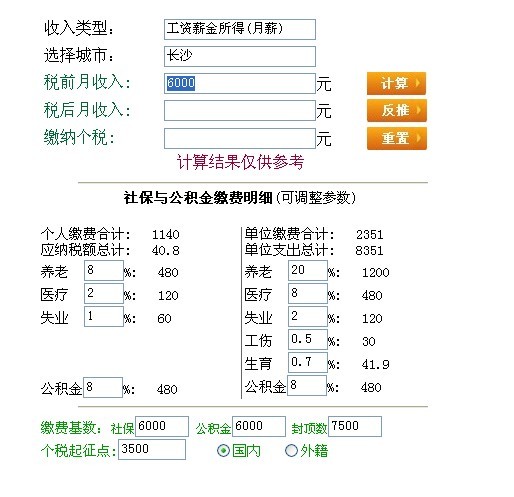

个人税收计算器(只限长沙)全线仿照九米个税计算器,但它那太盘大了,全国各地的税率和三险一金的比率,我懒得去查,因为刚学完JavaScript。所以就来仿照它的来写个,加深一下自己的JavaScript基础,所以没用JQuery了。写的有些繁琐,没办法,技术有限,没经验

没用任何工具,只用记事本编辑,想想这样能让自己犯的错印象更深,呵呵

HTML代码放上,大家帮着看看有什么需要改的地方吗?谢谢

这是HTML页面:

以下是HTML代码:

<html>

<head>

<style>

#count{

background-image:url(img/jisuan.jpg);

width:60px;

height:23px;

border:0;

}

#backpush{

background-image:url(img/fantui.jpg);

width:60px;

height:24px;

border:0;}

#reset{

background-image:url(img/chongzhi.jpg);

width:60px;

height:23px;

border:0;}

</style>

<title>个税计算器</title>

<script>

var koufei=0;

function $(obk){

return document.getElementById(obk);

}

//写出计算的方法

function countFun(percent,val){

return (percent/100)*val;

}

//截取小数点后两位;

function floatTwo(num){

var i=num.toString().indexOf(".");

if(i>0){

var a1=num.toString().substring(0,i+2);

return a1;

}else

return num;

}

function changValue(val){

var shebao = $("shebao");

var gongjijing = $("gongjijing");

var maxnum = $("maxnum");

var reg = /^\d+|-$/gi; //判断是否输入的是数字并为正数

if(reg.test(val)==false){

$("pre-tax").value="";

return;

}

if(val<=850){

shebao.value="1500";

gongjijing.value="850";

}else if(val>850 && val<=1500){

shebao.value="1500";

gongjijing.value=val;

}else if(val>1500 && val<=7500){

shebao.value=val;

gongjijing.value=val;

}else if(val>7500){

shebao.value=7500;

gongjijing.value=7500;

}

//显示 个人缴费详情

$("yanglaovalue").innerText=floatTwo(countFun($("tx_yanglao").value,shebao.value));

$("yiliaovalue").innerText=floatTwo(countFun($("tx_yiliao").value,shebao.value));

$("shiyevalue").innerText=floatTwo(countFun($("tx_shiye").value,shebao.value));

$("gongjijingvalue").innerText=floatTwo(countFun($("tx_gongjijing").value,gongjijing.value));

var baoxian = parseInt($("yanglaovalue").innerText)+parseInt($("yiliaovalue").innerText)+parseInt($("shiyevalue").innerText)+parseInt($("gongjijingvalue").innerText); //三险一金所有费用

$("taxtotal").innerText =floatTwo(baoxian);//显示个人缴费合计

//显示右边单位缴费详情:

$("yanglaovalue2").innerText=floatTwo(countFun($("tx_yanglao2").value,shebao.value));

$("yiliaovalue2").innerText=floatTwo(countFun($("tx_yiliao2").value,shebao.value));

$("shiyevalue2").innerText=floatTwo(countFun($("tx_shiye2").value,shebao.value));

$("gongjijingvalue2").innerText=floatTwo(countFun($("tx_gongjijing2").value,gongjijing.value));

$("gongshangvalue").innerText=floatTwo(countFun($("tx_gongshang").value,shebao.value));

$("shengyuvalue").innerText=floatTwo(countFun($("tx_shengyu").value,gongjijing.value));

//计算单位缴费合计:

$("departmenttotal").innerText=parseInt($("yanglaovalue2").innerText)+parseInt($("yiliaovalue2").innerText)+parseInt($("shiyevalue2").innerText)+parseInt($("gongjijingvalue2").innerText)+parseInt($("gongshangvalue").innerText)+parseInt($("shengyuvalue").innerText);

//显示单位总支出, 单位总支出=计算单位缴费合计+税前月收入;

$("departmenttotal2").innerText=parseInt($("departmenttotal").innerText)+parseInt(val);

//显示应纳税额总计:

var num = val-parseInt($("taxtotal").innerText)-$("taxstart").value;

if(num>0){

$("musttaxtotal").innerText=floatTwo(num*caluTaxPercent(num)-koufei);

}else

$("musttaxtotal").innerText=0;

}

//给我应纳税所得额,我返回税率 /应纳税所得额=扣除三险一金后月收入 -扣除标准

function caluTaxPercent(val){

if(val<=1500){

koufei=0;

return 0.03;

}else if(val>1500 && val <=4500){

koufei=105;

return 0.1;

}else if(val>4500 && val<=9000){

koufei=255;

return 0.2;

}else if(val>9000 && val<=35000){

koufei=1005;

return 0.25;

}else if(val>35000 && val<=55000){

koufei=2755;

return 0.30;

}else if(val>55000 && val<=80000){

koufei=5505;

return 0.35;

}else if(val>80000)

koufei=13505;

return 0.45;

}

//点击计算按钮时执行的事件

function count(){

$("tax").value=$("musttaxtotal").innerText;

$("back-tax").value=$("pre-tax").value-$("tax").value-parseInt($("taxtotal").innerText);

}

</script>

</head>

<body>

<div id="maindiv" style="width:400px;margin-left:230px">

<div id="topdiv" style="font-size:16px">

<table align="center" width="400px">

<tbody>

<tr>

<td style="width:30%">收入类型:</td><td colspan="2" align="left"><input type="text" value="工资薪金所得(月薪)" readonly="readonly"/></td>

</tr>

<tr style="width:50%">

<td>选择城市:</td><td align="left"><input type="text" value="长沙" readonly="readonly"/></td><td></td>

</tr>

<tr>

<td><font color="#006633">税前月收入:</font></td>

<td align="left"><input type="text" name="pre-tax" id="pre-tax" onkeyup="changValue(this.value)"/>元</td>

<td><input type="button" name="count" id="count" onclick="count()"/></td>

</tr>

<tr>

<td><font color="#006633">税后月收入:</font></td>

<td align="left"><input type="text" name="back-tax" id="back-tax" />元</td>

<td><input type="button" name="backpush" id="backpush"/></td>

</tr>

<tr>

<td><font color="#006633">缴纳个税:</font></td>

<td align="left"><input type="text" name="tax" id="tax" readonly="readonly"/>元</td>

<td><input type="button" name="reset" id="reset"/></td>

</tr>

<tr>

<td align="center" colspan="3"><font color="#990033">计算结果仅供参考</font></td>

</tr>

</tbody>

</table>

</div>

<div id="middiv" style="font-size:14px; font-family:"新宋体"">

<hr align="center" style="margin-left:25px;margin-rigth:50px;" width="350px"/>

<div align="center" style=";padding-bottom:20px"><b>社保与公积金缴费明细</b>(可调整参数)</div>

<div align="left" id="mid-leftdiv" style="width:200px; border-right:1px solid #666666; float:left">

个人缴费合计:<span id="taxtotal" name="taxtotal" style="margin-left:20px"></span><br />

应纳税额总计:<span id="musttaxtotal" name="musttaxtotal" style="margin-left:20px"></span><br />

养老<input type="text" id="tx_yanglao" name="tx_yanglao" size="4" style="margin-left:15px" value="8"/>%:<span id="yanglaovalue" name="yanglaovalue" style="margin-left:20px"></span><br />

医疗<input type="text" id="tx_yiliao" name="tx_yiliao" size="4" style="margin-left:15px" value="2"/>%:<span id="yiliaovalue" name="yiliaovalue" style="margin-left:20px"></span><br />

失业<input type="text" id="tx_shiye" name="tx_shiye" size="4" style="margin-left:15px" value="1"/>%:<span id="shiyevalue" name="shiyevalue" style="margin-left:20px"></span><br /><br /><br /><br />

公积金<input type="text" id="tx_gongjijing" name="tx_gongjijing" size="4" value="8"/>%:<span id="gongjijingvalue" name="gongjijingvalue" style="margin-left:20px"></span><br />

</div>

<div id="mid-rightdiv" style="margin-left:30px">

单位缴费合计:<span id="departmenttotal" name="departmenttotal" style="margin-left:20px"></span><br />

单位支出总计:<span id="departmenttotal2" name="departmenttotal2" style="margin-left:20px"></span><br />

养老<input type="text" id="tx_yanglao2" name="tx_yanglao2" size="4" style="margin-left:15px" value="20"/>%:<span id="yanglaovalue2" name="yanglaovalue2" style="margin-left:20px"></span><br />

医疗<input type="text" id="tx_yiliao2" name="tx_yiliao2" size="4" style="margin-left:15px" value="8"/>%:<span id="yiliaovalue2" name="yiliaovalue2" style="margin-left:20px"></span><br />

失业<input type="text" id="tx_shiye2" name="tx_shiye2" size="4" style="margin-left:15px" value="2"/>%:<span id="shiyevalue2" name="shiyevalue2" style="margin-left:20px"></span><br />

工伤<input type="text" id="tx_gongshang" name="tx_gongshang" size="4" style="margin-left:15px" value="0.5"/>%:<span id="gongshangvalue" name="gongshangvalue" style="margin-left:20px"></span><br />

生育<input type="text" id="tx_shengyu" name="tx_shengyu" size="4" style="margin-left:15px" value="0.7"/>%:<span id="shengyuvalue" name="shengyuvalue" style="margin-left:20px"></span><br />

公积金<input type="text" id="tx_gongjijing2" name="tx_gongjijing2" size="4" value="8"/>%:<span id="gongjijingvalue2" name="gongjijingvalue2" style="margin-left:20px">6564</span><br />

</div>

<hr align="center" style="margin-left:25px;margin-rigth:50px;" width="350px"/>

<div id="bottom" style="font-size:14px; color:#009900">

缴费基数:<span style=" font-size:12px">社保</span><span><input type="text" size="6" id="shebao" name="shebao"/></span> <span style=" font-size:12px">公积金</span><input type="text" size="6" id="gongjijing" name="gongjijing"/><span style=" font-size:12px"> 封顶数</span><input type="text" size="6" id="maxnum" name="maxnum" value="7500"/><br />

个税起征点:<input id="taxstart" name="taxstart" type="text" size="8" value="3500"/>

<input type="radio" name="type" id="type" value="国内" checked="checked" style="margin-left:20px"/>国内<input type="radio" name="type" value="外籍" style="margin-left:20px"/>外籍

</div>

</div>

</div>

</body>

</html>

本文介绍了一个使用JavaScript编写的个人税收计算器,适用于长沙地区的税率和三险一金比率,旨在帮助用户理解税收计算过程。

本文介绍了一个使用JavaScript编写的个人税收计算器,适用于长沙地区的税率和三险一金比率,旨在帮助用户理解税收计算过程。

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?