What is an optimizer?

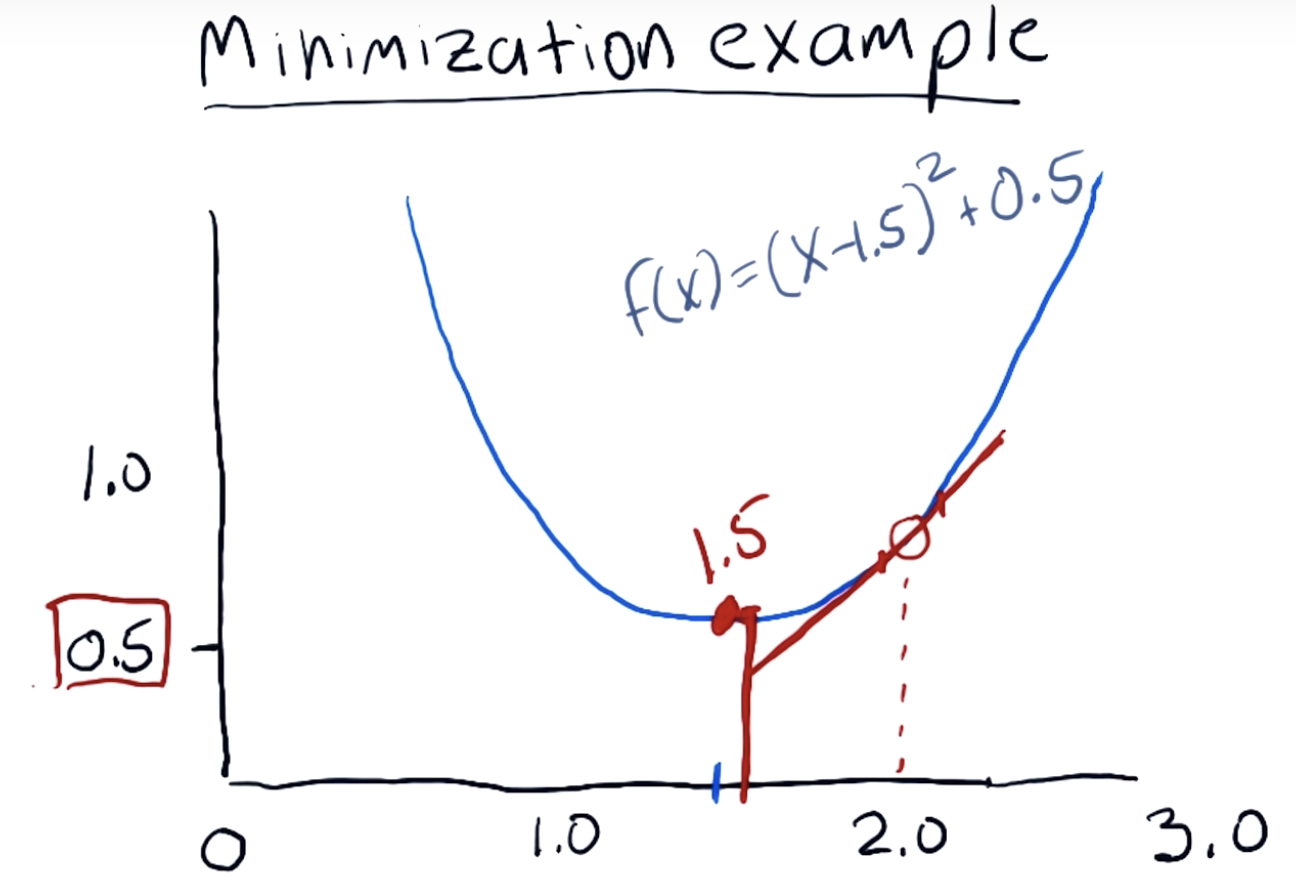

Minimization example

How to defeat a minimizer

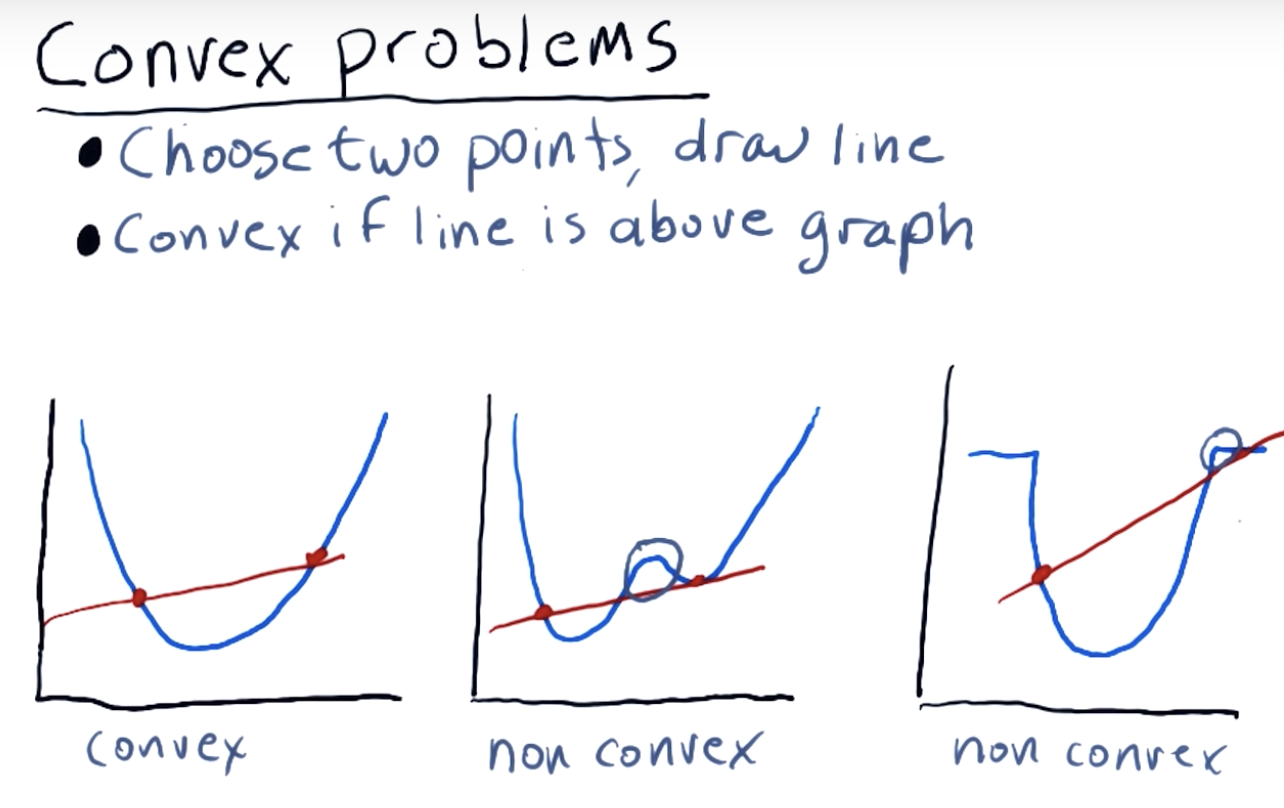

Convex problems

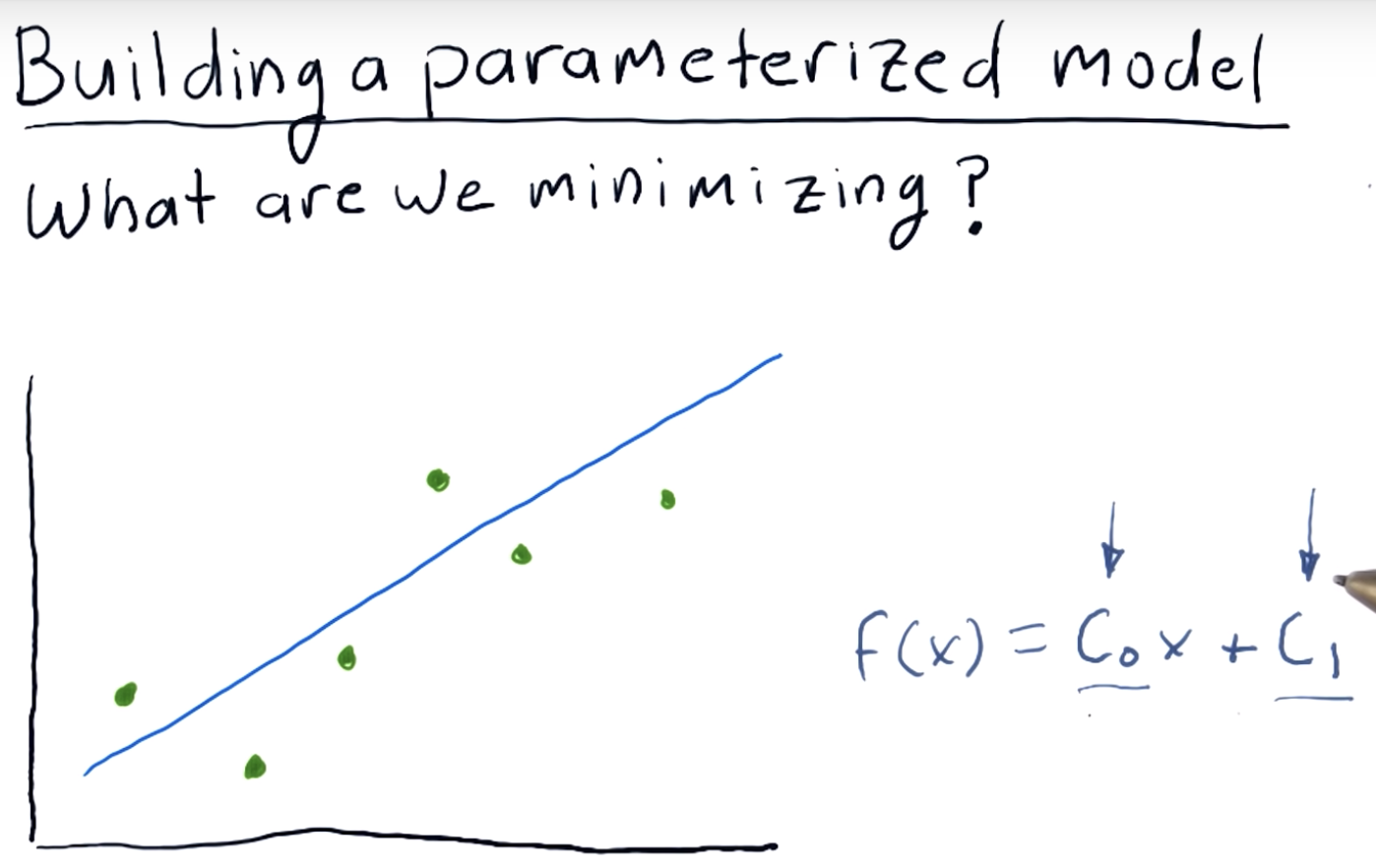

Building a parameterized model

Minimizer finds coefficients

What is portfolio optimization?

The difference optimization can make

Which criteria is easiest to solve for?

Cumulative return is the most trivial measure to use - simply investing all your money in the stock with maximum return (and none in others) would be your optimal portfolio, in this case.

Hence, it is the easiest to solve for. But probably not the best for risk mitigation.

Framing the problem

Ranges and constraints

本文探讨了优化器的基本概念及其在解决复杂问题中的应用,特别是如何通过优化算法找到最佳的投资组合,以实现风险与收益的最佳平衡。文章还讨论了在优化过程中容易解决的指标,如累积回报,以及其在风险管理方面的局限性。

本文探讨了优化器的基本概念及其在解决复杂问题中的应用,特别是如何通过优化算法找到最佳的投资组合,以实现风险与收益的最佳平衡。文章还讨论了在优化过程中容易解决的指标,如累积回报,以及其在风险管理方面的局限性。

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?