Risks for hedge funds

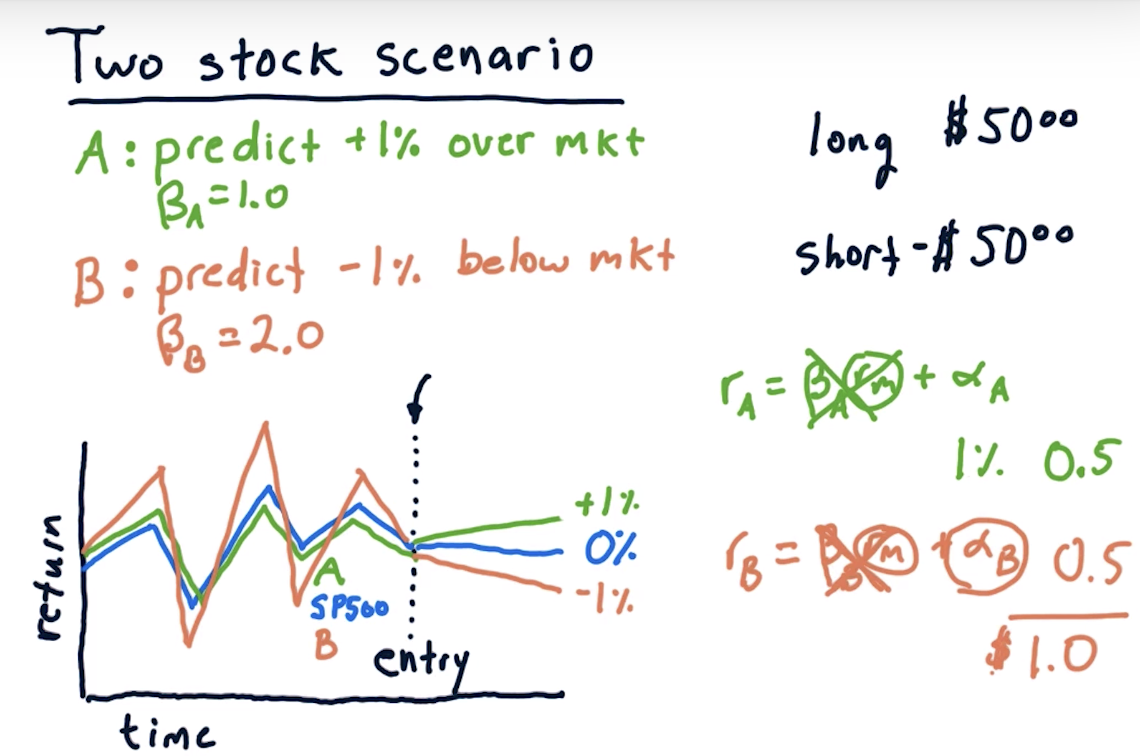

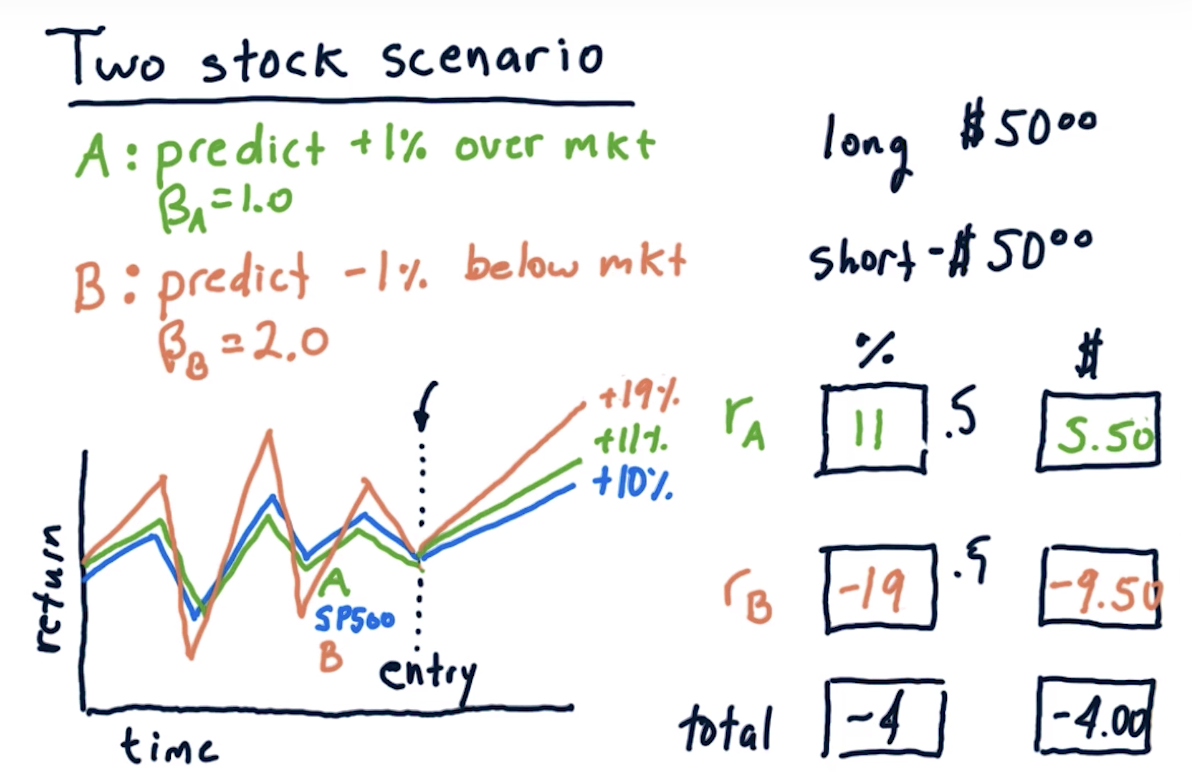

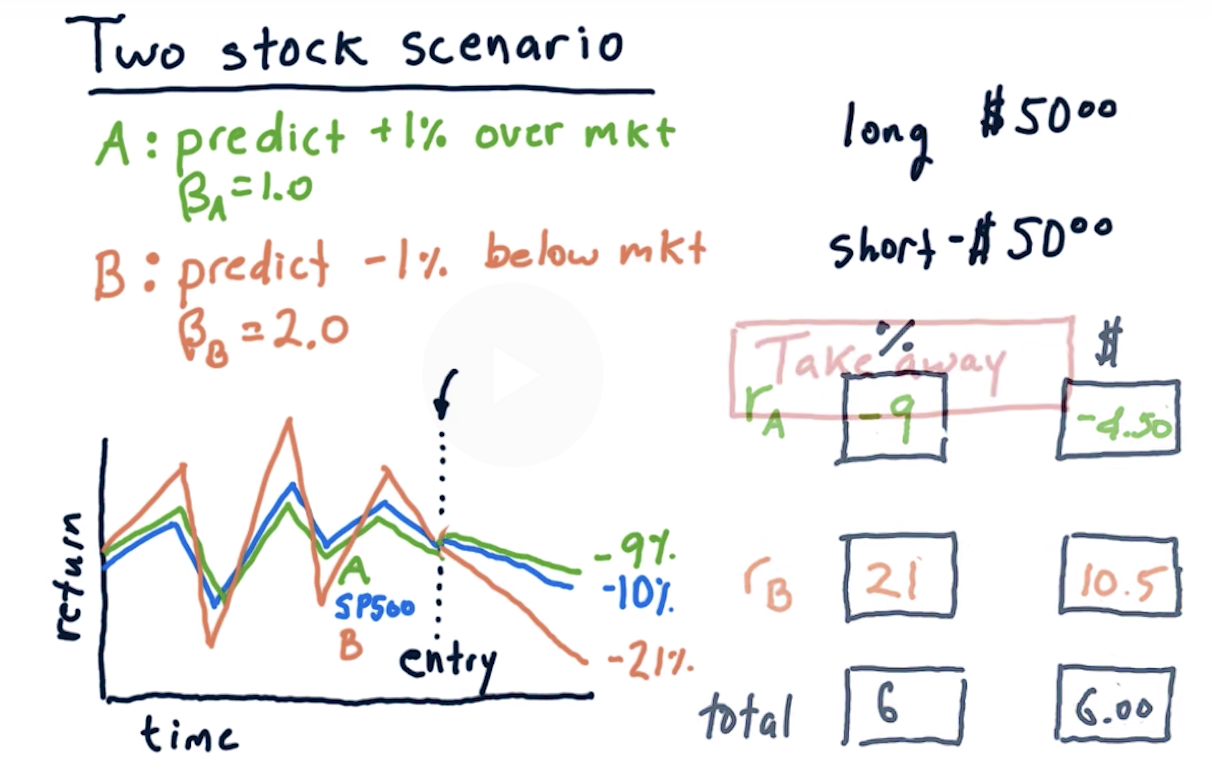

Two stock scenario

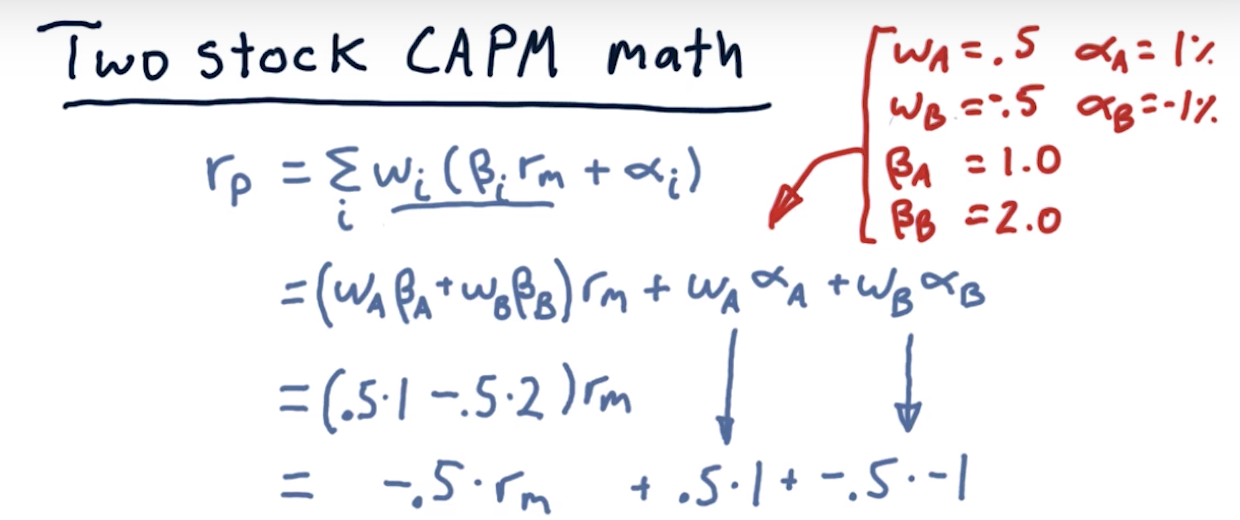

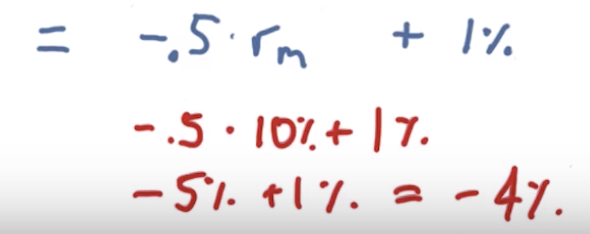

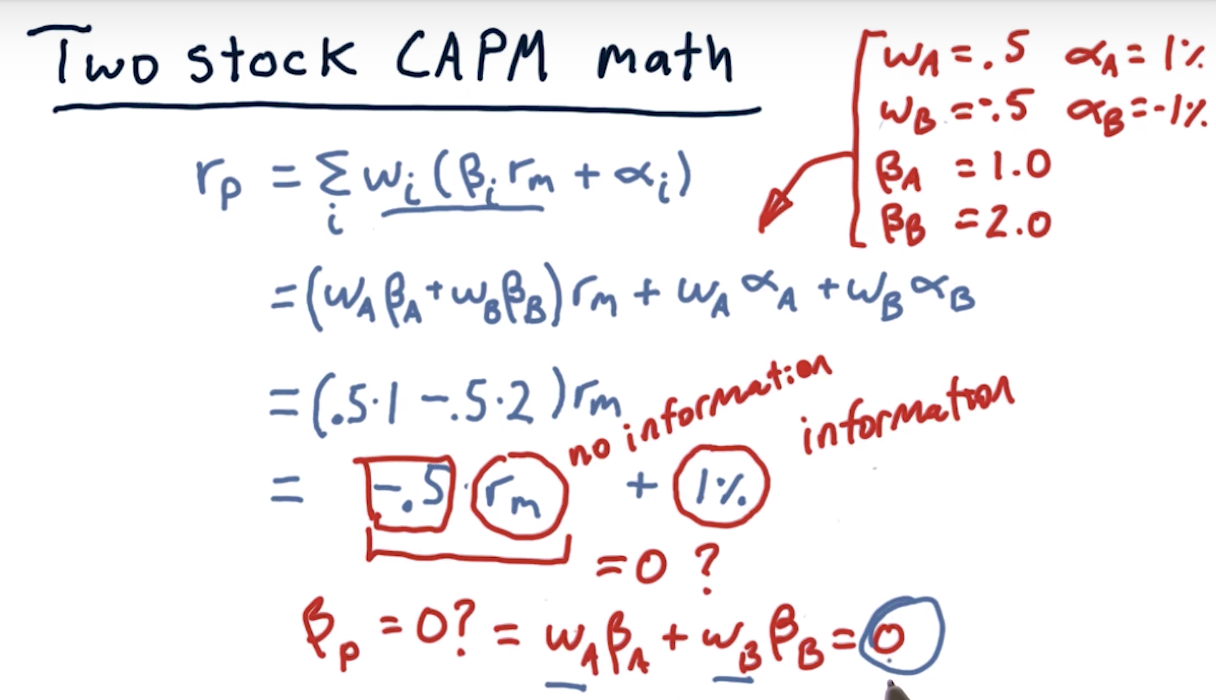

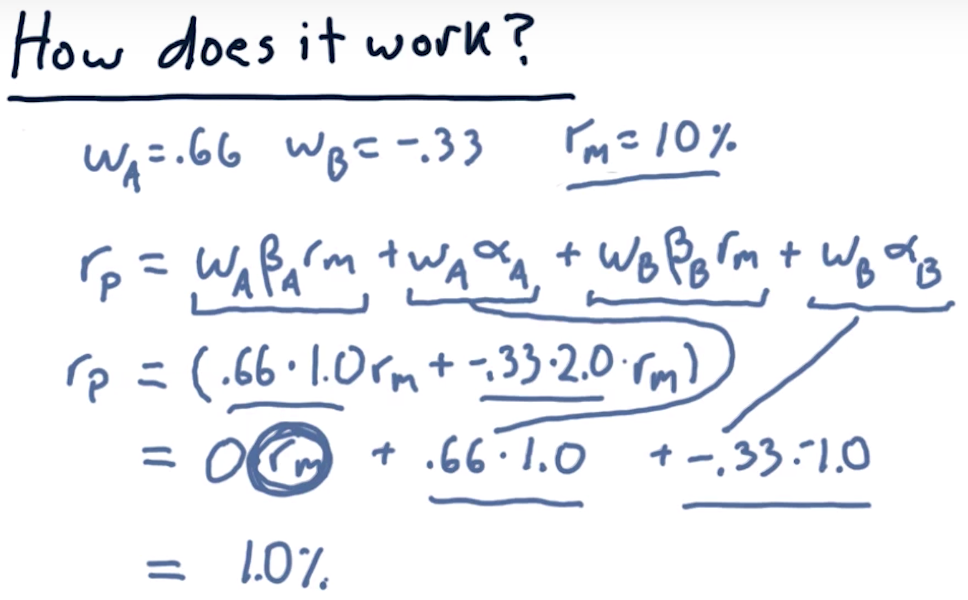

Two stock CAPM math

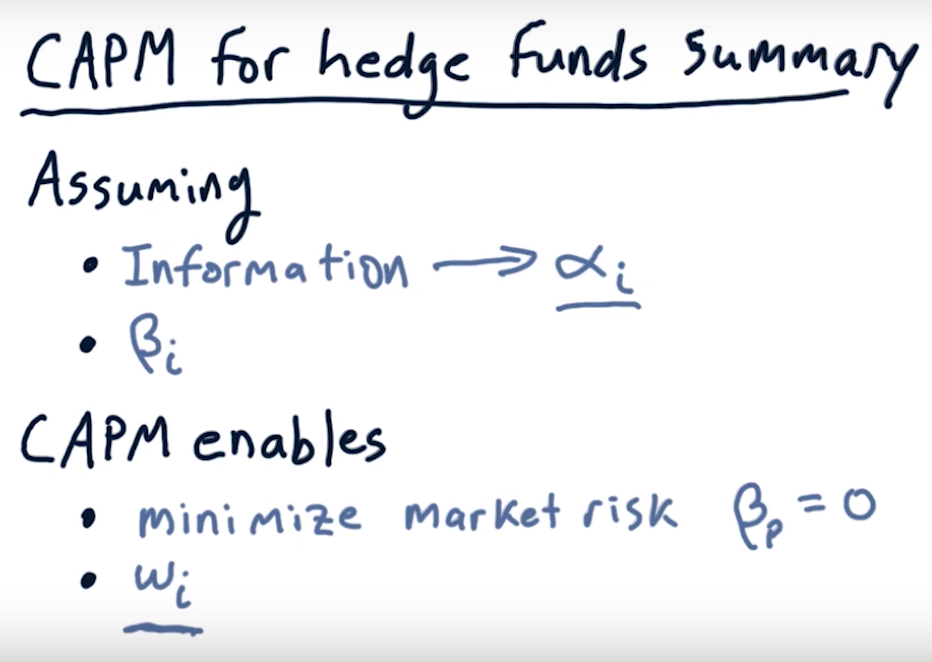

how to remove the incluence of the market or beta???

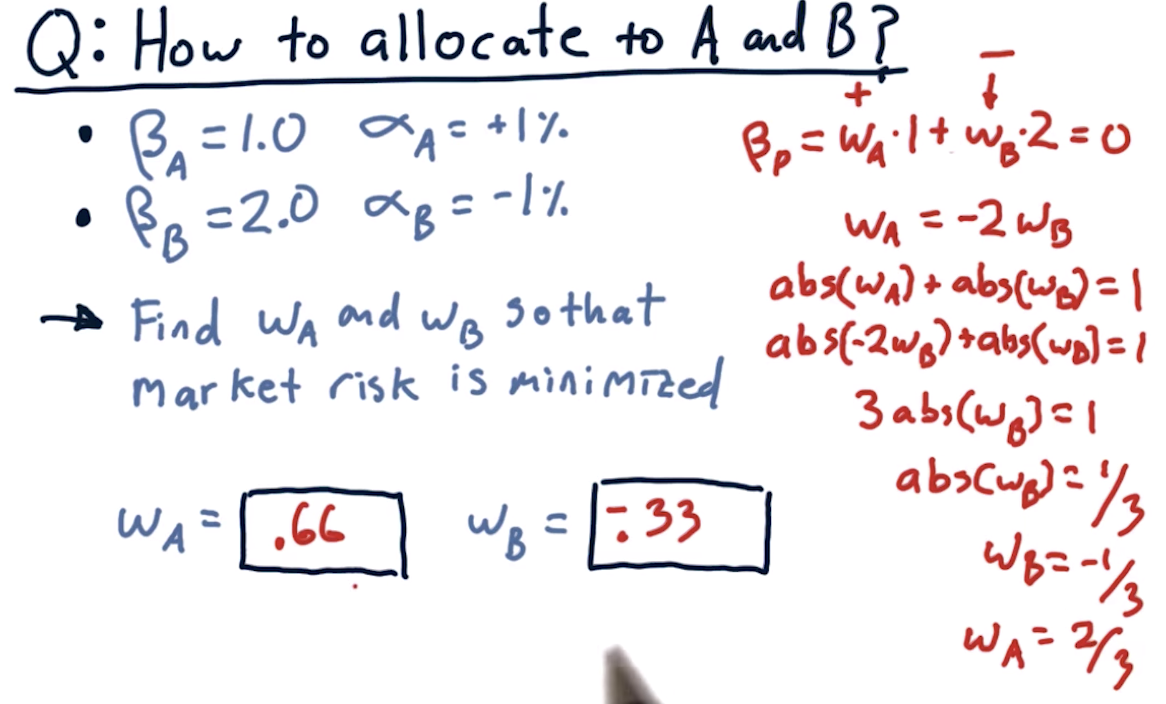

Allocations remove market risk

How does it work?

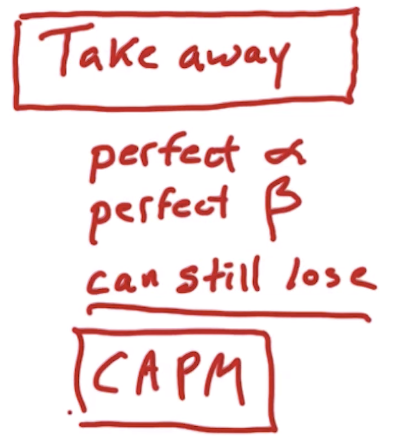

CAPM for hedge funds summary

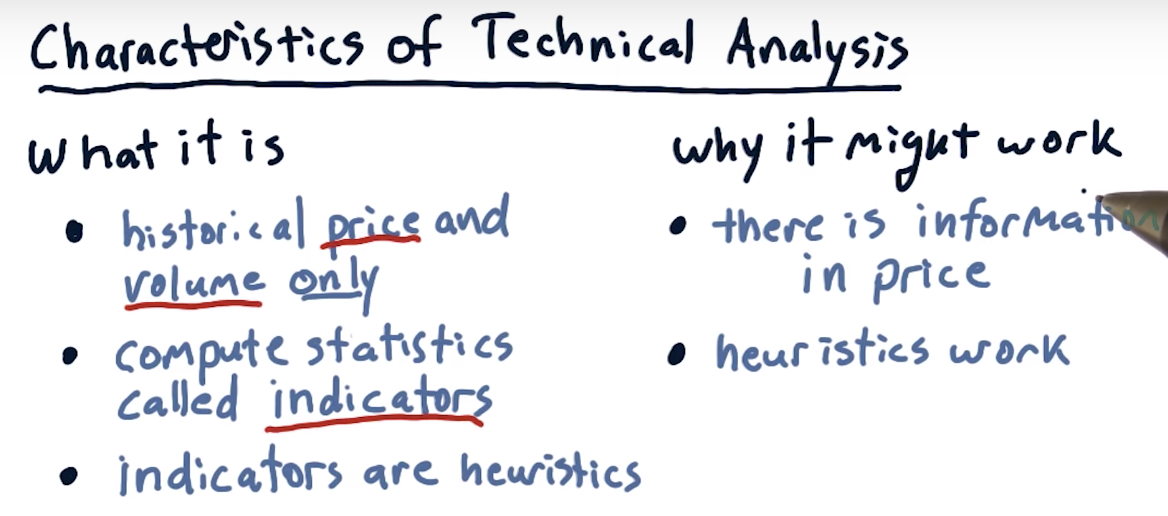

two broad categories of approaches to use for choosing stocks to buy or sell => (1) Technical vs. (2) fundamental analysis

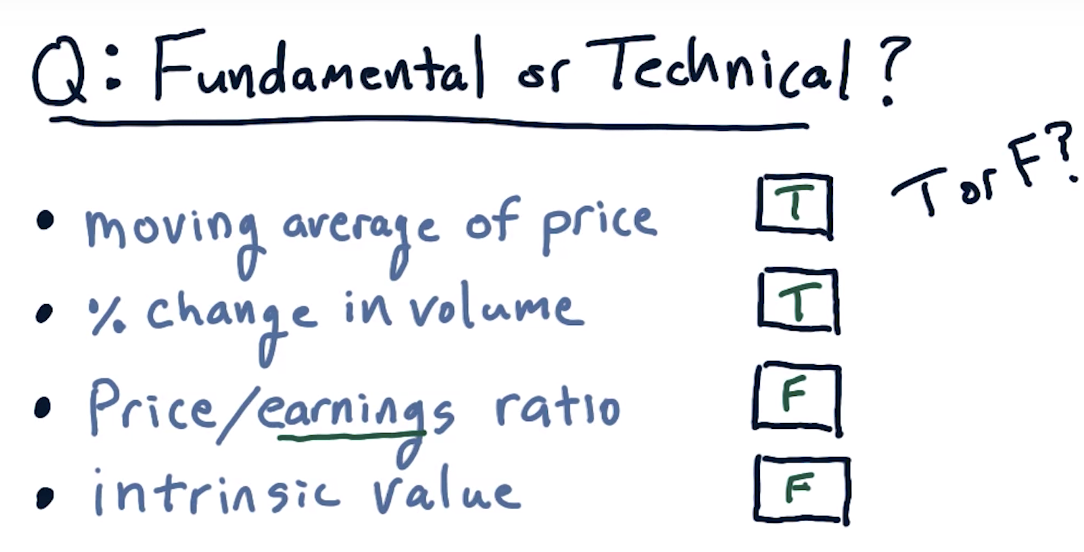

(1) Technical analysis => doesnt care about the value of a company => looking for patterns or trends in a tock's price

(2) Fundamental analysis => looking at aspects of a company in order to estimate its value, looking for the situations where the price of a company is below its value

Characteristics

Potential indicators

earning is a fundamental factor => P/E ratio is F

intrinsic value => based on dividends => F

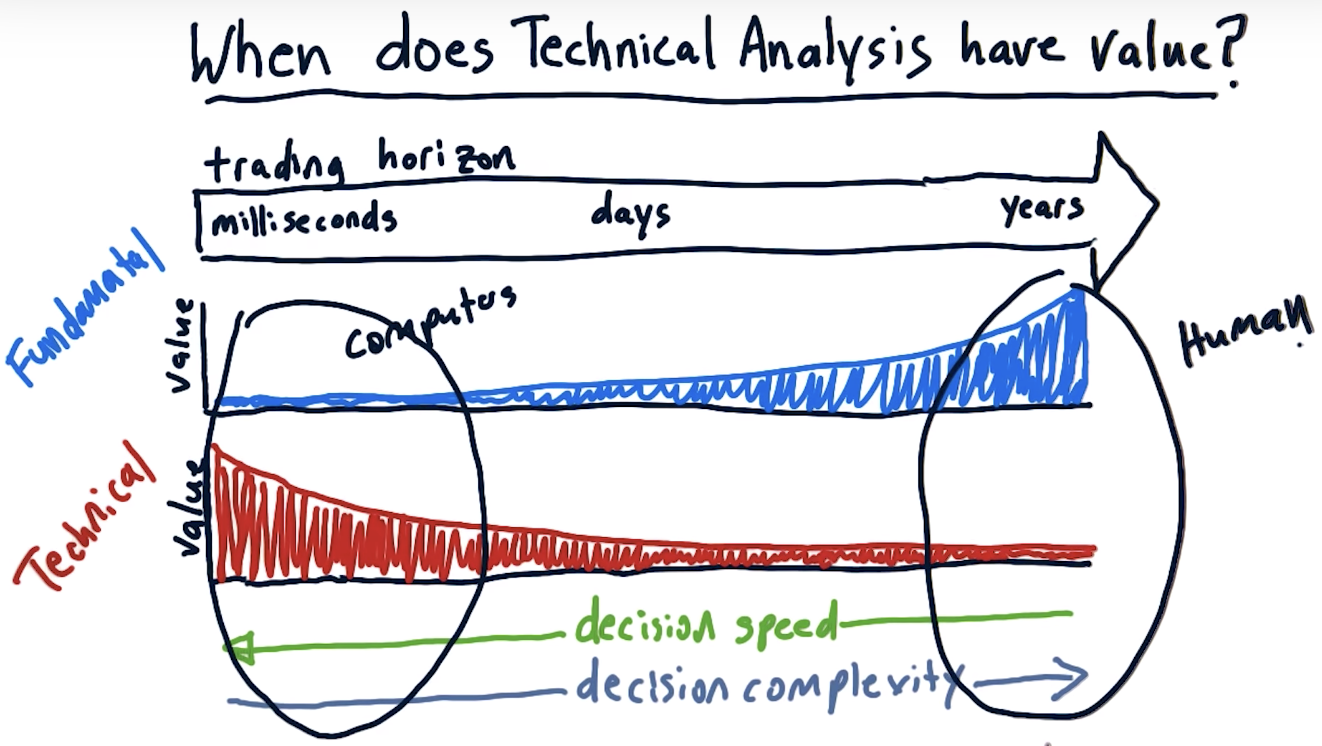

When is technical analysis valuable?

When is technical analysis valuable? (part 2)

consider where is the best region for human to operate and where is the best region for computers to operate

=> different types of hedge funds

ms => computer

day => mixture of human and computer

year => human

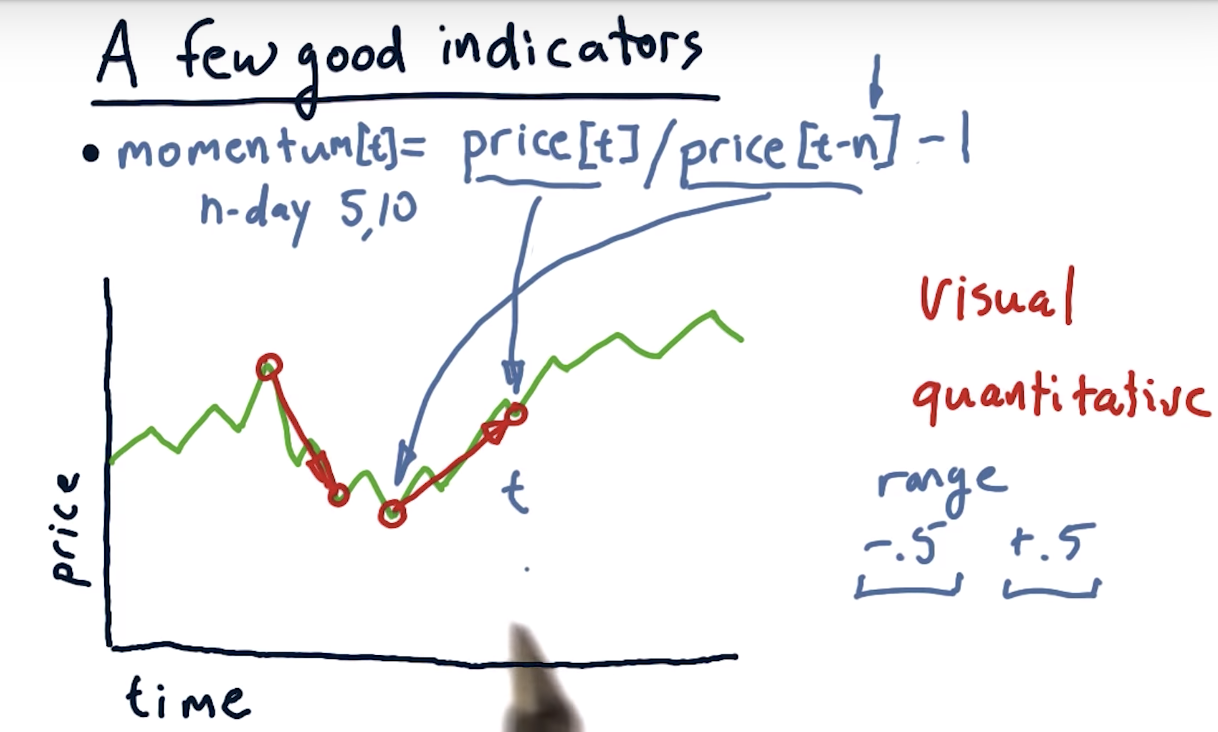

A few indicators: Momentum

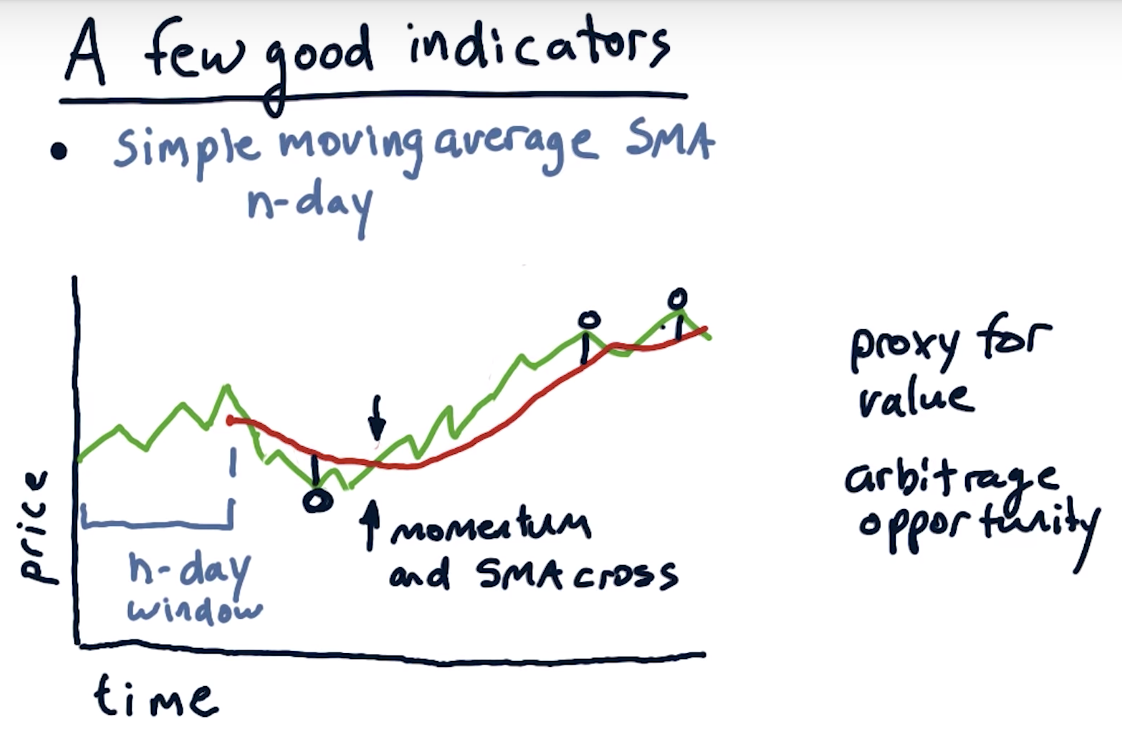

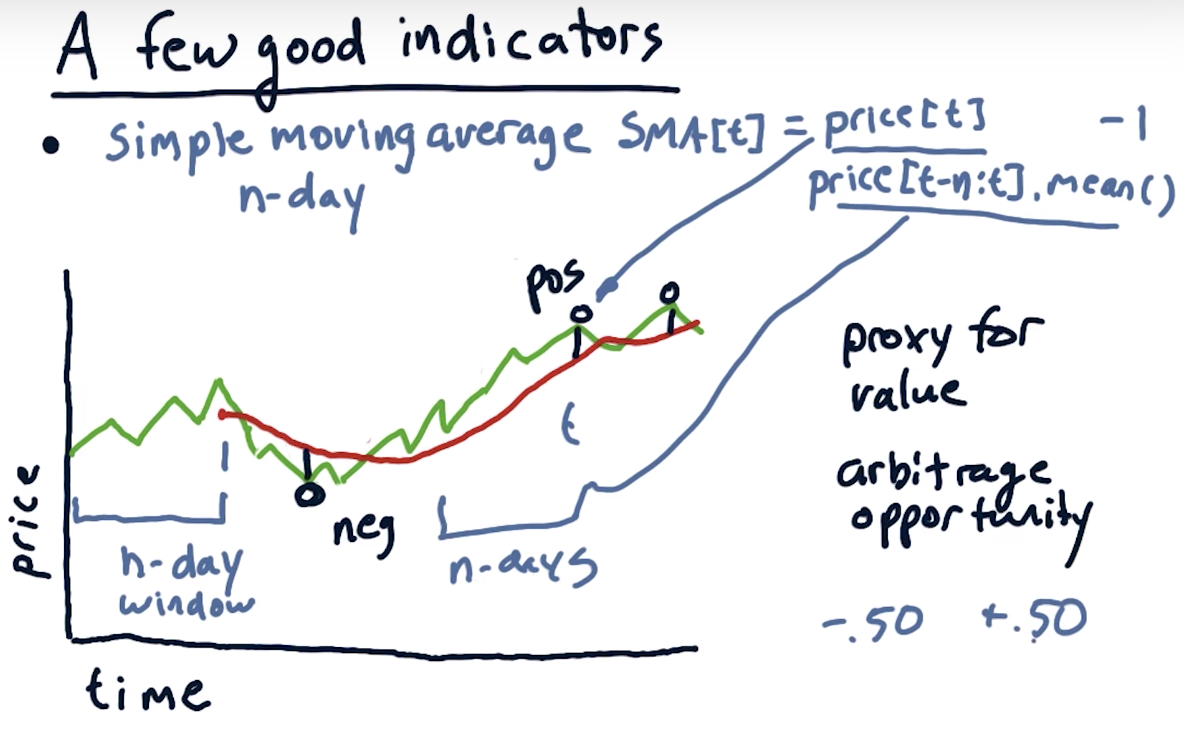

A few indicators: Simple moving average

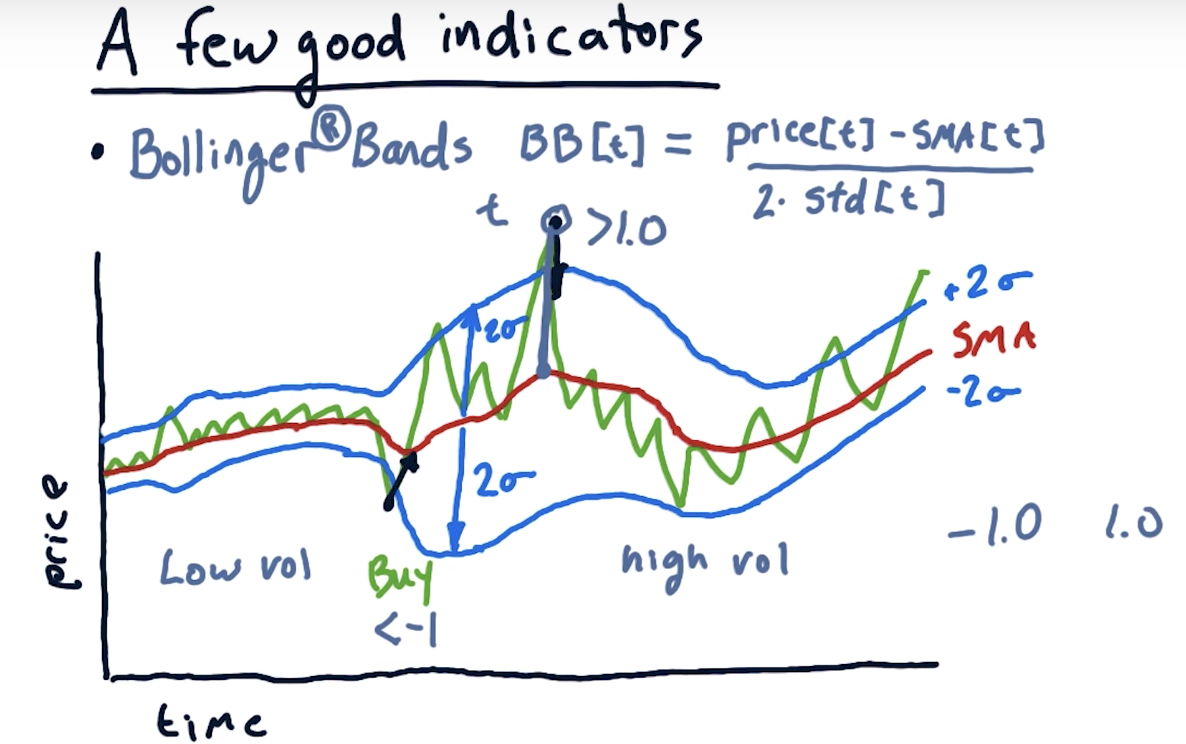

A few indicators: Bollinger Bands

Buy or sell?

for ②, it's unclear whether green curve will return or not, whereas for ③, situation is exactly opposite.

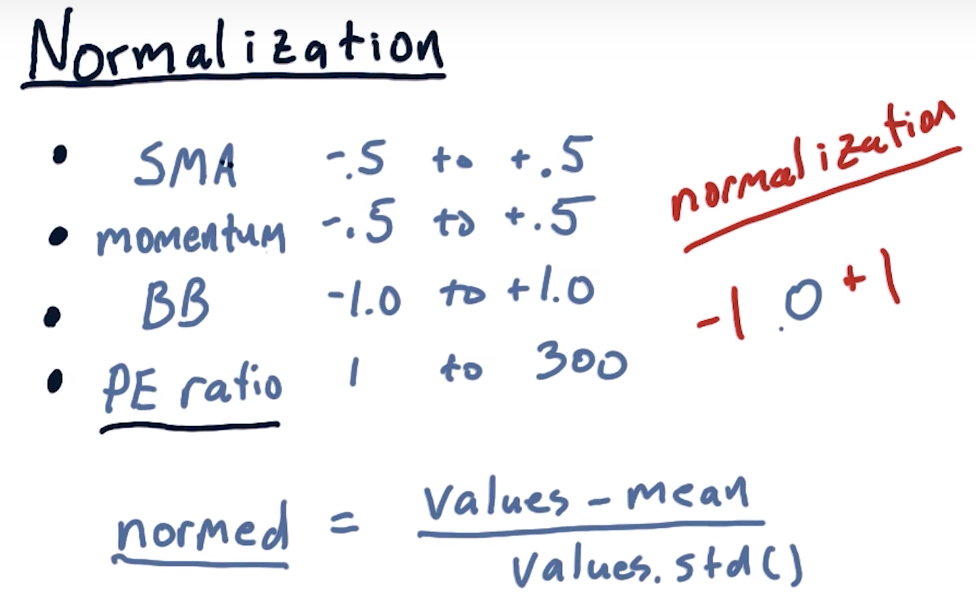

Normalization

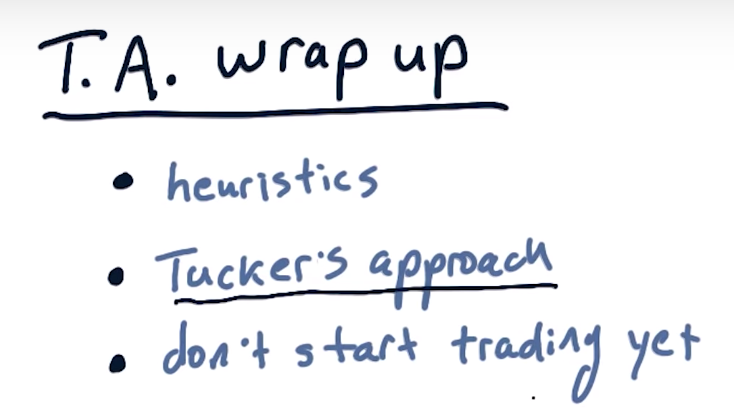

Wrap up

本文探讨了对冲基金面临的风险,包括市场风险及如何通过不同策略消除这些风险。文章对比了技术分析与基本面分析两种选股方法,并讨论了技术分析在不同时间尺度上的价值。此外,还列举了一些投资指标,如动量、简单移动平均和布林带等。

本文探讨了对冲基金面临的风险,包括市场风险及如何通过不同策略消除这些风险。文章对比了技术分析与基本面分析两种选股方法,并讨论了技术分析在不同时间尺度上的价值。此外,还列举了一些投资指标,如动量、简单移动平均和布林带等。

1797

1797

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?