票\卖出股票.xlsx')print(sell_df)else:sell_df=pd.DataFrame()sell_df.to_excel(r'卖出股票\卖出股票.xlsx')return buy_df,sell_dfdef update_all_data(self):'''更新策略数据'''with open(r'{}\自定义股票池策略.json'.format(self.path),encoding='utf-8') as f:com=f.read()user_def_text=json.loads(com)is_bond_models=user_def_text['是否开启债券模型']account_av_buy_amount=user_def_text['账户大概可以买入的股票数量']with open(r'分析配置.json',encoding='utf-8') as f:com=f.read()main_text=json.loads(com)special_stock_list=main_text['特殊标的']special_cash=main_text['特殊固定交易资金']fix_cash=main_text['固定交易资金']trader_ratio=int(special_cash/fix_cash)print('债券模型交易资金比例{}'.format(trader_ratio))if is_bond_models=='是':print('开启债券模型************************')print(self.save_position())print(self.save_balance())self.get_del_buy_sell_data()self.get_buy_sell_stock()buy_df,sell_df=self.get_del_not_trader_stock()hold_stock=pd.read_excel(r'持股数据\持股数据.xlsx',dtype='object')if hold_stock.shape[0]>0:hold_stock['证券代码']=hold_stock['证券代码'].apply(lambda x: '0'*(6-len(str(x)))+str(x))hold_amount=hold_stock.shape[0]hold_stock['国债']=hold_stock['证券代码'].apply(lambda x: '是' if (x) in special_stock_list else '不是')bond_hold_stock=hold_stock[hold_stock['国债']=='是']else:hold_amount=0bond_hold_stock=pd.DataFrame()#债券模型buy_stock_list=[]sell_stock_list=[]bond_models=custom_bond_trend_rotation_strategy(trader_tool=self.trader_tool,exe=self.exe,tesseract_cmd=self.tesseract_cmd,open_set=self.open_set,qmt_path=self.qmt_path,qmt_account=self.qmt_account,qmt_account_type=self.qmt_account_type)bond_buy_df,bond_sell_df=bond_models.update_all_data()if buy_df.shape[0]>0:stock_list=buy_df['证券代码'].tolist()for stock in stock_list:buy_stock_list.append(stock)if bond_buy_df.shape[0]>0:stock_list=bond_buy_df['证券代码'].tolist()for stock in stock_list:buy_stock_list.append(stock)if sell_df.shape[0]>0:stock_list=sell_df['证券代码'].tolist()for stock in stock_list:sell_stock_list.append(stock)if bond_sell_df.shape[0]>0:stock_list=bond_sell_df['证券代码'].tolist()for stock in stock_list:sell_stock_list.append(stock)buy_stock_list=list(set(buy_stock_list))sell_stock_list=list(set(sell_stock_list))buy_amount=len(buy_stock_list)sell_amount=len(sell_stock_list)#账户数量account_amount=hold_amount+buy_amount-sell_amountif account_amount<account_av_buy_amount:print('账户资金充足不用释放资金*************')buy_df=pd.DataFrame()buy_df['证券代码']=buy_stock_listbuy_df['交易状态']='未买'buy_df.to_excel(r'买入股票\买入股票.xlsx')print('买入股票***************')print(buy_df)sell_df=pd.DataFrame()sell_df['证券代码']=sell_stock_listsell_df['交易状态']="未卖"sell_df.to_excel(r'卖出股票\卖出股票.xlsx')print('卖出股票***************')print(sell_df)self.get_del_not_trader_stock()else:print('账户资金不充足释放资金*************')#释放数量release_amount=account_av_buy_amount-account_amountrelease_amount=abs(release_amount)print('释放数量{}********************'.format(release_amount))if bond_hold_stock.shape[0]>0:bond_hold_stock['卖出']=bond_hold_stock['证券代码'].apply(lambda x: '是' if str(x) in sell_stock_list else '不是')bond_hold_stock=bond_hold_stock[bond_hold_stock['卖出']=='不是']bond_hold_stock=bond_hold_stock[:int(release_amount/trader_ratio)]bond_stock_list=bond_hold_stock['证券代码'].tolist()print('释放的股票池***************')print(bond_hold_stock)for stock in bond_stock_list:sell_stock_list.append(stock)sell_stock_list=list(set(sell_stock_list))buy_df=pd.DataFrame()buy_df['证券代码']=buy_stock_listbuy_df['交易状态']='未买'buy_df.to_excel(r'买入股票\买入股票.xlsx')print('买入股票***************')print(buy_df)sell_df=pd.DataFrame()sell_df['证券代码']=sell_stock_listsell_df['交易状态']="未卖"sell_df.to_excel(r'卖出股票\卖出股票.xlsx')print('卖出股票***************')print(sell_df)self.get_del_not_trader_stock()else:print('债券没有持股释放不了资金')buy_df=pd.DataFrame()buy_df['证券代码']=buy_stock_listbuy_df['交易状态']='未买'buy_df.to_excel(r'买入股票\买入股票.xlsx')print('买入股票***************')print(buy_df)sell_df=pd.DataFrame()sell_df['证券代码']=sell_stock_listsell_df['交易状态']="未卖"sell_df.to_excel(r'卖出股票\卖出股票.xlsx')print('卖出股票***************')print(sell_df)self.get_del_not_trader_stock()else:print('不开启债券模型************************')print(self.save_position())print(self.save_balance())self.get_del_buy_sell_data()self.get_buy_sell_stock()buy_df,sell_df=self.get_del_not_trader_stock()

综合交易模型60

综合交易模型 · 目录

上一篇强大的禄得可转债自定义因子轮动系统完成,可转债三低为例子

个人观点,仅供参考

喜欢此内容的人还喜欢

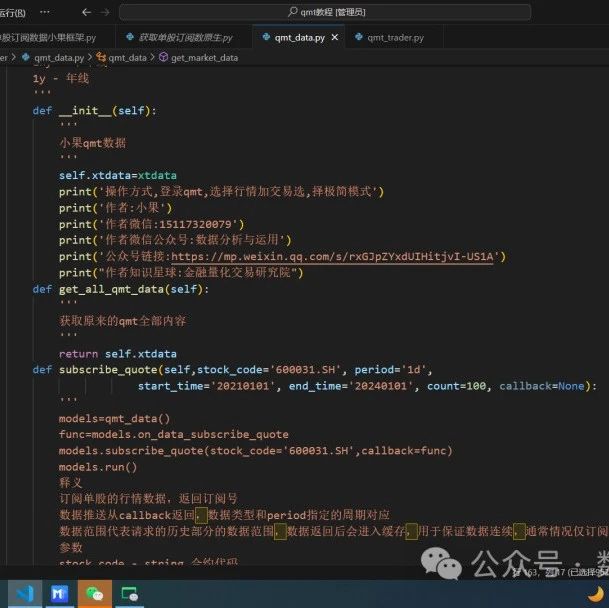

qmt教程2----订阅单股行情,提供源代码

数据分析与运用

不喜欢

不看的原因

确定

- 内容低质

- 不看此公众号内容

策略周报---收益0.75%,稳稳的幸福

数据分析与运用

不喜欢

不看的原因

确定

- 内容低质

- 不看此公众号内容

量化研究---pywencai问财数据的使用,提供源代码

数据分析与运用

不喜欢

不看的原因

确定

- 内容低质

- 不看此公众号内容

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?