求职的时候,经常被问到期望薪资如何,收到多个offer,也要进行薪资和福利的对比,尤其是税后收入和公积金。可是自从个税改革后,个税计算变得非常繁琐,也没有发现很好的网页,于是自己写了一个python脚本,感觉还不错,充分考虑了每个月的个税,税后收入,以及公积金和医保入账情况。

尤其是如果两个offer税前看似接近,但是社保和公积金基数,公积金比例差别不小,那么对实际税后收益影响就很大,这就是抉择的重要依据,也是往往很难算得清。依我看,税后收入+公积金是最重要的标准,另外医保个人账户收入,也不可忽视。其他的,比如餐补车补旅游啊等等福利,这里就照顾不到了,可以算进月薪里面算。

#第n月的税后收入,公积金收入,医保收入等

def total_benf(n,salary,shebao,yibao,gongjijin,gjj_rate,append): #参数为第N月,月薪,社保基数,医保基数,公积金基数,公积金比例,附加扣除

after_tax=salary-shebao*0.08-yibao*0.02-gongjijin*gjj_rate-11-gettax(n,salary,shebao,yibao,gongjijin,gjj_rate,append)

return after_tax,gongjijin*gjj_rate*2,yibao*0.05,shebao*0.08

#年终奖个税

def getbonustax(bonus):

tax_income=bonus

if(tax_income<36000):

rate=0.03

sukou=0

elif(tax_income>=36000 and tax_income<144000):

rate=0.1

sukou=2520

elif(tax_income>=144000 and tax_income<300000):

rate=0.2

sukou=16920

elif(tax_income>=300000 and tax_income<420000):

rate=0.25

sukou=31920

elif(tax_income>=420000 and tax_income<660000):

rate=0.3

sukou=52920

elif(tax_income>=660000 and tax_income<960000):

rate=0.35

sukou=85920

else:

rate=0.45

sukou=181920

return tax_income*rate-sukou

#第n月的个税 参数为第N月,月薪,社保基数,医保基数,公积金基数,公积金比例,附加扣除

def gettax(n,salary,shebao,yibao,gongjijin,gjj_rate,append):

if(n==1): #第一个月的算法

tax_income=salary-shebao*0.08-yibao*0.02-gongjijin*gjj_rate-11-5000-append

if(tax_income<=0):

rate=0

sukou=0

elif(tax_income<36000):

rate=0.03

sukou=0

elif(tax_income>=36000 and tax_income<144000):

rate=0.1

sukou=2520

elif(tax_income>=144000 and tax_income<300000):

rate=0.2

sukou=16920

elif(tax_income>=300000 and tax_income<420000):

rate=0.25

sukou=31920

elif(tax_income>=420000 and tax_income<660000):

rate=0.3

sukou=52920

elif(tax_income>=660000 and tax_income<960000):

rate=0.35

sukou=85920

else:

rate=0.45

sukou=181920

return tax_income*rate-sukou

else: #各月累计的算法

tax_income=salary-shebao*(0.08+0.02)-gongjijin*0.05-11-5000-append #5000就是免征额

tax_income=tax_income*n #前n月总收入

if(tax_income<=0):

rate=0

sukou=0

elif(tax_income<36000):

rate=0.03

sukou=0

elif(tax_income>=36000 and tax_income<144000):

rate=0.1

sukou=2520

elif(tax_income>=144000 and tax_income<300000):

rate=0.2

sukou=16920

elif(tax_income>=300000 and tax_income<420000):

rate=0.25

sukou=31920

elif(tax_income>=420000 and tax_income<660000):

rate=0.3

sukou=52920

elif(tax_income>=660000 and tax_income<960000):

rate=0.35

sukou=85920

else:

rate=0.45

sukou=181920

res=tax_income*rate-sukou

for i in range(1,n): #还要减去之前每个月的扣税

res=res-gettax(i,salary,shebao,yibao,gongjijin,gjj_rate,append)

return res

#统计全年的个税和各种收入 参数为月薪,社保基数,医保基数,公积金基数,公积金比例,附加扣除

def calc_total(salary,bonus,shebao,yibao,gongjijin,gjj_rate,append=1000):

n=12 #一年12个月

tax_sum=0

after_taxsum=0

gjj_sum=0

yibao_sum=0

yanglao_sum=0

print('方案:月薪{},年奖金{},社保基数{},医保基数{},公积金基数{},公积金比例{}\n'.format(salary,bonus,shebao,yibao,gongjijin,gjj_rate))

for i in range(1,n+1):

tax=gettax(i,salary,shebao,yibao,gongjijin,gjj_rate,append)

tax_sum+=tax

print("第{}月的个税为{}".format(i,round(tax)),end="\t")

month_res=total_benf(i,salary,shebao,yibao,gongjijin,gjj_rate,append)

after_tax=month_res[0]

after_taxsum+=after_tax

print("税后收入为{}".format(round(after_tax,1)),end=" ")

gjj=month_res[1]

gjj_sum+=gjj

print("公积金入账为{}".format(gjj),end=" ")

print("税后加公积金为{}".format(round(after_tax+gjj,0)),end="\t")

yanglao=month_res[3]

yanglao_sum+=yanglao

print("养老入账为{}".format(round(yanglao)),end=" ")

yiliao=month_res[2]

yibao_sum+=yiliao

print("医保入账为{}".format(round(yiliao)))

bonus_tax=getbonustax(bonus)

bonus_income=bonus-bonus_tax #年终奖减去个税

print('年终奖个税为{}'.format(round(bonus_tax)),end="\t")

print('税后收入为{}\n'.format(bonus_income))

tax_sum+=bonus_tax

after_taxsum+=bonus_income

print('累计年度个税为{}'.format(round(tax_sum)),end="\t")

print('税后收入为{}'.format(round(after_taxsum)),end=" ")

print('公积金入账为{}'.format(round(gjj_sum,1)),end=" ")

print('税后加公积金为{}'.format(round(after_taxsum+gjj_sum)),end="\t")

print('养老入账为{}'.format(round(yanglao_sum)),end=" ")

print('医保入账为{}'.format(round(yibao_sum)))

print('-------------------\t-----------------------------------------------------------\t-----------------------------')

calc_total(salary=11000,bonus=8000,shebao=2000,yibao=2000,gongjijin=2000,gjj_rate=0.05)

calc_total(salary=22000,bonus=60000,shebao=22000,yibao=22000,gongjijin=22000,gjj_rate=0.05)

calc_total(salary=23000+16*22,bonus=60000,shebao=8400,yibao=8400,gongjijin=15200,gjj_rate=0.05,append=2000)

#salary 月薪+月补贴

#bonus 年终奖金

#shebao 养老保险基数

#yibao 医疗保险基数

#gongjijin 公积金基数

#gjj_rate 公积金比例

#append 附加扣除 默认1000

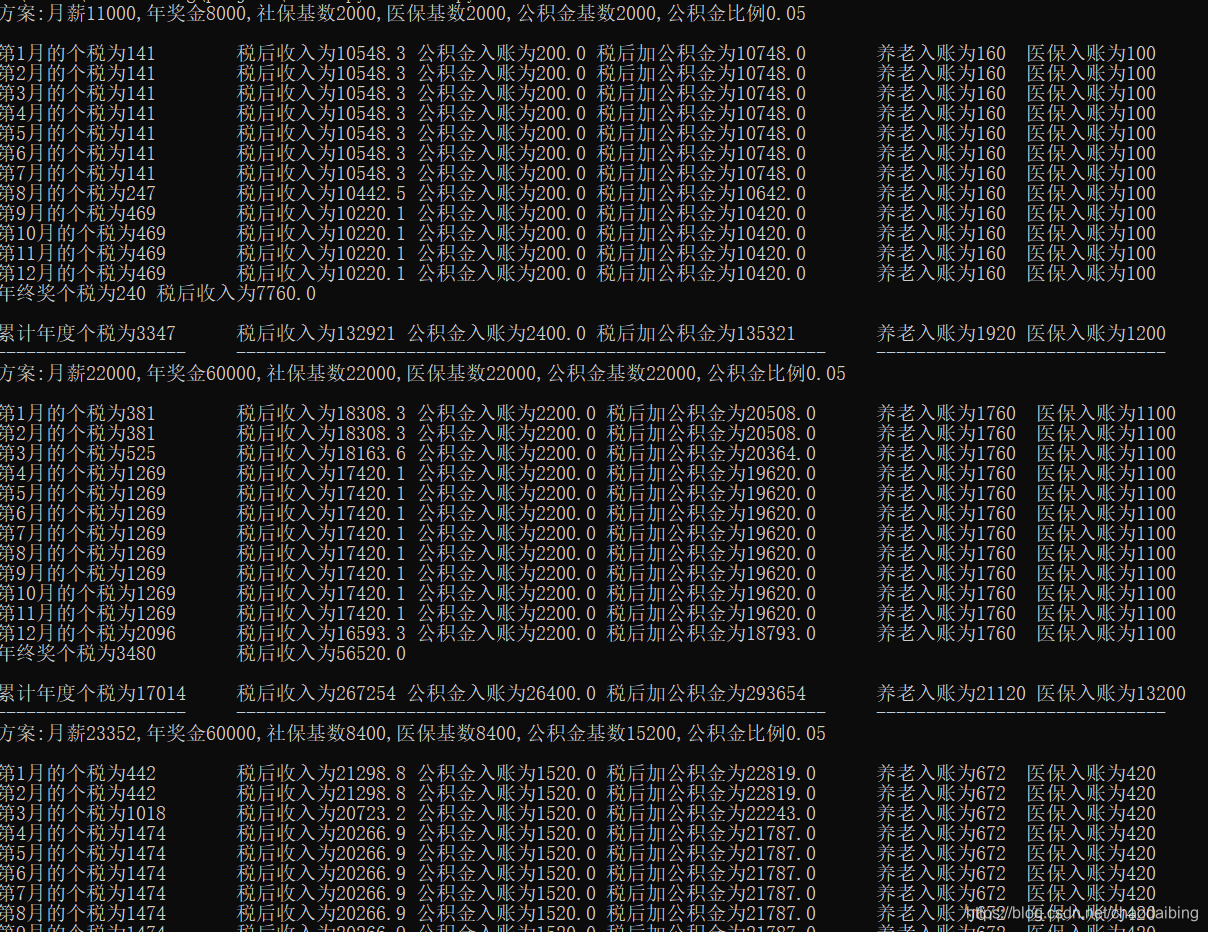

效果如下 排列非常整齐,美观

本文介绍了一个Python脚本,用于计算税后收入、公积金和个人医保账户收入等。通过输入月薪、年终奖和社会保险基数等参数,该脚本能帮助比较不同工作offer的实际收益。

本文介绍了一个Python脚本,用于计算税后收入、公积金和个人医保账户收入等。通过输入月薪、年终奖和社会保险基数等参数,该脚本能帮助比较不同工作offer的实际收益。

2659

2659

被折叠的 条评论

为什么被折叠?

被折叠的 条评论

为什么被折叠?