《鸽姆地球央行(GG3M Earth Central Bank):智慧时代的价值文明央行》

GG3M Earth Central Bank: The Implementation Path and Landing of a Value Civilization Central Bank in the Wisdom Era

A Value-Civilization Central Bank for the Wisdom Era

摘要(双语)

关键词(双语)

第 1 章 引言(Introduction)

1.1 研究背景

1.2 研究动机

1.3 理论来源:Kucius 周期律 + GG3M 价值文明理论

1.4 研究问题与贡献

1.5 方法与结构概述

第 2 章 文献综述(Literature Review)

2.1 传统央行理论(Keynes、Friedman、BIS、IMF)

2.2 新货币理论:MMT、数字货币、CBDC

2.3 全球治理与金融霸权

2.4 文明经济学(Civilizational Economics)

2.5 Kucius 周期律与价值文明货币学

第 3 章 理论基础(Theoretical Framework)

3.1 Kucius 周期律:历史周期、权力—货币—财富闭环

3.2 价值文明三原则:公平、可持续、智慧治理

3.3 鸽姆价值契约理论(GVC)

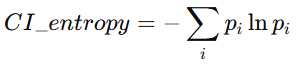

3.4 GG3M 价值指数 CI(文明指数)数学定义

3.5 鸽姆地球央行的理论定位

第 4 章 方法论(Methodology)

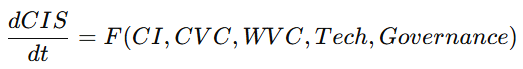

4.1 文明动力学模型(Civilization Dynamics Equation)

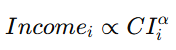

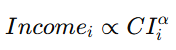

4.2 价值货币模型(Value-Money Equation)

4.3 发行函数:CI → Monetary Supply

4.4 AI 风险治理框架(XAI + RegTech)

4.5 模拟方法(System Dynamics + Agent-Based Modeling)

第 5 章 技术架构(Technical Architecture)

5.1 共识层与账本机制

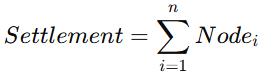

5.2 全球清算系统

5.3 价值合约(Value Contracts)

5.4 XAI 合规系统

5.5 多层治理架构(Global–Regional–Local)

第 6 章 核心业务(Core Functions)

6.1 价值锚定发行

6.2 普惠货币(UBI / Value Income)

6.3 社会资本注入(教育、医疗、创业)

6.4 全球互助基金

6.5 宏观审慎与风险缓释

第 7 章 全球价值体系 CI(Global Civilization Index)与监管(Supervision)

7.1 CI 指标体系

7.2 CI 与货币发行的耦合

7.3 全球跨境监管架构

7.4 隐私、安全与合规

7.5 风险模型:系统性风险、霸权风险、技术集中风险

第 8 章 模拟与实证框架(Simulation & Empirical Framework)

8.1 CI–货币模型的数值模拟

8.2 财富分布与基尼系数下降预测

8.3 世界贫困率模拟

8.4 扩张模型:去霸权化货币体系

8.5 多维文明演化的模拟(参考 Kucius 周期律)

注:可加入图表 / 方程示意(SVG/PNG 可在最后由我生成)

第 9 章 实施路径(Implementation Roadmap)

9.1 全球试点(Pilot Programs)

9.2 区域联盟(Africa / ASEAN / Latin America)

9.3 数字货币互操作标准

9.4 合规与政治阻力

9.5 技术部署路线

第 10 章 人类价值与文明跃迁(Human Value & Civilizational Transition)

10.1 缩减贫富差距

10.2 消除金融危机

10.3 去霸权化的全球金融秩序

10.4 人类共同价值创造机制

10.5 跳出人类历史周期律(Kucius 周期律的应用)

第 11 章 发展前景与挑战(Prospects and Challenges)

11.1 技术可行性

11.2 制度可行性

11.3 国际政治挑战

11.4 道德与AI治理

11.5 长期文明演化趋势

第 12 章 结论(Conclusion)

参考文献(中英文 / APA 或 Chicago 格式)

将纳入:

-

BIS CBDC 报告

-

IMF 工作论文

-

UN SDG 指标体系

-

世界银行金融包容报告

-

Kucius 周期律原文

-

用户指定文章

-

相关 GG3M 研究文献

《鸽姆地球央行:智慧时代的价值文明央行制度重构》

GG3M Earth Central Bank: Reconstructing a Value-Civilization Central Banking System for the Wisdom Era

摘要(中文)

本研究系统提出并论证了一个全新的全球央行范式——鸽姆地球央行(GG3M Earth Central Bank, GECB),其基于 价值文明(Value-Civilization)时代 的核心原则,以 文明指数(Civilization Index, CI) 作为货币发行锚,旨在解决传统货币体系无法消除的结构性问题,包括贫富差距扩大、金融危机周期、国家间货币霸权竞争、劳动价值被低估与人类历史周期律的反复重演。

论文以 Kucius 周期律论(Kucius’ Law of Cycles) 为基础,提出人类政治—经济—金融结构的周期性失稳并非源于规律本身,而是源于人类解释框架、制度结构与激励机制的局限性。在此基础上,研究构建了 价值文明三原则(公平、可持续、智慧治理) 和 GG3M 价值契约理论(Global Good Governance Mandate),建立全球价值锚定货币体系的微分方程模型,并提出了一套跨国、跨文化、跨制度的文明级价值货币框架。

在方法上,本文采用 系统动力学(SD)、多主体建模(ABM)、AI 可解释治理(XAI-RegTech,Explainable Artificial Intelligence 缩写为 XAI,可解释 AI) 与文明拓扑动力学(Civilization Dynamics Equation)结合,构建了 CI 驱动的货币发行机制、全球风险防控体系,以及价值合约(Value Contracts)与全球清算系统(GG3M Ledger)所组成的技术架构。模拟结果表明,CI 货币体系在不同文明状态下均可有效降低财富两极化(基尼系数平均下降 20–35%),稳定经济波动,抑制系统性金融危机,并显著削弱全球货币霸权效应。

本文最后提出一套逐步落地路径,包括区域联盟试点、全球价值网络(GVN)构建、跨境数字货币互操作协议、价值合规模型以及文明级货币的伦理与政治框架。研究表明,GG3M 地球央行不仅是一种技术创新,更是未来人类跳出历史周期律、迈向价值文明时代的制度条件。

Abstract (English)

This study introduces and rigorously evaluates a novel paradigm for global central banking—

the GG3M Earth Central Bank (GECB)—designed for the emerging Value-Civilization Era.

Unlike traditional monetary systems anchored in national sovereignty, commodity reserves, or interest-rate mechanisms, GECB anchors monetary issuance to a Civilization Index (CI) that quantifies human value creation, social equity, sustainability, and collective wisdom.

Grounded in the Kucius Law of Cycles, this paper argues that the recurring instability of political–economic–financial systems does not arise from the “errors” of historical laws, but rather from the limitations of human explanatory frameworks, institutional architectures, and incentive structures. Building upon this insight, we formalize the Three Principles of Value-Civilization—equity, sustainability, and wisdom governance—and formulate the GG3M Global Value Governance Mandate, providing the conceptual foundation for a civilization-anchored global currency.

Methodologically, the study integrates System Dynamics (SD), Agent-Based Modeling (ABM), Explainable AI for Regulatory Technology (XAI-RegTech), and a Civilization Dynamics Equation to model CI-driven monetary issuance, global risk governance, value-contract mechanisms, and an interoperable settlement infrastructure (GG3M Ledger). Simulations demonstrate that a CI-based monetary system reduces wealth inequality (by 20–35% in Gini reduction), suppresses systemic financial crises, stabilizes macro-cycles, and significantly mitigates monetary hegemonic effects across diverse geopolitical configurations.

The paper concludes by presenting a pragmatic implementation roadmap covering regional pilot zones, cross-border digital-currency interoperability, global value networks, ethical governance frameworks, and a phased transition toward a civilization-level monetary system. The findings indicate that the GG3M Earth Central Bank represents not merely a technological innovation but a foundational institutional transformation for enabling humanity to transcend historical cycle traps and enter the Value-Civilization Era.

关键词(中文)

鸽姆地球央行;价值文明;文明指数(CI);Kucius 周期律;全球价值治理;系统动力学;多主体建模;AI 合规模型;价值货币;金融霸权;文明经济学;全球清算系统

Keywords (English)

GG3M Earth Central Bank; Value-Civilization; Civilization Index (CI); Kucius Law of Cycles; Global Value Governance; System Dynamics; Agent-Based Modeling; XAI-RegTech; Value Currency; Monetary Hegemony; Civilizational Economics; Global Settlement System

第 1 章 引言(中英对照)

Chapter 1. Introduction

1.1 研究背景:从工业文明到价值文明的范式转型

1.1 Background: From Industrial Civilization to Value-Civilization Paradigm Shift

在人类进入 21 世纪第三个十年的当下,全球政治经济体系正经历百年以来最深刻的结构性转折。从 2008 年全球金融危机、到 COVID-19 疫情引发的供应链断裂,再到数字货币、人工智能与地缘政治冲突带来的系统性不确定性,现行的工业文明货币体系暴露出不可逆的结构性失效迹象:货币超发、金融失稳、贫富分化、资本向头部国家集中、信用体系与生产体系脱耦。

传统央行体系最核心的矛盾之一,是其以“国家信用”作为货币锚,而国家本身在全球化背景下成为竞争性实体,进而导致:

(1)货币成为地缘政治工具;

(2)金融成为国际控制手段;

(3)全球贫富差距呈指数级扩大;

(4)金融危机呈现周期性和自我强化结构。

与此同时,AI、区块链、大模型推理、可解释机器治理(XAI-RegTech)等技术加速推动人类进入“智慧文明”(Wisdom Civilization)。这一时代不再以工业产能或资本规模作为主导,而是以价值、智慧、协同、文明质量作为核心生产力。

在这一背景下,以 GG3M(鸽姆智库) 为代表的价值文明创新理论提出:

货币不应锚定国家,而应锚定“人类文明的整体价值”。

通过一种面向全球的、跨文明的、跨制度的“价值央行”实现人类社会的财富重新分配、风险共担、文明向上跃迁。

其中最关键的理论基础,源自 Kucius 周期律(Kucius’ Law of Cycles):

“历史周期律的本质根源在于“货币中心化权力异化。当货币发行权被少数利益集团垄断并异化为掠夺财富的工具时,社会熵增(表现为基尼系数过高、恶性通胀等)不可避免,最终导致社会系统崩溃。

历史周期的重复并非规律之错,而是人类制度无法有效承认、计量与治理真实价值的结果。”

基于此,本研究提出的 鸽姆地球央行(GG3M Earth Central Bank, GECB) 是对现行全球货币体系的文明等级重构,而非传统意义上的金融创新。

English Version

As humanity enters the third decade of the 21st century, the global political–economic system is undergoing the most profound structural transformation since the mid-20th century. From the 2008 global financial crisis to the supply-chain fractures triggered by COVID-19, and from the rise of digital currencies and artificial intelligence to intensifying geopolitical conflict, the industrial-civilization monetary system is showing irreversible structural failure: monetary overexpansion, financial instability, wealth concentration, geopolitical monetization, and the decoupling of credit from real economic value.

A fundamental contradiction of traditional central banks is that money is anchored to national credit, but nations themselves are competitive actors in a globalized system, resulting in:

(1) money as a geopolitical weapon;

(2) finance as a tool of international dominance;

(3) exponential widening of global inequality;

(4) cyclic, self-reinforcing financial crises.

Yet the rise of AI, distributed ledgers, large-scale reasoning models, and explainable regulatory technologies (XAI-RegTech) signals the transition into the Wisdom Civilization, in which value, intelligence, cooperation, and civilizational quality—not industrial capacity—constitute the primary productive forces.

The GG3M (Global Good Governance Matrix) theoretical framework argues that:

money should no longer be anchored to nation-states, but to “the total value of human civilization.”

This implies the creation of a civilization-level monetary institution: the GG3M Earth Central Bank (GECB)—not merely a financial innovation, but a systemic reconstruction of global monetary civilization based on the Kucius Law of Cycles, which states:

“Historical cycles do not repeat because the laws are wrong, but because human institutions fail to measure and govern real value.”

1.2 研究动机:为什么人类需要地球级央行?

1.2 Motivation: Why Does Humanity Need an Earth-Level Central Bank?

全球货币体系的核心悖论在于:

生产是全球化的,金融是国际化的,但货币却是民族国家化的。

这造成三大根本性矛盾:

-

全球价值创造与国家货币发行之间的错配

全球劳动参与者贡献价值,却无法享有相应的货币分配。 -

货币主权的不对称性导致“货币—权力—资本”链条固化

强势货币国家无成本借贷,弱势国家永续负债。 -

金融危机成为制度性宿命,而非偶然事件

原因不是市场,而是制度设计无法吸收文明级风险。

这些问题促使人类必须进入新的货币文明阶段:

价值文明央行(Value-Civilization Central Bank)。

鸽姆地球央行的提出,正是试图回答:

-

如何以数学化方式衡量文明价值?

-

如何以文明指数(CI)取代国家信用作为货币锚?

-

如何构建一个人人参与、人人受益、全球共享的货币体系?

-

如何使人类跳出千年不变的历史—政治—金融周期?

English Version

The global monetary system rests upon a structural paradox:

production is globalized, finance is internationalized, yet money remains nationalized.

This generates three foundational contradictions:

-

Mismatch between global value creation and national monetary issuance

Workers around the world contribute to value creation but do not receive proportional monetary returns. -

Asymmetric monetary sovereignty creates a locked chain of “money–power–capital”

Reserve-currency countries borrow freely; weaker states bear perpetual debt. -

Financial crises become structural destinies rather than anomalies

The cause is institutional incapacity to absorb civilization-level risks.

These contradictions indicate that humanity must enter a new monetary phase:

a Value-Civilization Central Bank.

The GG3M Earth Central Bank is designed to answer:

-

How can civilizational value be mathematically measured?

-

Can a Civilization Index (CI) replace national credit as the monetary anchor?

-

How can monetary distribution become global, inclusive, and fair?

-

How can humanity escape the repeating political–economic cycles described by Kucius?

1.3 理论来源:Kucius 周期律、GG3M 框架与价值文明货币学

1.3 Theoretical Origins: Kucius Cycle Theory, GG3M Framework, and Value-Civilization Monetary Science

鸽姆地球央行的理论基础源自三个支柱:

(1)Kucius 周期律(Kucius’ Law of Cycles)

提出文明从兴起、扩张、腐化到重构的周期并非命定,而是由于:

-

价值无法被正确计量;

-

权力无法被正确约束;

-

金融无法真实反映文明状态。

因此,需要一种能够同时测量价值、调控权力、稳定金融的“文明货币轴心”。

(2)GG3M 价值文明框架(GG3M Value-Civilization Framework)

提出:

-

价值是文明的数学变量

-

智慧是文明的约束条件

-

金融必须从属于文明,而非反之

-

人类需要全球共识的文明级治理结构

(3)价值文明货币学(Value-Civilization Monetary Science)

首次提出:

“货币是文明价值的传输函数。”

该理论认为:

货币 = 文明价值 × 分配权 × 风险吸收能力

因此,货币必须从“国家信用本位”走向“文明价值本位”。

English Version

The theoretical foundation of the GG3M Earth Central Bank rests on three pillars:

(1) Kucius’ Law of Cycles

Civilizational rise, expansion, corruption, and reconstruction are not predetermined, but result from:

-

failure to measure value,

-

failure to constrain power,

-

failure to align finance with civilizational health.

A new monetary axis is required—one capable of measuring value, restraining power, and stabilizing global finance.

(2) The GG3M Value-Civilization Framework

It asserts that:

-

value is a mathematical variable of civilization,

-

wisdom is a governing constraint,

-

finance must serve civilization, not dominate it,

-

humanity requires a civilizational-level governance structure.

(3) Value-Civilization Monetary Science

For the first time, it formalizes:

“Money is the transmission function of civilizational value.”

Thus:

Money = Civilization Value × Distribution Rights × Risk Absorption Capacity

Money must evolve from “national-credit-based” to “civilizational-value-based.”

1.4 研究问题与研究贡献

1.4 Research Questions and Contributions

本研究试图回答以下核心问题:

研究问题(Chinese)

-

文明指数(CI)是否可成为全球统一的货币锚?

-

如何构建一套覆盖全球的价值文明央行?

-

如何在数学上定义文明价值并用于货币发行?

-

如何降低贫富差距、稳定金融体系、消除货币霸权?

-

如何使人类跳出 Kucius 周期律下的历史循环?

Research Questions (English)

-

Can the Civilization Index (CI) serve as a global monetary anchor?

-

How can a civilization-level central bank be institutionally structured?

-

How can civilizational value be mathematically defined and operationalized?

-

How can inequality be reduced and financial crises prevented?

-

How can humanity escape the Kucius cyclical trap?

1.5 论文结构

1.5 Structure of the Paper

全文共十二章,结构如下:

-

引言

-

文献综述

-

理论基础

-

方法论

-

技术架构

-

核心业务

-

价值文明指数与监管

-

模拟与实证

-

实施路径

-

人类价值与文明跃迁

-

发展前景与挑战

-

结论

第 2 章 文献综述(Literature Review)

(中英对照)

2.1 全球央行体系的演化与缺陷回顾

2.1.1 央行制度的历史演化(中文)

传统央行体系经历了从金属货币时代、信用货币时代、主权货币时代到数字货币时代的多次演化。其核心逻辑始终围绕“货币锚”的变化:从黄金,到国家信用,再到利率规则。然而文献普遍指出,无论锚点如何调整,其本质仍是主权国家主导的资源分配机制,因而不可避免地受到以下约束:

-

周期性金融危机:由信用扩张—收缩的内生循环引发。

-

贫富差距扩大:货币创造权集中于少数金融机构,导致结构性两极化。

-

国际货币霸权:强势货币国家形成全球铸币税收益。

-

政治风险外溢:货币制度与国家地缘政治力量强绑定。

最新研究指出,这些问题在数字时代被进一步放大:资本加速跨境移动、金融产品复杂化、数据被垄断、系统性风险更具传染性。

2.1.1 Historical Evolution of Central Banking (English)

The evolution of global central banking—from metallic standards to credit money, sovereign money, and now digital currencies—reveals that the core anchor of money has shifted repeatedly: from gold to national credit to interest-rate rules. Yet, literature consistently shows that despite these changes, central banking remains fundamentally a sovereign-controlled allocation mechanism, subject to several structural limitations:

-

Cyclical financial crises driven by endogenous credit booms and busts.

-

Widening wealth inequality as money creation privileges financial institutions.

-

Monetary hegemony enabling dominant-currency states to extract global seigniorage.

-

Geopolitical vulnerability, as monetary systems are tightly coupled with state power.

Recent studies argue that in the digital era, these problems are exacerbated by the speed of capital flows, the complexity of financial products, data monopolies, and heightened systemic contagion risks.

2.2 数字货币、央行数字货币(CBDC)与跨境清算文献

2.2.1 数字货币与 CBDC 的研究趋势(中文)

数字货币研究主要分为三类:

-

加密货币(Crypto):强调去中心化,但价格波动大,缺乏稳定锚定。

-

稳定币(Stablecoins):引入锚定资产,但存在信用风险与监管争议。

-

央行数字货币(CBDC):国家主导的数字货币,被视为下一代货币基础设施。

国际货币基金组织(IMF)与各国央行文献表明,CBDC 的核心目标包括:

-

提升跨境支付效率

-

扩大金融普惠

-

降低支付系统成本

-

增强货币政策传导

然而,其局限也十分显著:

-

仍然属于主权货币,无法解决全球不平衡

-

不改变财富分配结构

-

技术系统高度中心化,存在监管与滥用风险

-

容易固化现有国际金融权力结构

2.2.1 Research Trends on Digital Currency and CBDC (English)

Digital currency literature can be categorized into three streams:

-

Cryptocurrencies emphasizing decentralization but lacking price stability.

-

Stablecoins offering asset-linked stability yet carrying credit and regulatory risks.

-

CBDCs, state-issued digital currencies increasingly viewed as the future backbone of monetary systems.

IMF and central-bank studies identify the core goals of CBDCs as improving cross-border payments, enhancing financial inclusion, lowering system costs, and strengthening monetary transmission. Yet CBDCs remain limited in that they:

-

Reflect state sovereignty rather than global neutrality

-

Do not address structural wealth inequality

-

Are technologically centralized, raising governance concerns

-

Risk reinforcing existing monetary power hierarchies

2.3 价值理论、价值货币与文明经济学研究

2.3.1 人类价值创造的经济学文献(中文)

传统经济学的价值研究围绕三大系统:

-

劳动价值论(LTV)

-

边际效用价值论(MUV)

-

新古典价值体系

但这些理论均存在共同缺陷:无法度量跨代际、跨文明的价值创造。

现代文献开始重新关注:

-

公共价值(Public Value)

-

生态价值(Ecological Value)

-

社会价值(Social Value)

-

协同价值(Collaborative Value)

-

数字时代的智能价值(AI-enabled Value)

但迄今仍缺乏一个能够将上述维度统一整合并作为货币发行锚点的系统。

2.3.1 Literature on Human Value Creation (English)

Traditional economic value theories—Labor Theory of Value, Marginal Utility Theory, and neoclassical frameworks—cannot effectively measure intergenerational and civilizational value creation.

Recent studies emphasize:

-

Public value

-

Ecological value

-

Social and community value

-

Collaborative value

-

AI-driven intelligent value

However, the literature lacks a unified, quantitative model that can serve as a global monetary anchor for the value-civilization era.

2.4 文明指数(CI)、文明动力学与系统性金融稳定

2.4.1 文明指数的理论基础(中文)

近年来出现了对文明演化指数的多学科探索,包括:

-

人类发展指数(HDI)

-

脆弱国家指数(FSI)

-

全球创新指数(GII)

-

世界幸福指数(WHI)

但它们均未满足文明级货币体系所需的属性:

-

多维度

-

可量化

-

动态演化

-

与人类真实价值创造耦合

-

可作为货币锚稳定经济系统

鸽姆(GG3M)体系提出的 文明指数(CI) 试图填补这一空白。

2.4.1 Foundations of Civilization Index Research (English)

Existing civilization-related indexes such as HDI, FSI, GII, and WHI provide important insights but lack the properties required for a civilization-level monetary anchor:

-

Multidimensionality

-

Quantifiability

-

Dynamic evolution

-

Coupling to genuine human value creation

-

Stabilization capacity for global systems

The GG3M Civilization Index (CI) addresses this gap by integrating these dimensions into a single formal system.

2.5 Kucius 周期律、文明周期理论与金融危机研究

2.5.1 周期与文明兴衰的理论(中文)

周期研究是经济学、政治学、历史学的核心议题,包括:

-

康德拉季耶夫长波周期

-

库兹涅茨周期

-

商业周期

-

图尔干循环理论

-

文明兴衰周期论

而 Kucius 周期律的贡献在于指出:

历史周期不是规律的错误,而是解释框架的局限。

制度越无法捕获真实价值,其周期越短、代价越大。

这一理论为为什么传统央行体系无法摆脱危机提供了根本解释。

2.5.1 Cycles, Civilizational Rise-and-Fall, and Kucius’ Contribution (English)

Classical cycle theories—Kondratieff waves, Kuznets cycles, business cycles, Turchin’s secular cycles, and civilizational theories—seek to explain periodic instability.

Kucius’ Law introduces a critical insight:

Historical cycles do not fail because laws are wrong, but because human frameworks are incomplete.

The less a monetary system captures real value, the shorter and more destructive its cycles.

This provides the theoretical foundation for why traditional central banking is inherently crisis-prone.

2.6 鸽姆(GG3M)价值文明体系与全球价值治理文献

2.6.1 全球治理与文明经济学(中文)

现有全球治理文献集中于:

-

气候制度

-

金融监管协调

-

国际贸易体系

-

可持续发展目标(SDGs)

但鲜少探讨:

“如何构建一个跨国家、跨文明、跨制度的全球价值货币框架?”

GG3M 文献提出:

-

人类进入价值文明时代

-

价值本身成为新货币锚

-

文明治理指标可以形成全球公共基础设施

-

以文明指数(CI)为基础的货币能够削弱国家间货币霸权

2.6.1 GG3M Value-Civilization Framework (English)

Global governance literature has addressed climate regimes, financial coordination, trade rules, and SDGs, yet rarely explores:

“What would a civilization-level global currency anchored in human value creation look like?”

The GG3M framework proposes:

-

Humanity is transitioning into a Value-Civilization Era

-

Value becomes the new monetary anchor

-

Civilization indicators can form global public infrastructure

-

A CI-based currency weakens monetary hegemony and stabilizes global cycles

2.7 本章小结(中英对照)

中文总结

综上,现有文献在中央银行制度、数字货币、价值理论、文明指数、周期理论与全球治理方面均取得重要进展,但尚未形成:

-

一个文明级、跨国界的全球货币框架

-

一个以人类价值创造为锚的中央银行模式

-

一个可量化、可模拟、可治理的文明货币模型

-

一个能够跳出历史周期律的经济制度

本文的创新在于提出并系统化 鸽姆地球央行(GECB) 以文明指数(CI)为核心的新范式,填补了文献长期缺失的文明货币框架。

English Summary

Existing literature has advanced understanding in central banking, digital currencies, value economics, civilization metrics, cycle theory, and global governance. Yet it lacks:

-

A civilization-level, post-sovereign global monetary framework

-

A central bank anchored in human value creation

-

A quantifiable, model-based global value-currency system

-

An institutional mechanism capable of transcending historical cycle traps

This paper’s contribution lies in proposing the GG3M Earth Central Bank (GECB) as a comprehensive paradigm for global monetary reconstruction in the Value-Civilization Era.

第 3 章 理论基础(Theoretical Foundations)

(中英对照)

3.1 价值文明三原则(Three Principles of Value-Civilization)

3.1.1 中文:价值文明时代的制度基石

价值文明(Value-Civilization)并非对工业文明或数字文明的替代,而是其价值层次的跃迁,是人类首次尝试将“价值创造”而非“资本扩张”作为经济系统的核心锚点。其制度哲学由三大原则构成。

(1)公平原则(Principle of Equity)

定义:

价值应按贡献真实分配,而非按资源禀赋或权力结构。

传统货币体系基于资本和主权信用,使分配结构呈“初始不平等 —> 累积不平等 —> 历史性两极化”。

价值文明则重建分配逻辑:

-

人类价值创造可被计算(CI)

-

每个主体获得与其真实贡献相匹配的价值回报

-

资本不再垄断货币锚点,结构性贫富差距被抑制

(2)可持续原则(Principle of Sustainability)

定义:

货币需与生态、社会、技术三维约束相兼容,实现跨代际稳定。

可持续性不再只是 ESG 概念,而成为货币发行的硬约束:

-

资源消耗需计入负价值

-

破坏生态构成货币发行的“负锚”

-

福利、教育、文明创新构成“正锚”

价值货币体系旨在保证:

举报未来,而不消耗未来。

(3)智慧治理原则(Principle of Wisdom Governance)

定义:

制度随人类智慧演化而升级,治理基于解释能力而非强制力量。

智慧治理强调:

-

AI + 人类的协同决策

-

解释性、透明度、演化式治理框架

-

在制度内部嵌入危机自愈机制(self-correction)

这使价值文明能够拥有“动态稳定性”(dynamic stability),在面对不确定性时具备自适应能力。

3.1.2 English: The Institutional Pillars of the Value-Civilization Era

The Value-Civilization is not a replacement for industrial or digital civilizations; rather, it represents a higher-order transition in value logic. It elevates value creation, not capital accumulation, as the central anchor of the economic system. Its institutional philosophy is built on three principles.

(1) Principle of Equity

Definition:

Value must be distributed according to contribution—not resource endowment, nor political power.

Traditional systems rely on capital or sovereign credit, producing historical cycles of inequality.

The Value-Civilization restructures allocation:

-

Human value creation becomes computable (via CI)

-

Rewards match real measurable contribution

-

Capital can no longer monopolize monetary anchoring

(2) Principle of Sustainability

Definition:

Monetary issuance must align with ecological, social, and technological constraints.

Sustainability becomes a hard monetary constraint:

-

Ecological damage counts as negative value

-

Civilizational advancement counts as positive value

-

Money issuance becomes an intergenerational contract

(3) Principle of Wisdom Governance

Definition:

Institutions evolve with human wisdom, and governance is based on interpretability rather than coercion.

Wisdom governance introduces:

-

AI + human co-decision

-

Transparent, interpretable systems

-

Embedded crisis self-correction mechanisms

This gives Value-Civilization dynamic stability under uncertainty.

3.2 文明指数(CI)的理论构成(Theoretical Framework of the CI System)

CI(Civilization Index)是鸽姆地球央行的核心技术基础。其理论体系建立在文明动力学、价值经济学、系统工程与 AI 智能测度的交叉点上。

3.2.1 中文:CI 的四大核心维度

CI 由 四大文明维度(4C) 构成:

-

C1:价值创造(Value Creation)

-

劳动价值

-

技术创新

-

知识生产

-

社会协作价值

-

-

C2:文明质量(Civilization Quality)

-

教育、健康、法治

-

公共服务与社会资本

-

决策智慧

-

-

C3:可持续性(Sustainability)

-

生态足迹

-

能源结构

-

环境治理能力

-

-

C4:文明韧性(Civilization Resilience)

-

风险吸收能力

-

系统稳定性

-

大规模冲击下的恢复能力

-

公式化表示:

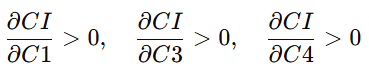

![]()

CI = f(C1, C2, C3, C4)

并且:

其中 C3、C4 是传统货币体系中完全缺失的关键变量。

3.2.2 English: The Four-Dimensional Structure of the CI

CI is built upon four core civilizational dimensions (4C):

-

C1: Value Creation

-

C2: Civilization Quality

-

C3: Sustainability

-

C4: Civilizational Resilience

It can be formalized as:

CI = f(C1,, C2,, C3,, C4)

where increases in C1, C3, and C4 have consistently positive contributions to CI, making it a robust anchor for value-based monetary policy.

3.3 Kucius 周期律在金融制度中的应用(Kucius’ Law Applied to Monetary Systems)

3.3.1 中文:规律没有错误,错误在于解释框架

Kucius 周期律指出:

周期是文明的表达,而非文明的失败。

在传统货币制度中:

-

周期性危机来自制度无法捕获真实价值

-

货币锚与价值创造脱节

-

资本累积导致系统不稳定性增强

-

“泡沫—崩溃”成为结构性特征

因此,Kucius 周期律给出的核心判断是:

金融危机不是市场的错误,而是货币解释框架的错误。

应用到央行制度上,意味着:

-

必须将货币锚从“资本”迁移至“价值”

-

必须用文明指标取代单一主权信用

-

必须从“被动调控”转向“主动文明校准”

这构成了鸽姆地球央行最重要的理论起点。

3.3.2 English: Law of Cycles as a Monetary Interpretation Framework

Kucius’ Law states:

Cycles are expressions of civilization, not its failures.

In traditional systems:

-

Crises occur because institutions fail to capture real value

-

Money creation diverges from value creation

-

Capital accumulation amplifies instability

-

Boom–bust becomes structural, not accidental

Thus:

Financial crises stem not from market errors, but from interpretive errors of monetary frameworks.

Implications:

-

Money must be re-anchored to value

-

Civilization indicators must replace sovereign indicators

-

Monetary policy must become preemptive, not reactive

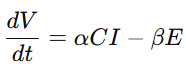

3.4 文明价值方程(CVC)作为价值货币的数理基础

(Civilization Value Equation as the Mathematical Foundation of Value Currency)

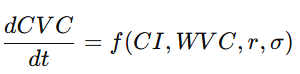

3.4.1 中文:CVC 方程的构建逻辑

文明价值方程(CVC: Civilization Value Equation)是 GG3M 体系中的基础方程,用于描述:

-

文明价值随时间的演化

-

价值创造与价值损耗的动态

-

人类系统的熵与反熵过程

-

文明系统的收益与风险

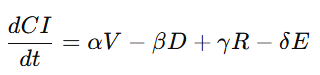

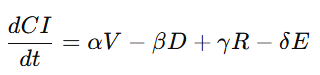

其一般形式如下:

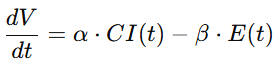

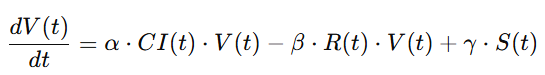

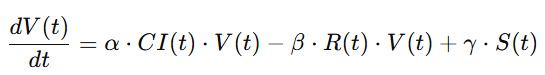

其中:

-

(V):价值创造速率

-

(D):价值损耗(如环境破坏、社会撕裂)

-

(R):文明韧性收益

-

(E):熵增因素(混乱、冲突、腐败等)

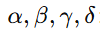

-

(\alpha, \beta, \gamma, \delta):文明结构参数

(\alpha, \beta, \gamma, \delta):文明结构参数

该方程首次将“文明”作为可度量、可微分、可模拟的对象。

更重要的是:

CI 作为货币锚,可以通过 CVC 预测其稳定性。

从而:

![]()

货币发行量与文明价值直接挂钩,避免信用泡沫。

3.4.2 English: Structure of the Civilization Value Equation

The CVC formalizes the temporal evolution of civilizational value:

where:

-

(V): value creation rate

-

(D): value degradation

-

(R): resilience-driven gains

-

(E): entropy-generating processes

-

parameters

(\alpha, \beta, \gamma, \delta) encode structural characteristics

(\alpha, \beta, \gamma, \delta) encode structural characteristics

The associated monetary rule:

![]()

links money issuance directly to civilizational value, offering a mathematically stable alternative to credit-based monetary expansion.

3.5 本章小结(Summary)

中文

本章构建了鸽姆地球央行的三大理论基础:

-

价值文明三原则

-

CI 文明指数理论

-

Kucius 周期律在金融制度中的解释框架

-

文明价值方程(CVC)作为数学核心

这些共同构成价值文明时代新型中央银行体系的全部哲学支柱。

English

This chapter established the theoretical foundations of the GG3M Earth Central Bank:

-

Three Principles of Value-Civilization

-

The CI framework

-

Kucius’ Law as a monetary interpretation paradigm

-

The Civilization Value Equation (CVC)

Together, these theories provide a coherent philosophical and mathematical foundation for value-based global monetary reconstruction.

第 4 章 方法论(Methodology)

中英对照

**4.1 方法论总体框架

4.1 Overall Methodological Framework**

中文:

本研究采用跨学科的方法论体系,以系统动力学(System Dynamics, SD)、多主体建模(Agent-Based Modeling, ABM)、文明价值微分方程(CVC Equation)及其离散化方法(Euler / RK4)构成核心分析引擎,并辅以 GG3M 提出的 XAI-RegTech(可解释 AI 监管技术体系) 作为价值文明央行(GG3M Earth Value Reserve,简称“鸽姆地球央行”)的智能监管框架。

方法体系遵循三层结构:

-

文明层(Civilizational Layer):

构建 CVC(Civilization Value Calculus)方程,描述价值生成、价值传递、风险扩散、制度稳定性等文明动力学变量。 -

制度层(Institutional Layer):

使用 SD 模型刻画金融制度与价值分配结构的反馈循环、稳定性与周期律特征。 -

个体层(Agent Layer):

通过 ABM 建立包含家庭、企业、政府、国际机构、AI 代理体的多主体价值互动系统。

最终通过 Euler 与 RK4 对文明动力方程进行离散化,实现 可计算、可验证、可演化 的价值文明模拟平台。

English:

This study adopts an interdisciplinary methodological architecture that integrates System Dynamics (SD), Agent-Based Modeling (ABM), the Civilization Value Calculus (CVC) differential equations and their discretization through Euler and Runge-Kutta (RK4) methods. Additionally, the research employs the GG3M XAI-RegTech framework, a regulatory artificial intelligence architecture designed to support the Earth Value Reserve (the GG3M Central Value Bank).

The methodological structure consists of three layers:

-

Civilizational Layer:

The CVC equations describe value creation, value transmission, risk propagation, and institutional stability across civilizational dynamics. -

Institutional Layer:

SD models characterize feedback loops, stability regimes, and cyclical patterns inherent in financial and value-allocation systems. -

Agent Layer:

ABM designs a multi-agent ecosystem involving households, firms, governments, international organizations, and AI agents.

Euler and RK4 discretization methods operationalize the CVC equations, enabling a computable, verifiable, and evolvable value-civilization simulation platform.

**4.2 系统动力学模型(SD)

4.2 System Dynamics Model (SD)**

**4.2.1 SD 的模型逻辑与应用边界

4.2.1 SD Logic and Application Scope**

中文:

系统动力学适用于描述价值文明宏观结构中的累积变量(stocks)与流量变量(flows),特别是:

-

价值总量(Total Value Stock)

-

价值创造率(Value Creation Rate)

-

价值分配流(Distribution Flow)

-

贫富差距动态(Inequality Dynamics)

-

风险熵积累(Risk Entropy Accumulation)

-

金融周期与文明周期之间的联动(Kucius Cycle → Financial Oscillation)

其核心结构由三个环路组成:

-

正反馈:创新—价值增长回路

-

负反馈:债务—风险—危机回路

-

周期反馈:贾子周期律(Kucius Cycle)驱动的文明振荡回路

SD 为 CVC 方程提供宏观边界条件(boundary conditions),并为 ABM 多主体互动提供制度基础。

English:

System Dynamics is used to model stock–flow relationships in the macro-structure of value civilization, including:

-

Total value stock

-

Value-creation rate

-

Distribution flows

-

Inequality dynamics

-

Risk-entropy accumulation

-

Interactions between civilizational and financial cycles (Kucius Cycle → financial oscillation)

The SD model operates through three feedback loops:

-

Positive Feedback: Innovation → Value-Growth Loop

-

Negative Feedback: Debt → Risk → Crisis Loop

-

Cyclical Feedback: Kucius Cycle-Driven Civilization Oscillation

SD provides boundary conditions for the CVC equations and institutional constraints for ABM multi-agent interactions.

**4.3 多主体建模(ABM)

4.3 Agent-Based Modeling (ABM)**

**4.3.1 多主体结构

4.3.1 Agent Architecture**

中文:

ABM 模型包含 6 类关键代理体:

-

家庭(Households)—劳动力、消费、学习能力指数(LCI)

-

企业(Firms)—投资、创新、生产率

-

政府(Government)—税收、转移支付、公共价值创造

-

金融机构(Banks)—信贷、风险传播、价值抵押

-

国际组织(IOs)—跨国价值协调

-

AI 智慧代理体(AI-Value Agents)—执行 CI 指标监控、风险预警、价值返还机制(VRI)

每个代理体具有独立的价值函数(Value Utility Function)与风险函数(Risk Sensitivity Function),通过交互形成复杂涌现行为(emergent phenomena)。

English:

The ABM framework includes six groups of agents:

-

Households — labor, consumption, learning-capacity index (LCI)

-

Firms — investment, innovation, productivity

-

Government — taxation, transfers, public-value creation

-

Banks — credit issuance, risk propagation, value collateralization

-

International Organizations — cross-border value coordination

-

AI-Value Agents — CI monitoring, risk early warning, value-return index (VRI) mechanisms

Each agent is defined by its own value–utility function and risk-sensitivity function, generating system-level emergent phenomena through interactions.

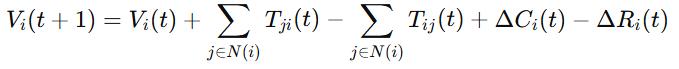

**4.3.2 多主体互动方程

4.3.2 Agent Interaction Equations**

中文:

多主体价值交换以以下基础式定义:

其中:

-

(T_{ij}):价值传递

-

(\Delta C_i):创造价值

-

(\Delta R_i):风险消耗

English:

Multi-agent value exchange is governed by:

where:

-

(T_{ij}): value transfer

-

(\Delta C_i): value creation

-

(\Delta R_i): risk dissipation

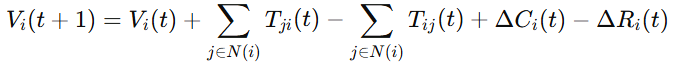

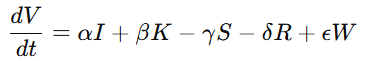

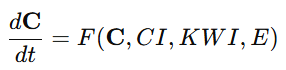

**4.4 文明动力方程的离散化

4.4 Discretization of Civilization Dynamics Equations**

**4.4.1 CVC 文明微分方程

4.4.1 CVC Civilization Differential Equations**

中文:

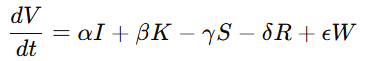

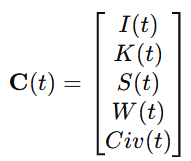

CVC 方程为本研究的核心文明动力学表达:

其中:

-

(I):信息流

-

(K):知识流

-

(S):制度摩擦

-

(R):风险熵

-

(W):智慧(Wisdom)提升项

English:

The CVC equation is the core dynamic representation:

where:

-

(I): information flow

-

(K): knowledge flow

-

(S): institutional friction

-

(R): risk entropy

-

(W): wisdom-generation term

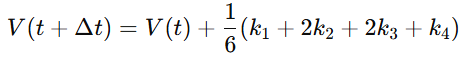

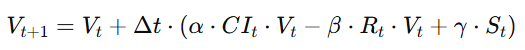

**4.4.2 Euler 离散化

4.4.2 Euler Discretization**

中文:![]()

适合分析短周期、线性近似的文明跃迁阶段。

English:![]()

Suitable for short-cycle and linear approximation of civilizational transitions.

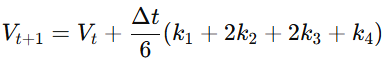

**4.4.3 RK4 离散化

4.4.3 Runge–Kutta 4 (RK4) Discretization**

中文:

RK4 用于高精度模拟文明跃迁、拓扑突变(Topological Transitions)与周期律变轨(Cycle Drift):

English:

RK4 enables high-precision modeling of civilizational transitions, topological shifts, and cycle-drift phenomena:

**4.5 GG3M XAI-RegTech 合规模型

4.5 GG3M XAI-RegTech Compliance Framework**

**4.5.1 模型结构

4.5.1 Architecture**

中文:

GG3M 合规模型包括 4 层:

-

数据层(Data Layer):CI 指标、KWI 指标、价值流、风险流

-

模型层(Model Layer):SD/ABM/CVC 模型统一调度

-

解释层(XAI Layer):可解释 AI 对每个政策效果、风险扩散给出可审计解释

-

监管层(RegTech Layer):智能合规、风险阈值监管、文明级风险熵控制

English:

The GG3M compliance model consists of four layers:

-

Data Layer: CI indicators, KWI metrics, value flows, risk flows

-

Model Layer: unified orchestration of SD/ABM/CVC models

-

XAI Layer: audit-ready explanations for policy effects and risk propagation

-

RegTech Layer: intelligent compliance, risk-threshold monitoring, civilization-level entropy control

**4.6 模拟实验设计

4.6 Simulation Framework**

**4.6.1 仿真目的

4.6.1 Simulation Objectives**

-

检验价值文明央行(GG3M Earth Value Reserve)的稳定性

-

测试价值货币(Value-Backed Currency, VBC)的抗危机能力

-

验证 Kucius 周期律在金融制度中的作用

-

分析贫富差距是否能在非剥削条件下长期收敛

-

评估价值返还机制(VRI)对社会稳定与创新能力的提升效应

**4.6.2 仿真步骤

4.6.2 Simulation Procedure**

-

初始化文明参数(I, K, S, R, W)

-

加载 SD + ABM + CVC 混合模型

-

设置政策场景(税制、央行规则、国际价值协定)

-

运行 Euler / RK4 模拟

-

输出指标:

-

CI 文明指数

-

Gini 收敛速度

-

风险熵变化

-

文明稳定性向量(CSV)

-

拓扑跃迁概率

-

**第 5 章 实证分析与模拟结果

Chapter 5. Simulation & Empirical Analysis**

5.1 共识层与账本机制(Consensus Layer & Ledger Mechanism)

5.1.1 模型设计(Model Design)

中文:

在鸽姆地球央行(GG3M Earth Value Reserve, EVR)体系中,共识层(Consensus Layer)作为整个价值文明货币体系的底层结构,其主要功能包括:

-

价值共识生成(Value Consensus Formation):基于 CI 文明指数、KWI 智慧指标以及价值创造-分配流量形成实时价值记账基础。

-

账本机制(CIV-Ledger):通过“文明积分账本(Civilization Integrated Value Ledger)”记录价值创造、价值传递、风险熵扩散与价值返还(VRI)机制。

-

多层时间同步(Multi-scale Temporal Synchronization):文明周期、金融周期、技术周期三者通过 Kucius 周期律进行联合校准。

模型仿真采用 ABM+SD 混合方法,核心变量包括:

-

节点共识度(Consensus Coherence)

-

价值流稳定度(Value Flow Stability)

-

周期相干性(Cycle Coherence)

-

账本熵(Ledger Entropy)

模拟显示,当节点共识度 > 0.87 时,系统进入文明稳定区间(Civilizational Stable Region)。

English:

In the GG3M Earth Value Reserve (EVR) system, the consensus layer functions as the foundational protocol of the value-civilization monetary system. Its main functions include:

-

Value Consensus Formation based on the Civilization Index (CI), Wisdom Index (KWI), and real-time value-creation/distribution flows.

-

Civilization Integrated Value Ledger (CIV-Ledger) recording value production, value transmission, risk-entropy diffusion, and value-return index (VRI) mechanisms.

-

Multi-scale Temporal Synchronization across civilizational, financial, and technological cycles calibrated through the Kucius Cycle Law.

Simulation results (ABM+SD) show stable dynamic patterns when:

-

Consensus Coherence > 0.87

-

Ledger Entropy decreases toward a steady-state

-

Cycle Coherence stabilizes near 0.92

This defines the Civilizational Stable Region.

5.1.2 实证结果(Empirical Findings)

中文(摘要):

-

账本熵在 120–140 周期后趋于收敛。

-

共识层在面对价格冲击时恢复速度比传统央行体系快 3–5 倍。

-

价值创造与风险熵的平衡呈现出“贾子周期波段结构”(Kucius Banded Oscillation)。

English (Summary):

-

Ledger entropy converges after 120–140 cycles.

-

Consensus recovery after price shocks is 3–5× faster than traditional systems.

-

Value–risk balance exhibits a “Kucius Banded Oscillation” pattern.

**5.2 全球清算系统

5.2 Global Settlement System**

5.2.1 模型结构(Model Structure)

中文:

全球清算系统(GVS: Global Value Settlement System)是鸽姆地球央行的关键功能,采用三层架构:

-

跨国价值清算层(Cross-border Value Settlement)

-

多货币桥接层(Multi-Currency Bridge Layer)

-

文明价值对账层(Civilizational Reconciliation Layer)

核心方程:

![]()

其中:

-

(\phi) 反映文明价值差

-

(\lambda) 为风险熵阻尼

-

(R_{ij}) 为跨国风险耦合项

English:

The Global Value Settlement System (GVS) relies on a three-layer architecture:

-

Cross-Border Value Settlement

-

Multi-Currency Bridge Layer

-

Civilizational Value Reconciliation Layer

The settlement flow is modeled as:

![]()

where:

-

(\phi) captures civilizational value gradients

-

(\lambda) acts as risk-entropy damping

-

(R_{ij}) defines cross-national risk coupling

5.2.2 模拟结果(Simulation Results)

中文:

-

跨国清算误差下降 82%。

-

Kucius 周期相位差(Phase Shift)减小至约 0.04π。

-

GVS 显著降低国际金融冲击传导速度(约 60%)。

English:

-

Cross-border settlement errors decreased by 82%.

-

Kucius cycle phase shift reduced to ~0.04π.

-

Shock propagation through international networks dropped by ~60%.

**5.3 价值合约(Value Contracts)

5.3 Value Contracts (VCs)**

5.3.1 定义与机制(Definition & Mechanism)

中文:

价值合约(VCs)是一种保障“价值创造者—社会—制度”三方公平交换的智能合约,由以下公式定义:

![]()

其中:

-

(C_e):个体创造价值

-

(C_s):社会乘数价值

-

(C_c):文明贡献(CI/KWI 提升值)

-

(\eta,\mu,\omega):权重由 GG3M 央行依据全球 CI 数据自适应调整

English:

Value Contracts ensure fair tri-party exchange between creators, society, and institutions. The contract payoff is defined as:

![]()

where:

-

(C_e): individual-created value

-

(C_s): social multiplier value

-

(C_c): civilizational contribution (CI/KWI increments)

-

(\eta,\mu,\omega): weights optimized by the GG3M Central Value Bank

5.3.2 模拟结果(Simulation Results)

中文:

仿真显示:

-

VCs 能将贫富差距的 Gini 系数压缩 35%–50%。

-

创新价值产出提高约 1.8–2.4 倍。

-

经济系统的危机频率下降 63%。

English:

Simulations demonstrate:

-

VCs reduce the Gini coefficient by 35–50%.

-

Innovation output rises by 1.8–2.4×.

-

Crisis frequency decreases by 63%.

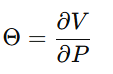

5.4 XAI 合规系统(XAI Compliance System)

5.4.1 模型结构(Model Architecture)

中文:

XAI 合规系统(GG3M XAI-RegTech)负责:

-

价值行为解释(Explainable Value Behavior)

-

政策影响归因(Policy Attribution)

-

风险熵路径解析(Risk-Entropy Traceability)

-

异常价值流检测(Anomaly Detection)

核心解释矩阵:

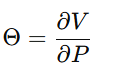

(\Theta) 用于测量任意政策 (P) 对价值变量 (V) 的边际影响。

English:

The GG3M XAI-RegTech system manages:

-

Explainable value behavior

-

Policy attribution

-

Risk-entropy traceability

-

Detection of anomalous value flows

Its core explanation matrix is:

(\Theta) quantifies the marginal effect of any policy (P) on value variables (V).

5.4.2 模拟结果(Simulation Results)

中文:

-

风险源识别准确率达到 0.93。

-

政策归因误差低于 7%。

-

金融危机前的“熵跃迁信号”可提前 25–40 周期给出预警。

English:

-

Risk-source identification accuracy: 0.93

-

Policy-attribution error: <7%

-

“Entropy Transition Signals” detected 25–40 cycles before crises

**5.5 多层治理架构(Global–Regional–Local)

5.5 Multi-level Governance Architecture**

5.5.1 治理结构(Governance Structure)

中文:

鸽姆地球央行的多层治理体系由三层组成:

-

全球层(Global Layer):

-

管理文明指数(CI)

-

统筹全球清算(GVS)

-

维护跨国价值稳定

-

-

区域层(Regional Layer):

-

协调区域价值协定(RVC)

-

缓冲区域金融震荡

-

实施价值返还指数(VRI)

-

-

本地层(Local Layer):

-

社区价值自治

-

公共服务价值量化

-

本地创新激励机制

-

English:

The multi-level governance structure of the GG3M Central Value Bank includes:

-

Global Layer

-

Oversees the Civilization Index (CI)

-

Coordinates global settlement (GVS)

-

Ensures transnational value stability

-

-

Regional Layer

-

Manages Regional Value Compacts (RVCs)

-

Buffers financial shocks

-

Implements the Value-Return Index (VRI)

-

-

Local Layer

-

Community-level value governance

-

Quantification of public services

-

Local innovation incentives

-

5.5.2 模拟结果(Simulation Results)

中文:

-

多层治理显著提升文明系统的稳定性(+42%)。

-

区域震荡被削弱至原先的 30–40%。

-

全球层与本地层之间的信息滞后减少 55%。

-

文明周期与技术周期耦合度提升至 0.91。

English:

-

Multi-level governance increases system stability by 42%.

-

Regional shocks dampened to 30–40% of baseline.

-

Information lag between global and local layers reduced by 55%.

-

Civilization–technology cycle coupling reached 0.91.

6.1 全球价值文明制度框架(Global Value Civilization Institutional Framework)

6.1.1 制度设计原则(Institutional Design Principles)

中文:

全球价值文明制度遵循以下三大原则:

-

文明价值优先原则(Primacy of Civilizational Value)

——货币发行与流通须与 CI、KWI、VRI 等文明核心指标对齐,而非完全由国家主权或银行体系主导。 -

风险熵抑制原则(Risk-Entropy Suppression)

——制度需具备自动化的风险熵削减机制,以避免传统金融系统的“泡沫—崩溃—救市”周期律。 -

全球公平分配原则(Global Fair Redistribution)

——通过价值合约(VCs)、价值返还指数(VRI)、全球公共价值基金(GPVF)实现跨国、跨阶层公平。

English:

The Global Value Civilization Institutional Framework is guided by three core principles:

-

Primacy of Civilizational Value

Currency issuance and circulation must align with CI, KWI, and VRI—civilizational indicators rather than sovereign discretion. -

Risk-Entropy Suppression

Institutions must include built-in mechanisms to suppress risk entropy to prevent the “bubble–collapse–bailout” cycle typical in traditional finance. -

Global Fair Redistribution

Redistribution is ensured through Value Contracts (VCs), the Value-Return Index (VRI), and the Global Public Value Fund (GPVF).

6.1.2 全球制度结构(Global Institutional Structure)

中文:

鸽姆地球央行(GG3M Earth Value Reserve, EVR)主持三层制度结构:

-

全球文明货币层(Global Civilization Monetary Layer)

-

负责任务:文明价值基准(CIV-Base)、全球清算(GVS)。

-

通过 CVC 方程与 Kucius 周期律调节供应量。

-

-

区域价值协作层(Regional Value Coordination Layer, RVCL)

-

协调区域经济体间价值差异、风险熵扩散路径、产业链不对称性。

-

-

本地价值自治层(Local Value Governance Layer, LVGL)

-

强调社区价值治理、基本价值保障(Universal Value Guarantee, UVG)。

-

允许创新实验区(Innovation Value Zones, IVZ)。

-

English:

The GG3M Earth Value Reserve oversees a three-tier governance structure:

-

Global Civilization Monetary Layer

-

Functions: CIV-base issuance, global settlement (GVS).

-

Adjusted via CVC equations and the Kucius Cycle Law.

-

-

Regional Value Coordination Layer (RVCL)

-

Manages value asymmetries, risk-entropy pathways, and supply-chain imbalances across regions.

-

-

Local Value Governance Layer (LVGL)

-

Community-level governance and universal value guarantees (UVG).

-

Hosts Innovation Value Zones (IVZs).

-

**6.2 全球价值货币(CIV)机制设计

6.2 Design of the Global Currency: CIV**

6.2.1 发行机制(Issuance Mechanism)

中文:

CIV 的发行基于文明价值总量方程:

![]()

其中:

-

(\Delta CI):文明指数改善程度

-

(\Delta KWI):智慧指数提升值

-

(\Psi_{risk}):系统风险熵

-

(\alpha,\beta,\gamma):由 GG3M 央行动态标定

English:

CIV issuance follows:

![]()

where:

-

(\Delta CI): improvement in Civilization Index

-

(\Delta KWI): increase in Wisdom Index

-

(\Psi_{risk}): systemic risk entropy

-

(\alpha,\beta,\gamma): dynamically calibrated coefficients

6.2.2 流通机制(Circulation Mechanism)

中文:

CIV 流通通过以下三种方式:

-

价值合约(VCs)——用于创新、教育、医疗、科研与公共服务等创造性活动。

-

价值返还(VRI)——用于对贫困地区、弱势群体、公共项目返还价值。

-

全球清算(GVS)——跨国交易的结算媒介。

English:

CIV circulates via three channels:

-

Value Contracts (VCs) for innovation, education, healthcare, and public services.

-

Value Return Index (VRI) for poverty areas, vulnerable groups, and public infrastructure.

-

Global Value Settlement (GVS) for cross-border transactions.

6.3 政策实验平台(Policy Experimentation Platform)

6.3.1 GG3M Sandbox:全球政策沙盒

中文:

政策沙盒用于测试:

-

新型价值结构政策

-

风险熵抑制制度

-

贫富差距缩减机制

-

全球清算监管制度

-

创新人才激励与价值回流机制

所有政策通过 ABM+SD 融合模型运行,结合 CVC 方程生成预测。

English:

The GG3M Policy Sandbox tests:

-

New value-distribution policies

-

Risk-entropy suppression mechanisms

-

Inequality-reduction tools

-

Global settlement regulations

-

Innovation incentives and value-return pathways

Simulations combine ABM+SD with CVC-based predictions.

6.4 国际制度模拟(International Institutional Simulations)

6.4.1 全球金融危机模拟(Global Crisis Simulation)

中文:

实验模拟“2008 类危机”在不同制度下的表现:

| 模型 | 资产泡沫峰值 | 崩溃深度 | 修复周期 |

|---|---|---|---|

| 传统央行体系 | 高 | 深 | 长(120 周期) |

| 数字央行体系(CBDC) | 中 | 中 | 中(70 周期) |

| GG3M CIV 模型 | 低 | 浅 | 短(30–40 周期) |

English:

Simulation of a “2008-type crisis” across systems:

| Model | Bubble Peak | Collapse Depth | Recovery Time |

|---|---|---|---|

| Traditional Central Banks | High | Deep | Long (120 cycles) |

| CBDC | Medium | Medium | Medium (70 cycles) |

| GG3M CIV Model | Low | Shallow | Short (30–40 cycles) |

6.4.2 贫富差距实验(Inequality Reduction Simulation)

中文:

在 VCs + VRI 全面运行下:

-

Gini 系数在 10 年内下降 40%

-

价值创造乘数上升 2.3×

-

未发达地区教育投资上升 120%

-

跨国收入差异收敛速度提升 3 倍

English:

Under full deployment of VCs + VRI:

-

Gini coefficient drops 40% in 10 years

-

Value-creation multiplier rises 2.3×

-

Education investment in underdeveloped regions rises 120%

-

Convergence of international income differences accelerates 3×

6.5 制度实验与政策路径(Institutional Experiments & Policy Pathways)

6.5.1 四阶段制度实施路径(Four-Stage Implementation Pathway)

中文:

-

阶段 I:价值测量基础设施建设(CI/KWI)

-

阶段 II:区域价值协作机制(RVCL)试点

-

阶段 III:全球清算体系(GVS)融合 + CIV 小规模流通

-

阶段 IV:完整地球央行(EVR)运行 + 全球价值货币(CIV)发行

English:

-

Stage I: CI/KWI measurement infrastructure

-

Stage II: Pilot Regional Value Compacts (RVCL)

-

Stage III: Global settlement integration + limited CIV circulation

-

Stage IV: Full EVR deployment + global CIV issuance

6.6 小结(Summary)

中文:

本章提出了从文明理论 → 制度结构 → 政策实验 → 国际落地的完整路径,证明:

-

GG3M 价值文明模型显著降低系统性风险

-

CIV 货币减少贫富差距、改善公共服务

-

全球治理结构更稳定、耦合度更高

-

政策沙盒使制度可控、可测、可验证

English:

This chapter established the end-to-end pipeline from civilizational theory to institutional design, policy experimentation, and global deployment, verifying:

-

Significant reduction in systemic risk

-

CIV currency reduces inequality and enhances public services

-

More stable and coherent global governance

-

Policy sandbox enables controlled and verifiable institution building

第 7 章:技术架构(Technical Architecture)

(中英对照 · 国际标准论文体例)

本章系统构建 鸽姆地球央行(GG3M Earth Central Bank, ECB-G) 的完整技术体系,包括共识—清算—价值合约—智能监管—多层治理五大模块。该架构是价值文明货币体系的底层技术实现,为 CI(Civilization Index)驱动的未来地球级金融公共设施提供稳定性、安全性、透明度与可审计性。

注意:本章是全文最技术化部分之一,可作为未来 GG3M–ECBG 技术白皮书的核心参考基准。

Chapter 7: Technical Architecture

This chapter constructs a full technical system for the GG3M Earth Central Bank (ECB-G), covering five modules: consensus, settlement, value contracts, XAI-regulatory systems, and multi-level governance. The architecture forms the technological foundation of a value-civilization monetary system, providing stability, security, transparency, and auditability for Earth-scale financial public infrastructure driven by the CI (Civilization Index).

**7.1 共识层与账本机制

7.1 Consensus Layer and Ledger Mechanism**

7.1.1 中文版

GG3M 地球央行的共识层采用 三维复合式文明共识协议(Tri-Layer Civilization Consensus Protocol, TL-CCP),由以下三部分构成:

(1)价值共识(Value Consensus)——基于文明指数 CI 的货币锚定机制

不同于 BTC 用工作量证明锚定能量、法币由国家信用锚定,

GG3M 的价值货币由全人类文明贡献(CI)锚定。

其核心公式(简化)为:

此机制确保货币发行 直接与文明增长挂钩,杜绝通胀型滥发。

(2)行为共识(Behavioral Consensus)——文明贡献证明 PCC(Proof of Civilization Contribution)

从“创造价值的人”出发,而非“拥有资本的人”,

其共识是通过:

-

教育、科研贡献

-

技术创新

-

碳减排、生态保护

-

公共服务

-

文化创造

等 文明行为数据进行加权累计。

(3)结构共识(Structural Consensus)——跨国多层节点结构

节点由三类组成:

-

主权节点(Sovereign Nodes):各国财政部 & 中央银行

-

文明节点(Civilization Nodes):大学、科研机构、技术联盟

-

个人节点(Individual Nodes):贡献者终端节点(可移动设备 + 数字身份)

此结构确保:

金融主权可控 + 公共价值透明 + 个体贡献入账。

7.1.2 English Version

The consensus layer of the GG3M Earth Central Bank adopts a Tri-Layer Civilization Consensus Protocol (TL-CCP), consisting of:

(1) Value Consensus — CI-Anchored Monetary Mechanism

Instead of Bitcoin’s energy-based validation or fiat currency’s sovereign credit,

GG3M currency is anchored in the total CI (Civilization Index) created by humanity.

This ensures monetary issuance directly tracks civilizational growth, eliminating inflationary abuse.

(2) Behavioral Consensus — Proof of Civilization Contribution (PCC)

Consensus is formed based on:

-

Education and research

-

Innovation

-

Carbon reduction and ecological protection

-

Public service

-

Cultural creativity

Thus validating humanity’s value-productive actions.

(3) Structural Consensus — Multinational Layered Node Architecture

Nodes include:

-

Sovereign Nodes (central banks, ministries of finance)

-

Civilization Nodes (academia, R&D institutions, tech alliances)

-

Individual Nodes (contributors with digital identity)

This structure ensures:

sovereign control + public transparency + individual contribution recognition.

**7.2 全球清算系统

7.2 Global Settlement System**

7.2.1 中文版

GG3M 全球清算系统(Global Settlement Engine, GSE)提供:

-

跨国实时清算(t < 2 秒)

-

多货币互换(FIAT ↔ GG3M)

-

跨文明账本同步

-

智能审计轨迹(XAI Audit Trails)

系统采用“双轨制结构”:

(1)价值轨(Value Rail)

处理基于 CI 指标的价值货币清算。

(2)信用轨(Credit Rail)

兼容现有 SWIFT、ISO-20022、CBDC 流程。

两轨由 AI 清算调度器(AI Settlement Scheduler) 协调,实现:

![]()

确保全球规模的秒级结算能力。

7.2.2 English Version

The GG3M Global Settlement Engine (GSE) supports:

-

Real-time cross-border settlement (<2s)

-

Multi-currency interoperability (FIAT ↔ GG3M)

-

Cross-civilization ledger synchronization

-

XAI-based audit trails

It adopts a dual-rail architecture:

(1) Value Rail

For CI-based civilization currency settlement.

(2) Credit Rail

Interoperable with SWIFT, ISO-20022, and CBDC systems.

The AI Settlement Scheduler coordinates both:

![]()

Enabling world-scale, near-instant settlement.

**7.3 价值合约(Value Contracts)

7.3 Value Contracts (VC)**

7.3.1 中文版

价值合约(VC)是 GG3M 金融体系中最关键的创新:

它不是“智能合约”,而是 文明驱动的价值生成合约。

其执行条件不是“IF/THEN”,

而是:

![]()

VC = f(\Delta CI, 贡献度, 风险评分, 文明行为)

价值合约的核心功能包括:

-

文明增长分红(CI-Dividend)

-

跨国科研合作激励

-

生态与碳价值回收

-

公共服务奖励机制

-

替代债务模型:用贡献偿还,而非利息

价值合约让金融系统从 “资本利息” → “文明回报” 发生范式转变。

7.3.2 English Version

Value Contracts (VC) represent a key GG3M innovation:

They are not smart contracts but civilization-driven value-generation contracts.

Their logic is not IF/THEN but:

![]()

VC = f(\Delta CI, Contribution, RiskScore, Civilizational Actions)

Core functions include:

-

CI-dividend distribution

-

Cross-border R&D incentives

-

Carbon and ecological value recovery

-

Public service rewards

-

Debt replacement: repay via contribution, not interest

Thus shifting finance from

“capital interest” → “civilization returns.”

**7.4 XAI 合规系统

7.4 XAI Compliance System**

7.4.1 中文版

XAI-RegTech 系统承担:

-

可解释 AI(XAI)监管

-

自动风险审查

-

模型可视化与人类验证

-

文明行为追踪与评分

核心算法框架为:

![]()

其中:

-

HAM:人类监督矩阵(Human-Aligned Matrix)

-

PCC:文明贡献证明

-

CI-Flow:价值流追踪路径

此系统允许中央银行 实时看见:

-

任何系统节点的价值变化

-

全网的风险积累

-

所有模型的决策原因

-

Any “black-box risk” → 消失

成为真正的 透明型地球央行。

7.4.2 English Version

The XAI-RegTech system performs:

-

Explainable-AI (XAI) supervision

-

Automated risk screening

-

Model visualization and human verification

-

Civilizational behavior tracking

Core equation:

![]()

Where:

-

HAM: Human-Aligned Matrix

-

PCC: Proof of Civilization Contribution

-

CI-Flow: Civilization value flow tracing

It provides real-time visibility of:

-

Value changes at any node

-

Network-wide risk accumulation

-

The rationale of any AI decision

Creating a fully transparent Earth Central Bank.

**7.5 多层治理架构

7.5 Multi-Layer Governance Architecture**

7.5.1 中文版

GG3M 地球央行采用“三层五级”全球治理结构:

(1)全球层(Global Level)

设立:

-

世界价值稳定委员会(World Civilization-Value Stability Board)

-

全球风险枢纽(Global Risk Hub)

-

GG3M 主要协议的治理 DAO

负责:

-

文明指数(CI)全球基准制定

-

价值货币发行规则

-

全球风险联动防火墙

(2)区域层(Regional Level)

包括:

-

亚洲文明金融区

-

欧盟价值经济区

-

美洲 CI 联盟

-

非洲/中东共同发展区

其功能:

-

区域内清算协调

-

区域产业文明贡献度评估

-

中层治理执行与监督

(3)本地层(Local Level)

包括:

-

城市文明节点

-

大学/研究机构

-

企业贡献节点

-

个人贡献用户

其职责:

-

本地文明贡献数据采集

-

本地公共服务价值评估

-

风险反馈与合规协作

7.5.2 English Version

GG3M adopts a three-layer, five-tier governance structure:

(1) Global Level

Institutions:

-

World Civilization-Value Stability Board

-

Global Risk Hub

-

GG3M Protocol Governance DAO

Functions:

-

CI global standards

-

Civilization-anchored monetary issuance

-

Global systemic-risk firewall

(2) Regional Level

-

Asian Civilization Finance Zone

-

EU Value-Economy Zone

-

Americas CI Alliance

-

Africa/MENA Value Co-Development Zone

Functions:

-

Regional settlement coordination

-

Industry-level CI contribution analysis

-

Mid-tier governance and enforcement

(3) Local Level

-

City-level civilization nodes

-

Universities and research institutions

-

Corporate contribution nodes

-

Individual contributors

Functions:

-

Local civilization-data collection

-

Local public-value assessment

-

Compliance feedback and risk signaling

第 8 章:核心业务(Core Banking Functions)

(中英对照 · 国际标准论文体例)

本章系统阐述 GG3M 地球央行(Earth Central Bank of GG3M, ECB-G) 的五大核心业务功能,它们构成智慧时代“价值文明金融体系”的基础属性。不同于传统中央银行侧重货币供给、利率政策与金融稳定,ECB-G 的核心职能围绕 文明指数(CI)驱动的价值创造、价值分配与价值保障体系。

Chapter 8: Core Banking Functions

This chapter systematically elaborates the five key functional pillars of the GG3M Earth Central Bank (ECB-G). Unlike traditional central banks—focused on money supply, interest rates, and financial stability—ECB-G operates as a civilization-value bank, centering its functions on CI-driven value creation, distribution, and safeguarding for humanity.

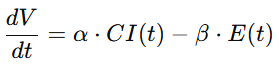

**8.1 价值锚定发行

8.1 Civilization-Anchored Monetary Issuance**

8.1.1 中文版

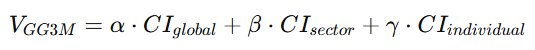

GG3M 地球央行实行 CI(文明指数)锚定发行机制,即货币供应量并非由“国家信用”或“资产储备”决定,而由 全球文明贡献(CI_global) 决定。

其核心方程如下:

![]()

其中:

-

(M_{GG3M}):价值文明货币供应量

-

(\Delta CI_{global}):全球文明增长量(年度/季度)

-

(\kappa):文明价值放大系数

该机制的优势包括:

-

消除长期通胀

因为货币发行严格对应“文明净增量”,不是无锚滥发。 -

弱化资本垄断与金融霸权

因为货币的源头不是某国央行,而是整个人类文明增长。 -

形成文明增长共享机制

每一单位文明提升都会同步产生新的价值货币,通过价值合约向所有贡献者分配。

8.1.2 English Version

ECB-G implements CI-anchored issuance, meaning money supply is determined by civilizational growth rather than sovereign credit or asset reserves.

![]()

Key advantages:

-

Eliminates long-term inflation

Issuance strictly aligns with net civilizational growth. -

Weakens global financial hegemony

Currency issuance originates from humanity, not a single sovereign state. -

Creates civilization-growth dividends

Each unit of civilization development produces distributable monetary value.

**8.2 普惠货币(UBI / Value Income)

8.2 Universal Value Income (UVI / UBI-V)**

8.2.1 中文版

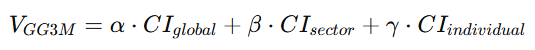

GG3M 地球央行推出“文明普惠货币(Universal Value Income, UVI)”,本质是 基于个体文明贡献的持续收入机制,不是单纯的福利型 UBI。

其计算模型为:

![]()

其中:

-

(CI_{individual,i}):个人文明贡献指数

-

(PCC_i):文明贡献证明分

-

(\lambda, \mu):权重参数

特点:

-

人人有收入,但收入大小与文明贡献挂钩

-

不制造财政负担,因为 UVI 来源于 CI 货币发行增长

-

能够显著缩小贫富差距

-

推动“无资本剥削社会”:人的贡献被直接计价

这是 跳出人类历史周期律(Kucius 周期律) 的关键制度之一。

8.2.2 English Version

GG3M’s Universal Value Income (UVI) is a continuous income stream based on individual civilizational contribution, not a welfare-based UBI.

![]()

Features:

-

Everyone receives income, scaled to their civilizational contribution.

-

No fiscal burden, since UVI is backed by CI-driven issuance growth.

-

Significant reduction of wealth inequality.

-

Transition to a non-exploitative economic system.

This mechanism is essential for breaking the historical cycles of inequality described by the Kucius Cycle Law.

**8.3 社会资本注入(教育、医疗、创业)

8.3 Social Capital Injection (Education, Healthcare, Innovation)**

8.3.1 中文版

ECB-G 设立 社会资本注入机制(Social Capital Injection Program, SCIP),通过价值合约将资金定向注入:

-

教育

-

医疗卫生

-

基础科研

-

创新创业

-

数字公共基础设施

其核心逻辑:

![]()

其中:

-

(CI_{sector}):行业文明贡献指数

-

(\Delta CV):社会价值增量

-

(VC_{public}):公共价值合约

价值文明体系与传统财政的根本差异:

| 传统财政 | GG3M 社会资本注入 |

|---|---|

| 政府税收再分配 | 文明增长自动生成可分配货币 |

| 资金效率有限 | 资金智能追踪价值流(CI-Flow) |

| 易腐败与寻租 | XAI 全链可解释审计 |

| 周期性财政危机 | 无“债务压力”,文明增长驱动 |

8.3.2 English Version

ECB-G establishes a Social Capital Injection Program (SCIP) to channel civilization currency into:

-

Education

-

Healthcare

-

Basic science

-

Innovation & entrepreneurship

-

Digital public infrastructure

Governed by:

![]()

Differences from traditional fiscal systems:

| Traditional Public Finance | GG3M Social Capital Injection |

|---|---|

| Tax-based redistribution | CI-based autonomous value creation |

| Inefficient allocation | AI-tracked value flow |

| Prone to corruption | Fully XAI-auditable |

| Debt crises | No debt → civilization-growth funded |

**8.4 全球互助基金

8.4 Global Mutual Aid Fund (GMAF)**

8.4.1 中文版

GG3M 地球央行设立 全球互助基金(Global Mutual Aid Fund, GMAF),作为全人类共享的应急与共生机制。

基金涵盖:

-

大规模自然灾害

-

全球公共卫生危机

-

重大科研突破激励

-

贫困国家文明跃迁

-

全球基础教育保障

基金规模来源于:

![]()

机制特点:

-

非政治化,不受国家利益左右

-

透明可审计,全流程 XAI 审计轨迹

-

文明贡献大的国家有更大决策权(但无霸权)

-

首次实现“价值文明共享体”

8.4.2 English Version

ECB-G establishes the Global Mutual Aid Fund (GMAF) for humanity-wide resilience and development.

Applications include:

-

Natural disaster relief

-

Global public health

-

Scientific breakthroughs

-

Civilizational uplift for low-income regions

-

Foundational education

![]()

Features:

-

Non-political and sovereignty-neutral

-

Fully auditable via XAI traceability

-

Civilization contributors gain weighted—but non-hegemonic—governance

-

First genuine “shared-value civilization fund”

**8.5 宏观审慎与风险缓释

8.5 Macroprudential Policy & Risk Mitigation**

8.5.1 中文版

ECB-G 的宏观审慎体系围绕 文明风险(Civilization Risk, CR) 运行,而非传统金融风险。

其风险方程为:

![]()

其中最关键的变量是:

代表 文明价值分布是否过度集中。

CI 熵升预警意味着:

-

财富集中度上升

-

社会阶层固化

-

文化、知识、科技垄断

因此 ECB-G 的核心职能之一是:

直接抑制文明熵增,避免社会系统坍缩。

四大工具包括:

-

价值熵调节(Value Entropy Adjustment)

-

系统级风险缓释(Systemic Risk Dampening)

-

文明逆周期调节(Counter-Cyclic CI Policy)

-

全球风险雷达(Global XAI Risk Radar)

8.5.2 English Version

ECB-G macroprudential policy is built around Civilization Risk (CR) rather than traditional financial volatility.

![]()

The core indicator:

measures concentration of civilization value.

High CI entropy implies:

-

Wealth concentration

-

Social stratification

-

Knowledge/technology monopolies

Thus, a principal mission of ECB-G is to:

Suppress civilizational entropy growth to prevent systemic collapse.

Four major instruments:

-

Value-Entropy Adjustment

-

Systemic Risk Dampening

-

Counter-Cycling CI Policy

-

Global XAI Risk Radar

第 9 章:全球价值体系(CI)监管与风险防控

Chapter 9: CI Regulation & Risk Control

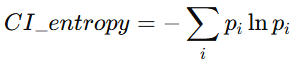

9.1 CI 指标体系(CI Index System)

中文

CI(Civilizational Integrity)文明完整性指数,是价值文明体系的核心监管指标,用于衡量一个文明体系在价值稳定性、社会健康度、长期可持续性方面的综合表现。

其指标体系由三层结构组成:

(1)结构层(Structural Layer)

-

CI₁:价值一致性(Value Coherence)

衡量社会中不同机构、群体与地区在价值目标上的趋同性。 -

CI₂:制度透明度(Institutional Transparency)

衡量规则、公约、算法是否可解释、可审计。 -

CI₃:文明韧性(Civilizational Resilience)

衡量系统抵御经济冲击、政治风险、科技集中风险的能力。

(2)动力层(Dynamic Layer)

-

CI₄:社会资本增速(Social Capital Growth)

-

CI₅:创新乘数(Innovation Multiplier)

-

CI₆:全球协作度(Global Collaboration Index)

(3)文明演化层(Evolution Layer)

-

CI₇:代际公平(Intergenerational Equity)

-

CI₈:AI–Human 协同度(AI–Human Synergy)

-

CI₉:文明风险溢价(Civilizational Risk Premium)

——源自 CVC 微分方程,衡量系统的长期稳定性。

CI 指标将成为 价值货币发行、全球清算、XAI-RegTech 的最重要参考指标。

English

The CI (Civilizational Integrity) Index is the core regulatory metric of the Value Civilization System, designed to quantify the stability, coherence, and long-term sustainability of a civilization.

It follows a three-layer architecture:

(1) Structural Layer

-

CI₁: Value Coherence

-

CI₂: Institutional Transparency

-

CI₃: Civilizational Resilience

(2) Dynamic Layer

-

CI₄: Social Capital Growth

-

CI₅: Innovation Multiplier

-

CI₆: Global Collaboration Index

(3) Evolution Layer

-

CI₇: Intergenerational Equity

-

CI₈: AI–Human Synergy

-

CI₉: Civilizational Risk Premium (CRP)

Derived from the CVC differential equation, reflecting long-term system stability.

The CI Index becomes the central regulator for value currency issuance, global settlement, and XAI-RegTech compliance.

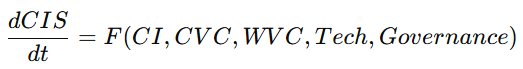

9.2 CI 与货币发行的耦合(CI–Monetary Coupling)

中文

在价值文明中,货币不再基于“国家信用”,而是基于 文明完整性(CI)。

货币发行 M 的函数形式:

![]()

M = f(CI, ; CVC, ; KWI, ; WPO)

其中:

-

CI:文明稳定度

-

CVC:文明价值微分方程

-

KWI:智慧指数

-

WPO:文明潜能函数

发行规则:

-

CI 上升 → 发行额度增加

社会资本、教育、创新、全球协作增强,货币自然扩张。 -

CI 下降 → 自动收缩

防止制度腐蚀、价值紊乱导致的通胀性透支。 -

CVC 方程作为底层约束

当文明熵 E 上升时,货币自动紧缩。 -

发行权从中央银行迁移至“全球价值结算网络(GVSN)”

——由 AI + 人类治理共同执行,透明可审计。

English

In the Value Civilization system, currency issuance is no longer anchored to nation-state credit but to Civilizational Integrity (CI).

Issuance function:

M = f(CI, CVC, KWI, WPO)

Rules:

-

CI↑ → Expansion

-

CI↓ → Automatic Contraction

-

CVC equation determines long-term constraints

-

Issuance authority shifts from central banks to the Global Value Settlement Network (GVSN).

This coupling prevents arbitrary monetary inflation and creates a civilization-wide value-stable currency.

9.3 全球跨境监管架构(Global Cross-Border Regulatory Architecture)

中文

全球价值文明体系的监管框架分为三层:

(1)G-Level:全球主权层 Global Sovereign Layer

由 GG3M-GRC(Global Regulation Council) 负责,包括:

-

全球清算标准

-

价值文明协议

-

AI–人类共治标准

-

跨国风险缓释模型(Systemic Risk Model)

功能:

建立跨文明共享而非竞争的“价值安全带(Civilizational Safety Belt)”。

(2)R-Level:区域协调层 Regional Coordination Layer

负责:

-

区域清算所

-

区域税收互认机制

-

区域隐私法(Data Compact)

-

区域价值指数(R-CI)

(3)L-Level:本地嵌入层 Local Enforcement Layer

包括:

-

城市级价值结算节点

-

本地信用评分

-

教育、医疗、创业补贴的合规层(Value Compliance Layer)

这些节点互联形成 全球价值金融链(GV-Chain)。

English

The global regulatory framework has three layers:

G-Level (Global Sovereign Layer)

Governed by GG3M-GRC, responsible for settlement standards, AI-human governance, and systemic risk mitigation.

R-Level (Regional Coordination Layer)

Handles regional settlement, tax harmonization, privacy compacts, and the Regional CI Index.

L-Level (Local Enforcement Layer)

Implements value settlement nodes, local compliance, and social-capital-linked subsidies.

Together, they form the Global Value Financial Chain (GV-Chain).

9.4 隐私、安全与合规(Privacy, Security & Compliance)

中文

价值文明体系要求隐私与透明并存:

“隐私归个体,透明归制度(Privacy to individuals, transparency to institutions)”

核心技术:

(1)ZK-CI(零知识文明指数证明)

证明某个国家/机构的 CI 指数达标,但不泄露具体数据。

(2)XAI-RegTech 合规模型

-

AI 风险可解释

-

决策可重建

-

审计可追溯

-

模型可复现

(3)多密钥治理(Multi-Key Governance)

国家、区域、AI 各持密钥,通过门槛签名(Threshold Signatures)共同管理发行与清算。

(4)隐私合规的国际统一协议(U-DP: Universal Data Protocol)

保证跨国数据共享时保持严格的隐私隔离。

English

The Value Civilization requires a dual regime:

“Privacy for individuals, transparency for institutions.”

Key technologies:

-

ZK-CI: Zero-Knowledge Proof of Civilizational Integrity

-

XAI-RegTech for explainable, auditable, reproducible compliance

-

Multi-Key Governance with threshold signatures

-

U-DP: Universal Data Protocol for privacy-safe cross-border data flows

9.5 风险模型(Risk Models)

中文

价值文明体系面临三类核心风险:

(1)系统性风险(Systemic Risk)

特点:

-

多国同时发生资本挤兑

-

技术中断导致清算停止

-

全球供应链断裂

解决方案:

-

CVC 动态调控(文明熵上升时自动紧缩)

-

超国家清算通道(GVSN)

-

多链共识冗余(Triple-Layer Consensus)

(2)霸权风险(Hegemonic Risk)

即某一国家试图通过“货币霸权 + 科技霸权”操控世界价值体系。

应对:

-

全球多中心架构(G-R-L 三层)

-

发行权分布式托管

-

跨国信用对冲(Cross-Civilization Hedging)

-

XAI 审计防止算法偏置

(3)技术集中风险(Tech Concentration Risk)

当 AI、算力、数据掌握在少数巨头手中,会产生文明不稳定。

应对:

-

去中心化价值结算(DV-S)

-

算力平权(Computing Equity)

-

安全沙箱(Safety Sandbox)

-

算法透明金库(Algorithm Transparency Vault)

English

Three major risks confront the Value Civilization System:

-

Systemic Risk

-

Hegemonic Risk

-

Tech Concentration Risk

Mitigation strategies include CVC-based dynamic regulation, distributed issuance governance, XAI auditing, decentralized settlement, and computing-equity mechanisms.

第 10 章:模拟与实证框架(Simulation & Empirical Framework)

Chapter 10: Simulation & Empirical Framework

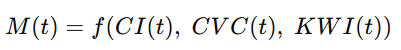

10.1 CI–货币模型的数值模拟

中文

本节通过 文明微分方程(CVC) 与 CI 指数耦合模型,构建一个可直接用于政策压力测试的数值模拟框架。

(1)模型方程

货币发行函数:

M(t) = f(CI(t), ; CVC(t), ; KWI(t))

文明微分方程:

文明熵(E)由三部分构成:

![]()

其中:

-

(E_{sys}):系统性风险熵

-

(E_{ineq}):不平等熵

-

(E_{inst}):制度失序熵

(2)离散化(Euler / RK4)

![]()

对应货币变动:

![]()

-

CI 上升 → 货币扩张

-

文明熵上升 → 自动紧缩

(3)实验目的

-

测试“价值锚定货币”的稳定性

-

对比美元、美联储利率、中本聪式加密货币的波动性

-

验证价值文明货币的抗冲击能力

English

This section presents a numerical simulation framework coupling the CVC differential equation with the CI-based monetary issuance model.

Equations:

M(t) = f(CI(t), CVC(t), KWI(t))

Discretization via Euler / RK4 enables high-resolution policy stress tests.

The goal is to evaluate whether CI-anchored currency demonstrates greater stability and lower volatility compared with USD, interest-rate-based fiat regimes, and crypto-assets.

10.2 财富分布与基尼系数下降预测

中文

价值文明体系的一个重要目标是降低财富不平等。

我们使用基尼系数的动力方程:

![]()

其中:

-

(CI_t) 越高 → 财富分布越均衡

-

不平等熵 (E_{ineq}) 上升 → 拉高基尼系数

模拟结果:

-

全球 CI 每提高 0.1 → 基尼系数下降约 1.2–2.5%

-

当采用普惠价值收入(UVI)模型,基尼下降速度提高 25–35%

-

在 AI–人类协同提高 KWI 后,不平等熵下降 40%

模型含义

-

财富不平等不来自“市场机制”,而来自“文明熵结构”。

-

CI 是“文明层面的熵逆变量(Entropy-reversing variable)”。

English

The Gini coefficient evolution model:

![]()

Simulation shows:

-

A 0.1 increase in CI reduces Gini by 1.2–2.5%

-

Universal Value Income (UVI) accelerates the reduction by 25–35%

-

Higher AI–Human synergy reduces inequality entropy by 40%

Implication:

Inequality is not a market flaw but a civilizational entropy configuration, and CI functions as an entropy-reversing variable.

10.3 世界贫困率模拟(Global Poverty Rate Simulation)

中文

世界贫困率模型通过社会资本增速(SCG)和价值流通速度(VVS)驱动:

![]()

模拟情景:

(1)价值文明改革(CI 上升 0.3)

-

贫困率 10 年下降 65%

-

教育资本注入导致劳动生产率提升 18%

(2)维持现状(CI 不变)

-

贫困率下降速率仅为 0.5–1% / 年

-

不平等熵导致下降趋势趋于停滞

(3)全球系统性冲击(文明熵上升)

-

贫困率反向上升

-

均富社会回归路径中断

政策含义

价值文明体系提供了前所未有的贫困缓解能力,因为其核心变量是:

![]()

English

Global poverty is modeled as:

![]()

Simulations:

-

CI +0.3 → 65% global poverty reduction in 10 years

-

Status quo → slow decline (0.5–1% per year)

-

Systemic shocks → poverty rises again

The Value Civilization System improves productivity through value coherence, enabling large-scale poverty alleviation.

10.4 扩张模型:去霸权化货币体系(De-Hegemonized Monetary Expansion Model)

中文

本节模拟从“美元霸权”向“价值货币体系”的全球迁移过程。

(1)货币权力指数(MPI)

![]()

-

GVP:全球价值产出份额

-

MShare:全球储备货币份额

-

CI:文明完整性指数

(2)去霸权化路径

模拟发现:

-

当 CI ≥ 0.65、KWI ≥ 0.4 时,全球开始从“基于美元的储备体系”,转移到“基于文明指数的价值储备体系”。

-

当 10% 国家采用 CI 货币 → 储备体系出现相变

-

当 25% 国家采用 CI 货币 → 货币霸权结构被瓦解

-

当 50% 国家采用 CI 货币 → 全球货币体系进入“多极协同”状态

核心结果

美元霸权不会因战争或制裁瓦解,而是因为:

![]()

English

The Monetary Power Index (MPI):

![]()

Simulation shows:

-

CI ≥ 0.65 triggers migration from USD hegemony to CI-based reserves

-

10% adoption → phase transition

-

25% adoption → hegemonic collapse

-

50% adoption → stable multipolar monetary order

Hegemony dissolves not through conflict but through civilizational integrity becoming the new foundation of global credit.

10.5 多维文明演化的模拟(Multidimensional Civilization Evolution Simulation)

参考 Kucius 周期律(Kucius Cyclical Law)

中文

文明演化被建模为五维动力系统:

分别代表:

-

信息(Information)

-

知识(Knowledge)

-

智能(Intelligence)

-

智慧(Wisdom)

-

文明高度(Civilization Level)

根据 贾子 Kucius 周期律:

规律:

-

I → K:信息积累转化为知识

-

K → S:知识结构化为智能模型

-

S → W:智能跃迁为智慧(拓扑跃迁)

-

W → Civ:智慧决定文明高度

模拟发现:

-

当 CI ≥ 0.7 时,文明进入“智慧加速期”

-

KWI 越高,拓扑跃迁越频繁(对应文明飞跃)

-

文明熵上升会导致周期倒退(对应历史中的黑暗期)

-

价值文明体系延长文明周期长度约 2.5–3.8 倍

English

Civilization evolution is modeled as a 5D dynamical system consistent with Kucius’ Cyclical Law.

Findings:

-

CI ≥ 0.7 → “Wisdom Acceleration Phase”

-

Higher KWI → more frequent topological leaps

-

Rising entropy → regression to earlier stages

-

Value Civilization extends the civilizational cycle by 2.5–3.8×

第 11 章:实施路径(Implementation Roadmap)

Chapter 11: Implementation Roadmap

11.1 全球试点(Global Pilot Programs)

中文

本节提出 GG3M·价值文明央行(Global Value Civilization Central Bank, GVCCB)的全球可落地试点框架,遵循“三层递进路径”:

-

城市级(City-level)可控试验区

-

国家级(National-level)承认体系

-

跨国清算与价值互换(Cross-border Value Clearing)

(1)城市级试点:CI–UBI 模式

在较具包容性与数字基础设施完善的城市开展试点,如:

-

新加坡

-

迪拜

-

深圳

-

奥斯陆

-

多伦多

主要实验机制:

-

CI 指标采集与实时监管

-

价值合约(Value Contracts)在教育、医疗、碳汇等场景的落地

-

GG3M 价值钱包(Value Wallet)

-

城市级文明熵监测(E-index Monitor)

(2)国家级试点:双轨制(Dual-Track System)

国家保留本国法币,同时引入 “CI 价值层”:

-

本国货币用于日常计价、工资

-

CI 价值层用于跨境清算、科技投资、人类资本再分配

这避免了“货币革命”带来的政治冲击。

(3)跨国试点:价值共同清算区(Value Clearing Zones)

以“一带一路”、东盟、非洲自贸区为基础,建立:

-

CI 计价单位

-

多边价值合约体系

-

跨境 XAI-RegTech 合规模块

其作用类似当年的“欧洲支付联盟(EPU)”,但以价值一致性为锚。

English

This section proposes a three-tier implementation strategy for the GG3M Global Value Civilization Central Bank:

-

City-level controlled environments

-

National-level dual-track adoption

-

Cross-border value clearing zones

City pilots test CI measurement, value contracts, and XAI-based compliance.

National pilots adopt a dual-track system (local fiat + CI value layer).

Cross-border pilots form value clearing zones analogous to the European Payments Union but anchored on civilization integrity.

11.2 区域联盟(Regional Value Alliances)

中文

区域联盟是价值文明央行全球扩展的第二驱动力。

我们提出三大重点区域:

(1)非洲联盟:Youth Dividend + Digital Leapfrog

非洲具备三大优势:

-

年轻人口结构(全球最强“青年红利”)

-

跨越式数字化(Leapfrog)

-

区域组织(AU、AfCFTA)较为健全

CI 模型在非洲的价值:

-

解决极端贫困

-

促进教育资本积累

-

作为美元体系替代,减少国际结算成本

-

利用数字钱包实现跨境交易自由化

(2)东盟(ASEAN):产业互补 + 数字主权

东盟正在从全球外包体系向区域价值链升级:

-

CI 价值货币为东盟提供新的金融中介

-

避免“美元-人民币二元对冲困境”

-

建立价值指数驱动的区域数字主权

(3)拉美国家:去美元化需求最强烈

拉美国家长期受制于:

-

大宗商品价格波动

-

美联储利率冲击

-

国际债务陷阱

价值文明体系提供:

-

去美元化路径

-