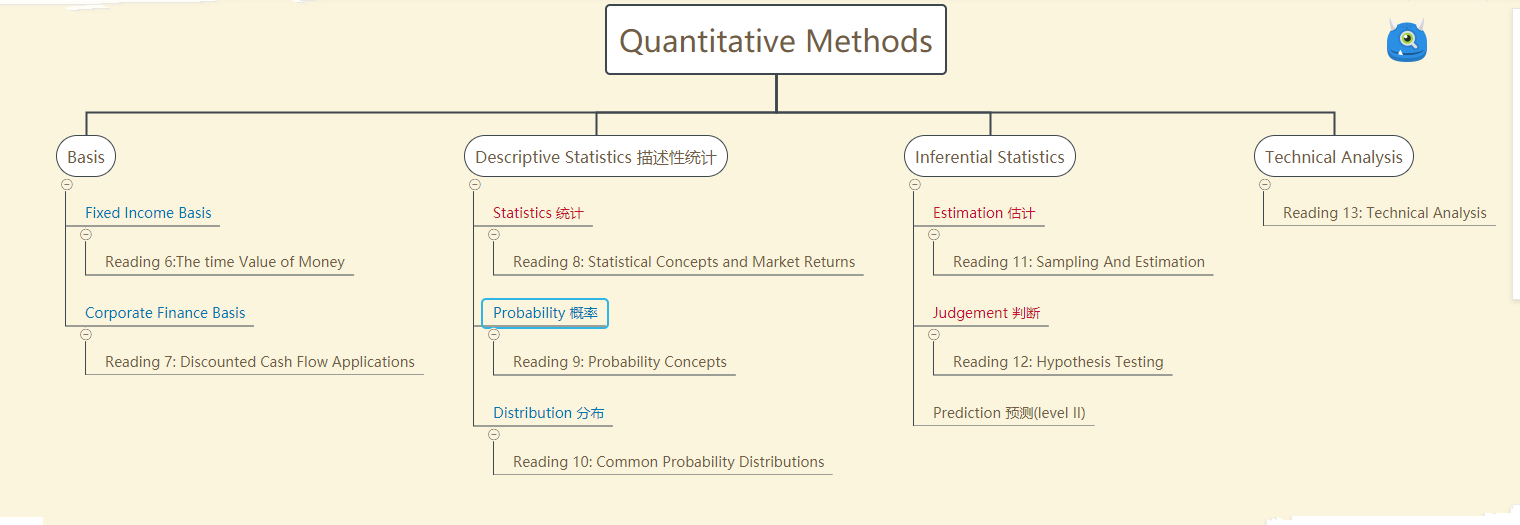

总体框架

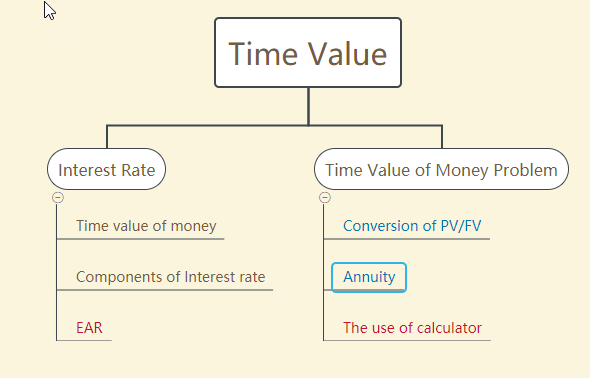

Time Value

Interest Rate

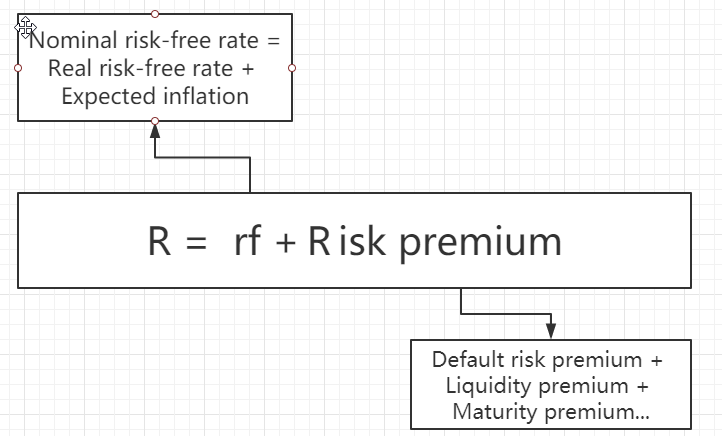

rf: 无风险收益率 (CFA中一般认为是美国短期国债T-bill的收益率)

Nominal risk-free rate: 名义无风险税率

Real risk-free rate: 实际无风险利率

Liquidity premium: 流动性风险溢价

Maturity premium: 到期风险溢价

Risk premium: 风险溢价

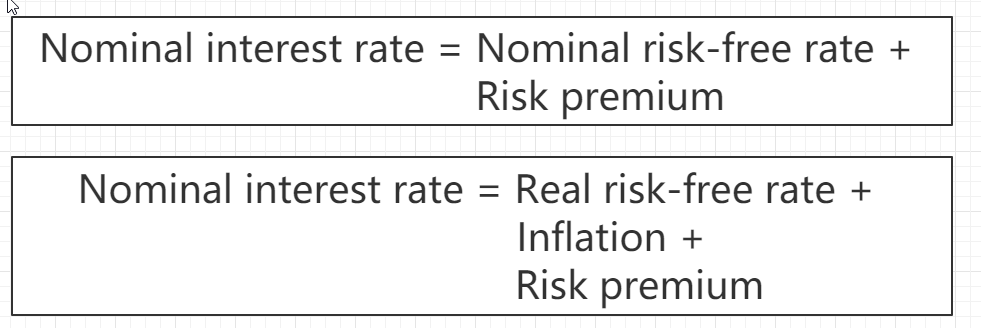

费雪效应

Nominal interest rate和Stated Interest rate是一个概念

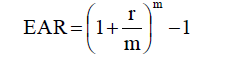

Effective annual rate(EAR)

For discrete compounding

- Where: m is the compounding frequency

- r is the noinal/quoted/stated annual interest rate

- r/m is periodic interest rate

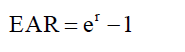

For continuous compounding

- 时时刻刻分分秒秒在计息.

- 例: 算名义年利率是8%, 求连续计算情形下的EAR.

- 计算器按法: 0.08 --> 2ND --> LN ==>结果: 1.083287

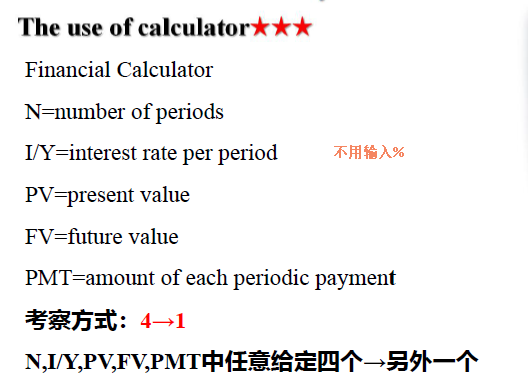

Conversion of PV/FV

Present Value (PV)

- The value of an initial investment.

Future Value (FV)

- The value of an initial investment would be worth n period from today.

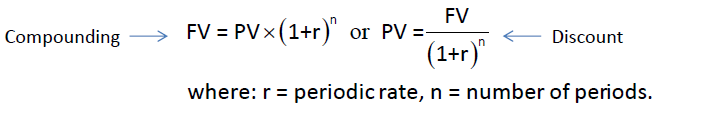

Conversion of PV/FV:

- compounding:

-

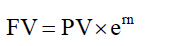

- continuous compounding:

-

- 站在今天去推测未来会价值几何: PV --> FV : 复利

- 站在未来推测今天需要存入多少: FV --> PV :折现

Annuity

Ordinary annuity

- all constant cash flows occuring at the end of each period(END), 后付年金

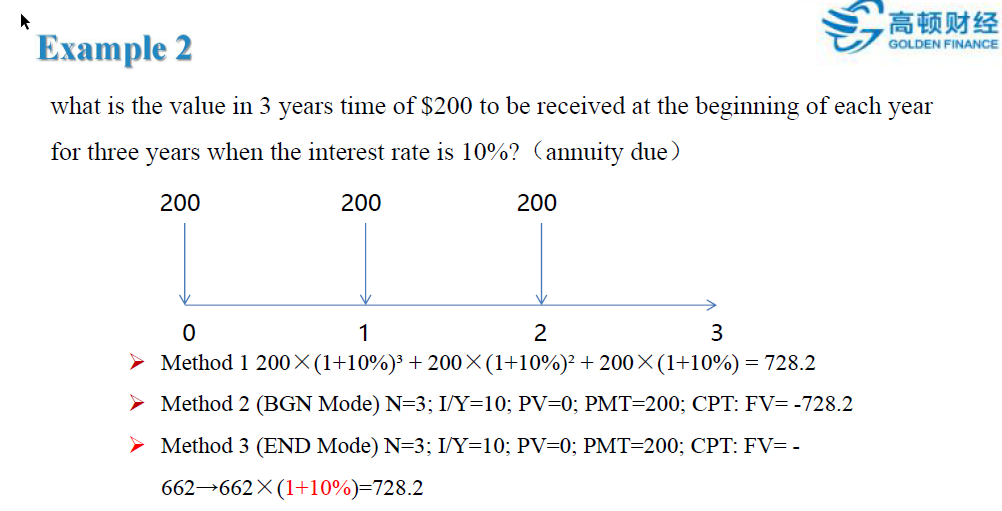

Annuity due

- all constant cash flows occuring at the beginning of each period(BEG), 先付年金

Prepetuity

- a set of constant never-ending sequential cash flows occuring at the end of each period, 永续年金

- PV = A/R

- where A: the periodic payment

- r: the periodic return

- PV = A/R

推荐用第三种方式, 就不用再把计算器在END和BGN模式之间去转换.

本文介绍了金融数学中的关键概念,包括无风险收益率、名义利率、实际利率等,并解释了有效年利率的计算方法及其与名义利率的区别。同时,文章还讨论了现值与终值的转换方法及年金和永续年金的概念。

本文介绍了金融数学中的关键概念,包括无风险收益率、名义利率、实际利率等,并解释了有效年利率的计算方法及其与名义利率的区别。同时,文章还讨论了现值与终值的转换方法及年金和永续年金的概念。

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?